from Mako Mining Corp. (isin : CA56089A1030)

Mako Mining Intersects 51.78 g/t Au over 3.9 m (Estimated True Width) at Las Conchitas, 62 m from Surface, Outside of Current Mineral Resource Estimate

VANCOUVER, BC / ACCESSWIRE / January 24, 2024 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to announce further results from a reverse circulation (RC) drill program at Mako's newest mining area, Las Conchitas, located immediately south of the company's San Albino gold mine, which is in commercial production.

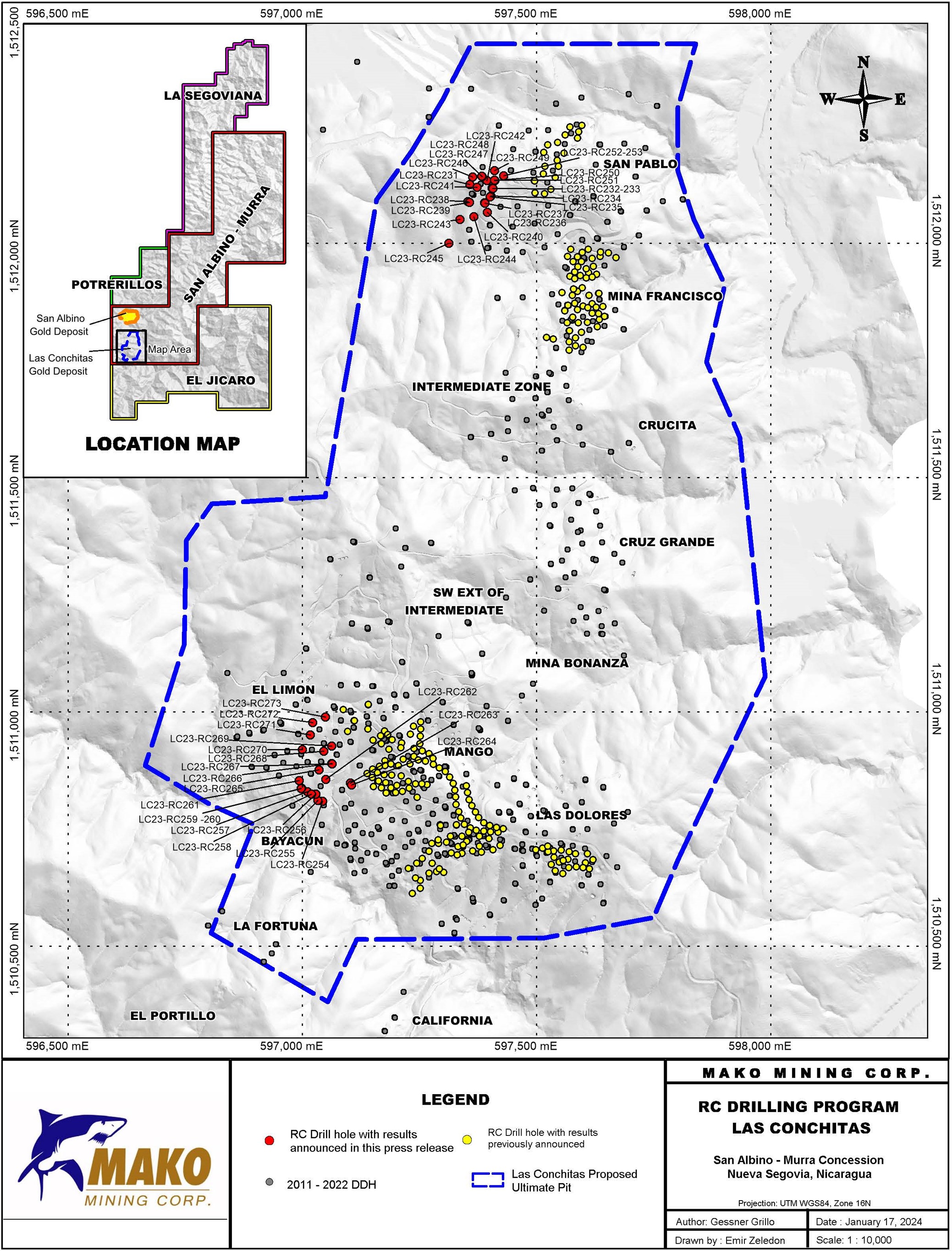

In 2023, Mako completed 11,737.6 m in 262 RC drill holes in the ongoing resource expansion drill program (see drill plan below). The results reported in this release are from two of three main zones at Las Conchitas (North and South), hosting the gold mineral resource estimate ("MRE") at the San Albino Project (see press release of December 6th, 2023). The main objectives of the near-surface, extension and confirmation drilling campaign were to gain a higher level of confidence of the geometry of gold mineralization within six areas of interest where the Company has received a permit to process material through the San Albino plant ("Las Conchitas Permit" see press release of June 19th, 2023) and to identify gold mineralization for potential resource expansion beyond the Company's current MRE.

Highlights

- Results of 20 RC drill holes in the southern portion of Las Conchitas ("LC-S"), together with prior results, support the potential for expanded, high grade, low strip ratio, minable material within the currently defined open pit.

- 51.78 g/t Au and 37.8 g/t Ag over 4.0 m (3.9 m Estimated True Width - ETW) - El Limon vein

- 19.43 g/t Au and 36.8 g/t Ag over 2.0 m (1.9 m ETW) - El Limon vein

- 25.75 g/t Au and 27.2 g/t Ag over 2.0 m (1.9 m ETW) - Mango vein

- 22.30 g/t Au and 22.8 g/t Ag over 2.0 m (1.8 m ETW) - El Limon vein

Akiba Leisman, CEO of Mako states, "when we released our updated MRE last December, which included the maiden resource for Las Conchitas, we explicitly stated that ‘modelling decisions were made with the understanding that there is a high probability that we will positively reconcile to the published mineral resource with additional drilling´. These