from Forum Asset Management

Forum Real Estate Income and Impact Fund Reports Q1 2024 Results

TORONTO, ON / ACCESSWIRE / May 1, 2024 / The Forum Real Estate Income and Impact Fund ("REIIF" or the "Fund") released its results for the first quarter ended March 31, 2024.

Series F investors in REIIF have earned a return of 2.18% for the first quarter, including the monthly distribution (3.97 cents/Series F/month, or 4.2% per annum (projected)).

In January 2024, the federal government announced a two-year cap on international undergraduate study permits (the "Cap"), aiming to address unsustainable international enrollment growth and the impact on the housing market. The Cap is primarily focused on international students enrolling in private colleges.

"The impact of the Cap is expected to be negligible, given the Fund's strategic allocation to purpose-built student accommodations ("PBSA") primarily focused on serving top-tier public universities and colleges," said Aly Damji, Managing Partner at Forum Asset Management ("Forum"), Fund Head and a Trustee of REIIF. "With a national vacancy rate of 1.5%, the lowest in decades, and over 5 million homes required to be built to restore affordability1, the Canadian rental housing market continues to support the Fund's rental housing investment thesis."

Acquisitions

At the end of March, pursuant to REIIF's right of first offer agreement with Forum, the Fund acquired a 50% interest in a fully leased, newly built, non-rent controlled PBSA property in Winnipeg, Manitoba ("The ARC") - located steps from the University of Manitoba in a market with an estimated shortfall of 20,000 beds.

Following The ARC acquisition, the Fund now comprises twelve properties, with 1,788 units serving over 2,000 residents with Gross Asset Value ("GAV") over $500M.

