from MACE SECURITY INTERNATIONAL INC (NASDAQ:MACE)

Mace(R) Security International, a Global Leader in Personal Self-Defense Sprays, Announces 2Q24 Financial Results

CLEVELAND, OH / ACCESSWIRE / September 30, 2024 / Mace Security International (OTCQB:MACE) today announced its second quarter 2024 financial results for the period ended June 30, 2024.

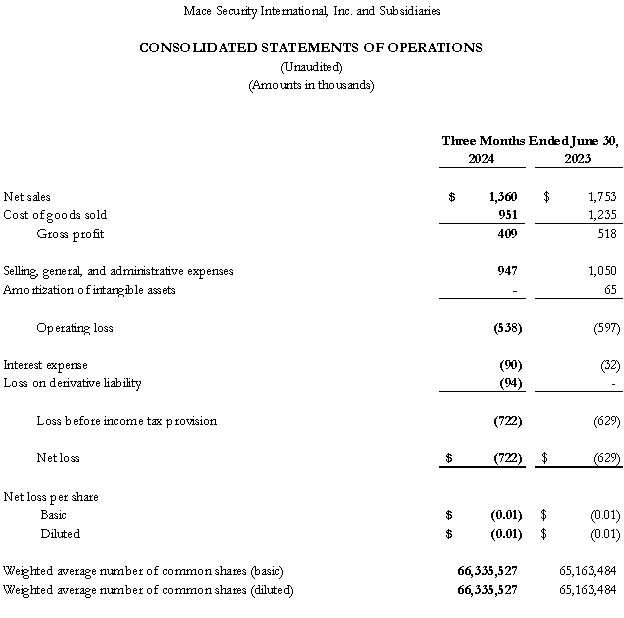

Second Quarter 2024 Financial Highlights

The Company's net sales for the second quarter of 2024 were $1,360,000, down (22%) versus the like period in 2023. The decrease vs prior year is mostly the result of the impact of the loss of two larger retail customers in 2024, as well as orders from new and existing international customers in 2023 not repeating in 2024.

Mace reported a gross profit rate of 30% in both Q2 2024 and the same quarter in 2023. The modifications implemented to the Company's operational cost structure in 2023 led to a 28% reduction in four-wall manufacturing costs in Q2 2024 on a quarter-over-quarter basis. This bodes well for margin improvement as revenue recovers. The Company will continue to invest in manufacturing process improvements and new product development as these are instrumental components of management's strategic vision for growth. This gross margin improvement was essentially offset by inflationary increases in freight and component costs.

SG&A expense were $947,000 in Q2 2024. When adjusted for non-recurring legal and financing costs of $24,000, expenses related primarily to the ongoing strategic alternatives project, and expenses related primarily to transition payroll/temporary labor costs associated with the Company optimizing its headcount of $59,000, and non-cash stock compensation costs of $40,000, SG&A expense was $824,000 in the second quarter 2024 or $30,000 (4%) lower than adjusted SG&A expense in the second quarter of 2023 of $854,000.

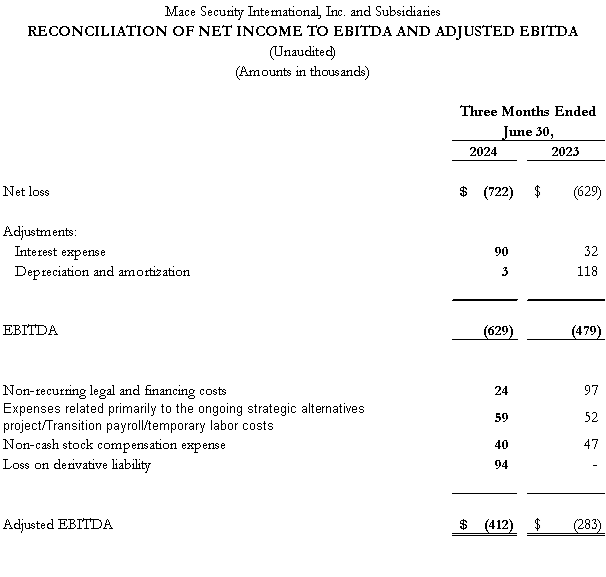

Net loss was ($722,000) in the second quarter of 2024, compared with net loss of ($629,000) in the same quarter in 2023.

Adjusted EBITDA for Q2, 2024 was a loss of ($412,000), compared with a loss of ($283,000) in the same period 2023.