spectacular high grade and shallow holes, outside of the current MRE, are a strong indication that this will come to fruition. The MRE is still open along strike and at depth. Earlier this week, we have begun to consistently mine the high-grade zones of LC-S, supplementing high grade production from other areas at San Albino. This high-grade production will allow us to continue generating significant cash flows for the foreseeable future which will be used to grow our business internally and externally, further enhance our balance sheet and continue to return capital to shareholders."

At LC-S, drilling was successful in targeting extensions of El Limon and Mango mineralized structures. The key objectives were to extend a high-grade, wide zone identified by the Company's previous diamond drilling. Drill hole LC23-RC273 (see table below) intersected a wide interval, starting at 62 m from surface of 51.78 g/t Au and 37.8 g/t Ag over 4.0 m (3.9 m ETW). This interval confirmed a 29m strike extension of high-grade mineralization, within the El Limon zone, of 14.50 g/t Au and 10.8 g/t Ag over 0.6 m (0.5 m ETW) at 57.6 m vertical depth in drill hole LC22-471 (see press release October 24th, 2022). In addition, drill hole LC23-RC272 intersected the same high-grade zone comprised of 19.43 g/t Au and 36.8 g/t Ag over 2.0 m (1.9 m ETW), 30 m SW along strike from LC23-RC273. Both of these recent drill holes intersected the zone outside of the current resource model and confirm potential resource expansion beyond the Company's current MRE.

In addition, several drill holes were designed to test the down dip extension of the Mango zone, stratigraphically located between the El Limon and Bayacun zones. This post-resource drilling in the Mango zone supports the potential for additional shallow (open-pitable), high grade, low strip ratio, mineral resources. Highlights of the Mango drilling include drill hole LC23-RC261 which intersected 25.75 g/t Au and 27.2 g/t Ag over 2.0 m (1.9 m ETW), at 72 m vertical depth and 20 m below the currently optimized pit design. This high-grade intercept represents an extension of 38 m down dip from core drill hole LC20-177 that reported 29.78 g/t Au and 22.2 g/t Ag over 0.5 m (ETW), (see press release August 18th, 2021).