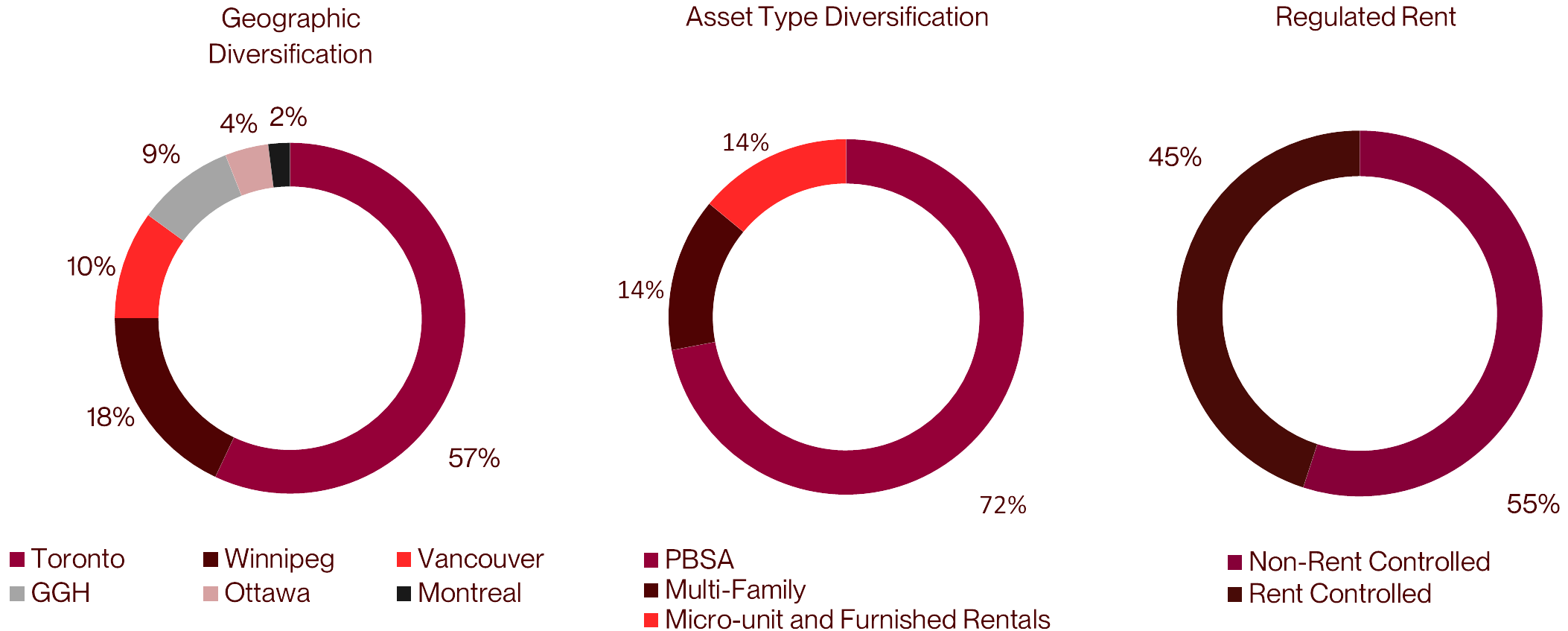

See below for Fund breakdown as of March 31, 2024:

Further, the Fund is under contract to acquire an additional +$100M of high-quality properties in Ontario, expected to close in the 2nd and 3rd quarters of 2024. Once the +$100M of acquisitions are completed, REIIF's GAV would be over $600M, with an over 70% strategic allocation to PBSA. The increase in the Fund's GAV to over $600M would represent an over 200% GAV increase since the Fund's inception in December 2021.

Portfolio Update

The portfolio at the end of the quarter is substantially stabilized, with portfolio occupancy of 97.5% and approximately 1.5% of units being repositioned to attract materially higher rents. Comparative Property NOI increased 16.0% from the prior year's comparable quarter, with a further embedded potential gain-to-lease of 15.0% portfolio-wide.

"The Fund's tenant turnover ratio is over 50% compared to 12.4%2 nationally, providing us with a competitive edge over Canadian multi-family portfolios by being able to capture the embedded gain-to-lease on turnover. This allows for increased cash flow and capital appreciation," said Aly Damji. "Accordingly, the Fund remains well-positioned to continue to deliver on its stated 8-to-12% target net return objectives for 2024".

During the quarter, the Fund continued with its suite renovation program and expansion of ALMA branding on 455 Abbott (Vancouver) - now "ALMA Gastown". Further, work has commenced on the common area and suite renovation project as part of rebranding 87 Mann (Ottawa) to an ALMA branded property. The scope of work at 87 Mann (Ottawa) will include refurbishment of vacant suites as well as upgrading lighting, carpets, paint, and furniture in common areas and signage.

Four assets were externally appraised, contributing to the positive returns realized in the first quarter of 2024 - with the fair value increases a result of income growth from higher rents on renovated suites, along with a slight decrease in capitalization rates resulting in an overall portfolio weighted average capitalization rate of 4.46% (4.48% at December 31, 2023).

Further, Forum is enhancing its valuation approach for the Fund, requiring semi-annual, external appraisals for each property. "We expect that additional third party validation of property values will result in less return volatility and improved investor confidence in the Fund's valuation methodology and resulting NAV," said Rajeev Viswanathan, Managing Partner and CFO at Forum.

Balance Sheet Update

The Fund has maintained a conservative net debt to net assets ratio of 43.6% and over $50M of liquidity.

The Fund's balance sheet is supported by fixed-rate mortgages, representing 89% of total indebtedness, with an overall coupon of 3.0% and a weighted average term of 7.1 years.

Distributions

The monthly distribution was paid on April 15th, 2024 to unitholders of record as at March 31, 2024 as follows:

Series of Trust Units | 2024 Monthly Distribution Per Unit5 | 2024 Annual Distribution Per Unit |

| A Series1 | $0.0326 | $0.3908 |

| F Series2 | $0.0397 | $0.4768 |

| H Series3 | $0.0407 | $0.4883 |

| I Series4 | $0.0431 | $0.5169 |

1 Includes REIIF Trust A Lead, A Oct 2023, A Nov 2023, and A Dec 2023 Series.

2 Includes REIIF Trust F Lead, F Oct 2023, F Nov 2023, and F Dec 2023 Series, and REII LP July 2023 F Series.

3 Includes REIIF Trust H Lead, H Nov 2023, and H Dec 2023 Series.

4 Includes REIIF Trust I Lead Series, and REII LP July 2023 I Series.

5 Represents the annual distribution per Unit divided by 12, rounded to four decimal places.

Impact Update

REIIF's impact and environmental, social and governance ("ESG") initiatives are focused on reducing its environmental footprint and increasing social engagement. REIIF's commitment to integrating leading responsible investment practices is recognized through Forum's UN Principles for Responsible Investment results, achieving 4 of 5 stars for its Real Estate module.3

Forum gained insights into The ARC's environmental impact and utility costs prior to acquisition, which will inform budgeting considerations relating to operating costs and capital investments associated with energy efficiency initiatives.