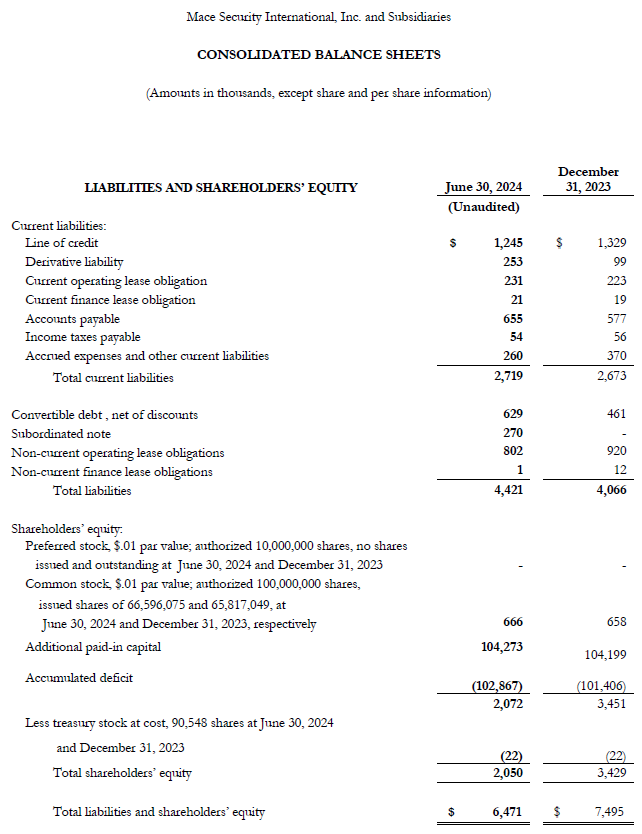

Cash and cash equivalents decreased to $60,000 as of June 30, 2024, a decrease of $179,000 over the $239,000 on hand on December 31, 2023. $1,245,000 was drawn against the Company's $2,000,000 bank line of credit at June 30, 2024.

Working capital decreased by ($948,000) compared to December 31, 2023, with a ($257,000) decrease in accounts receivable, ($423,000) decrease in inventory on lower sales and $78,000 increase in accounts payable.

Sanjay Singh, Chairman and CEO commented, "Sales continued to decline across our base business and retail segments partially offset by a pick-up in the Amazon vendor central platform. Also, impacting our revenues were suspension of our popular pepper gun and alarms on the Amazon seller central platform due to Amazon's implementation of a new policy regarding products carrying button cell buttons. The Company along with its agency are working hard to regain compliance and resume sales of products containing button cell batteries. The Company continued to reduce S, G and A costs due to the sales decreases. Sales to one of our largest retail customers increased by approximately 100% in Q2, 2024 when compared to Q1, 2024 due to our products moving to the checkout lane. Sales of our S2 pepper spray launchers are showing steady progress despite working capital constraints. Sales of S2 pepper spray launchers in Q3 to date are 10% higher than in Q2, 2024".

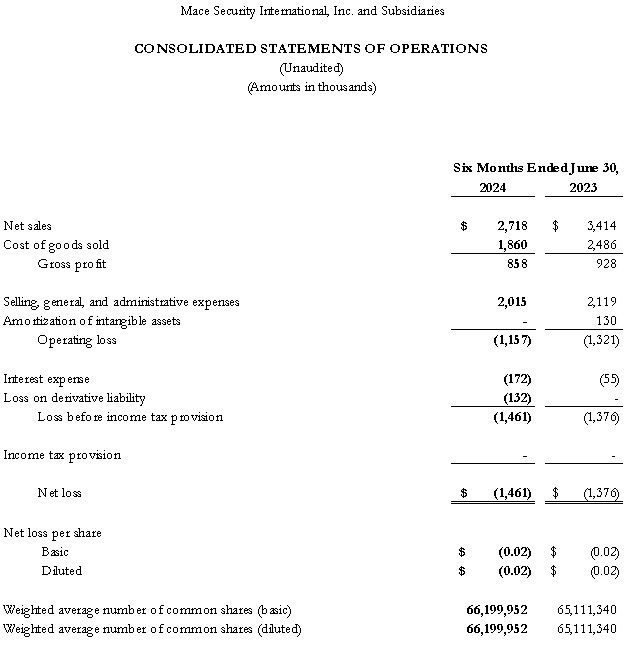

Year-to-Date June 2024 Financial Highlights

The Company's net sales for the six months ended June 30, 2024 were $2,718,000, down (20%) versus the like period in 2023. The decrease vs prior year is mostly the result loss of one significant retail customer in 2023 and two in 2024, as well as orders from new and existing international customers in 2023 not repeating in 2024. Partially offsetting this net sales decrease was a $73,000 increase in net sales on the Company's e-commerce platforms.

Mace reported a gross profit rate of 32% for the six months ended June 30,2024, compared with 27% for the same period in 2023. The modifications implemented to the Company's operational cost structure in 2023 led to a 23% reduction in four-wall manufacturing costs for the six months ended June 30, 2024 compared with the same 2023 period. This bodes well for margin improvement as revenue recovers. The Company will continue to invest in manufacturing process improvements and new product development as these are instrumental components of management's strategic vision for growth. This gross margin improvement was partially offset by inflationary increases in freight and component costs.