During the haul road construction for a bulk sampling program in the El Limon area, the Company confirmed and exposed additional high-grade mineralization in a road-cut, measuring approximately 80m down dip and 30m along strike. This area was not included in the current MRE. A total of 13 surface channel samples were collected within the area, with results ranging from 0.42 g/t Au and 4.3 g/t Ag over 1.0 m to 94.4 g/t Au and 25.7 g/t Ag over 0.8 m. Drill hole LC23-RC258 (see table below) intersected the same high grade mineralization exposed in the road cut, at a vertical depth of 9.3 m, of 22.30 g/t Au and 22.8 g/t Ag over 2.0 m, inside the current pit-constrained resource model boundaries but not included in the MRE.

In addition, the Company is reporting 23 RC drill holes at the northern portion of Las Conchitas ("LC-N"), at the Tirado and San Pablo zones. The main objective was to gain a higher level of confidence in the geometry of gold mineralization and expand it within and beyond the Company's current MRE boundaries. Drill hole LC23-RC251 intersected a splay of the San Pablo quartz vein, at 51 m vertical depth of 16.20 g/t Au and 19.0 g/t Ag over 3.0 m. This interval of high-grade gold mineralization was intersected outside of the current resource model and supports the potential to expand resources.

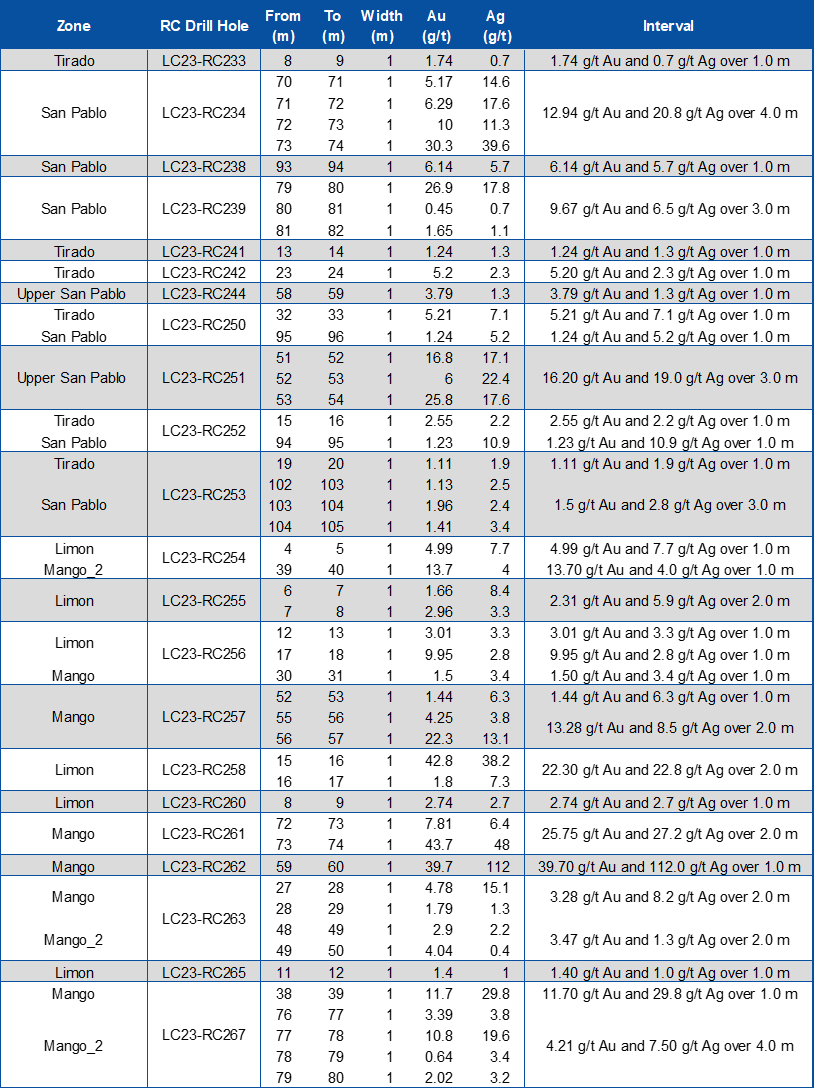

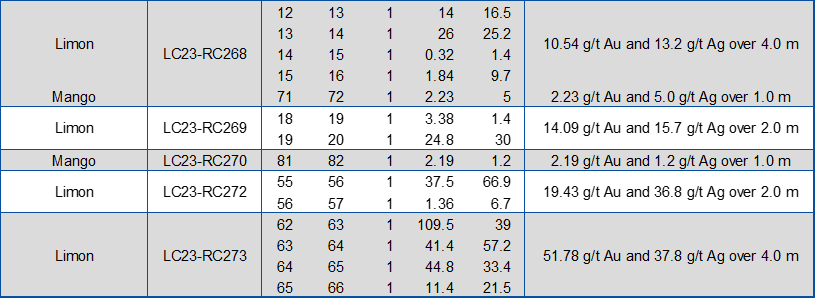

Table - Assay Results Reported in This Press Release

Note: The mineralized intervals shown above utilize a 1.0 g/t gold cut-off grade with not more than 1.0 m of internal dilution. *Widths are reported as drill hole lengths. Unless otherwise stated, true width is estimated to be between 75% and 100% of the downhole width. In addition to the drill holes presented in the table above, the following drill holes returned only anomalous values: LC23-RC235, LC23-RC237, LC23-RC247, LC23-RC259, LC23-RC266 and LC23-RC271. In addition to the drill holes presented in the table above, the following drill holes returned no significant values: LC23-RC231, LC23-RC232, LC23-RC236, LC23-RC240, LC23-RC243, LC23-RC245, LC23-RC246, LC23-RC248, LC23-RC249, LC23-RC264.

Figure - Drill Hole Plan

Sampling, Assaying, QA/QC and Data Verification