Community engagement is a cornerstone of the living experience, with 84% of Canadian residents valuing social events.4 In 2023, Forum hosted 110 resident engagements at its PBSA properties, which consistently earned accolades, increasing overall sense of value. REIIF remains committed to fostering community-focused experiences and will tailor programs to meet resident needs and preferences through ongoing feedback.

More information on REIIF's Impact Framework is available at www.forumreiif.ca/impact.

1 CMHC Rental Market Report January 2024.

2 Scotia Global equity Research dated Monday, March 25, 2024.

3 2023 PRI Assessment Report.

4 Simplydbs ShapeYourSpace Survey results.

About REIIF

REIIF invests principally in institutional-quality, multi-family apartments, purpose-built student accommodations ("PBSA"), and micro-units & furnished rentals, located in supply constrained markets in Canada. The Fund also strives to deliver a sector-leading impact and ESG-driven portfolio that is designed to enhance risk adjusted returns. For more information, please visit our website at www.forumreiif.ca.

About Forum

Forum is an investor, developer and asset manager operating across North America for over 25 years. Our core purpose is to deliver Extraordinary Outcomes™ to our stakeholders. Our adaptable, agile, and dynamic team is committed to sustainability and responsible investing, creating value that benefits the communities in which we invest.

Our investment focus includes real estate, private equity, and infrastructure. The enterprise value of our assets under management currently exceeds C$1.7 billion. Our investments have attracted a number of top investors. We're proud to have delivered top tier alternative asset returns since 2002, while positively impacting over 10,600 lives.

Contacts

Name: Rajeev Viswanathan, Chief Financial Officer

Phone Number: 416-947-0389

Email: rajeev@forumam.com

Cautionary Statement

This news release is for informational purposes only and is not intended as investment, financial or other advice or a recommendation to invest in the Fund. It is also not an offer, solicitation, or basis for any investment decision regarding REIIF securities, which are available only to "accredited investors" within certain jurisdictions of Canada and not for sale to the general public.

The information in this news release regarding the Fund's portfolio, including the number of properties, units, residents served, and Gross Asset Value (GAV) as well as fund performance and returns are based on current estimates developed from Forum's unaudited financial information, and are subject to change. Series F returns as expressed herein, are net of REIIF expenses like administrative costs, management fees, and unit class specific fees (excluding early purchase deductions for units held under a year). The targeted distribution rate and total return received by a unitholder will differ based on the series of REIIF units in which a unitholder invests and the distribution reinvestment plan strategy that such unitholder elects to pursue. Past performance is historical and not a guarantee of future results. Investors should not place undue reliance on these figures and are encouraged to perform their own due diligence or consult with a professional advisor before making any investment decisions.

This news release includes forward-looking statements under Canadian securities laws, identifiable by terms like "expect," "intends," and "anticipates," or variations of these, outlining REIIF's investment objectives, strategies, opportunity pursuits, expected annual net operating income growth, GAV growth, acquisition completions, expectations of the yield and returns on units within the Fund, ESG targets, financing strategies, distribution expectations, rental housing demand and supply expectations, rental housing shortfall estimates, and general market outlook. However, these statements are based on current management beliefs and available information, and they are not guarantees of future performance. They are subject to risks and uncertainties that could cause actual outcomes to vary significantly, including economic conditions, real estate market volatility, funding access challenges, timing issues, and currency or interest rate changes. While Forum strives to accurately predict future results, unforeseen factors may lead to material differences in actual outcomes. For more information on these factors, risks and uncertainties as well as the assumptions underlying management's forecasts, please refer to REIIF's confidential offering memorandum as amended or supplemented from time to time, which may be accessed here. These forward-looking statements reflect our position as of this release, with no obligation for updates unless required by law.

SOURCE: Forum Asset Management

View the original press release on accesswire.com