SG&A expense were $2,015,000 for the six months ended June 30, 2024. When adjusted for non-recurring legal and financing costs of $42,000, expenses related primarily to the ongoing strategic alternatives project, and expenses related primarily to transition payroll/temporary labor costs associated with the Company optimizing its headcount of $130,000, and non-cash stock compensation costs of $79,000, SG&A expense was $1,764,000 for the six months ended June 30, 2024 or $106,000 (6%) lower than adjusted SG&A expense in the comparable period of 2023 of $1,764,000.

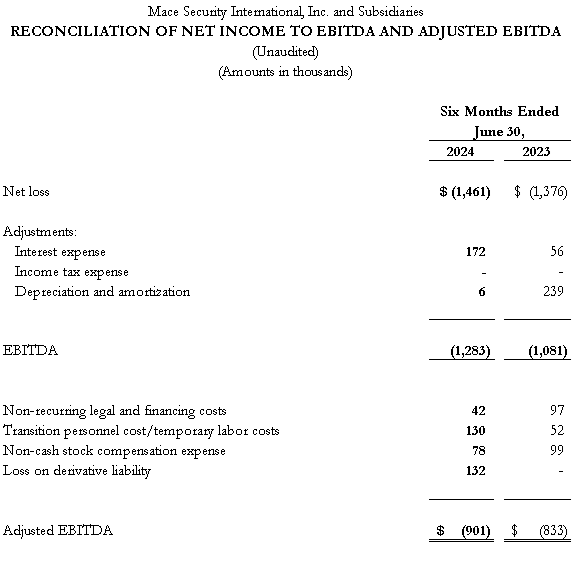

Net loss was ($1,461,000) for the six months ended June 30, 2024, compared with net loss of ($1,376,000) the comparable period in 2023.

Adjusted EBITDA for the six months ended June 30, 2024 was a loss of ($901,000), compared with a loss of ($833,000) in the same period 2023.

Annual Shareholder Meeting Date

The Company's Board of Directors has set Monday, November 18, 2024 as the date of the 2024 Annual Meeting of Shareholders of Mace Security International, Inc.

About Mace Security International, Inc.

Mace® Security International, Inc. (MACE) is a globally recognized leader in personal safety and security. Based in Cleveland, Ohio, the Company has spent more than 40 years designing and manufacturing consumer and tactical products for personal defense and security under its world-renowned Mace® Brand - the original trusted brand of defense spray products. The Company also offers aerosol defense sprays and tactical products for law enforcement and security professionals worldwide through its Mace® Take Down® brand, KUROS!® Brand personal safety products, Vigilant® Brand alarms, and Tornado® Brand pepper spray and stun guns. MACE® distributes and supports Mace® Brand products through mass market retailers, wholesale distributors, independent dealers, Amazon.com, Mace.com, and other channels. For more information, visit www.mace.com.

Forward-Looking Statements

Certain statements and information included in this press release constitute "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. When used, the words or phrases "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "projected," "intend to" or similar expressions are intended to identify "forward-looking statements" within the meaning of the Federal Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to several known and unknown risks and uncertainties that may cause our actual results, trends, performance or achievements, or industry trends and results, to differ materially from the future results, trends, performance, or achievements expressed or implied by such forward-looking statements. Those risks and uncertainties may include, but are not limited to, (a) general economic and business conditions, including the impact of the COVID-19 pandemic and other possible pandemics and similar outbreaks; (b) competition; (c) potential changes in customer spending; (d) acceptance of our product offerings and designs; (e) the variability of consumer spending resulting from changes in domestic economic activity; (f) a highly promotional retail environment; (g) any significant variations between actual amounts and the amounts estimated for those matters identified as our critical accounting estimates, as well as other significant accounting estimates made in the preparation of our financial statements; (h) the impact of current and potential hostilities in various parts of the world, including but not limited to the war which resulted from Russia's invasion of Ukraine, as well as other geopolitical or public health concerns; (i) the impact of international supply chain disruptions and delays; (j) the impact on the Company of changes in U.S. Federal and State income tax regulations; and (k) the impact of inflation and the ability of the Company to pass on rising prices to its customers. You are urged to consider all such factors. Because of the uncertainty inherent in such forward-looking statements, you should not consider their inclusion to be a representation that such forward-looking matters will be achieved. Mace Security International, Inc. assumes no obligation for updating any such forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements.

In this press release, the Company's financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. Management believes that presentation of operating results using non-GAAP financial measures provides useful supplemental information to investors and facilitates the analysis of the Company's core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company's business. A reconciliation of the GAAP financial results to non-GAAP financial results is included in the attached schedule.

Contact:

Investor Relations

InvestorRelations@mace.com

SOURCE: Mace Security International, Inc.

View the original press release on accesswire.com