All reverse circulation (RC) holes were drilled dry i.e above the water table and no water or other fluids were injected into the hole. RC drill samples were collected every 1 meter using a center-return hammer and samples were obtained from a Gilson chip splitter which is cleaned using compressed air after each sample. Samples were bagged and labeled at the drill site under a geologist's supervision and are logged on site by a geologist who selects visually mineralized intervals for fire assay. The mineralized interval(s) including 3-5 samples above and below the selected interval are continuously sampled and shipped to the Bureau Veritas Lab (BV) in Managua, respecting the best chain of custody practices. Pulps are sent by Bureau Veritas to their laboratory in Vancouver under their chain of custody for analysis. Gold was analyzed by standard fire assay fusion, 30 gr aliquot, AAS finish. Samples returning over 10.0 g/t gold are analyzed utilizing standard Fire Assay-Gravimetric method. The Company follows industry standards in its QA&QC procedures. Control samples consisting of duplicates, standards and blanks were inserted into the sample stream at a minimum ratio of 1 control sample per every 10 samples. Analytical results of control samples confirmed reliability of the assay data.

All surface samples reported in this press release were sent to BV in Vancouver. The same assay and chain of custody procedures were implemented as mentioned above.

Qualified Person

John M. Kowalchuk, P.Geo, a geologist and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Kowalchuk is a senior geologist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, E-mail: aleisman@makominingcorp.com, phone: (917) 558-5289 or visit our website at www.makominingcorp.com and SEDARPLUS www.sedarplus.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, that the Company is expected to positively reconcile to the published mineral resource with additional drilling at Las Conchitas; that the Company high-grade production will generate significant cash flows for the foreseeable future. Mako's primary objective to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24 measures having impacts on business operations not current expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedarplus.com. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on accesswire.com