from Meridian Mining SE (isin : CAG601871387)

Meridian Mining’s Cabaçal Pre-Feasibility Study Delivers USD 984 million NPV5 & 61.2% IRR (After-Tax), and Annual Average Production 141,000 AuEq Ounces

Cabaçal 2025 Pre-Feasibility Study Highlights:

(All amounts are in United States Dollars unless otherwise stated)

Meridian delivers exceptional economics from the Cabaçal Pre-Feasibility Study;

Base case after-tax NPV5 of USD 984 million (CAD1 1.43 billion) and 61.2% IRR;

(Assuming USD 2,119/oz Au, USD 4.16/lb Cu, and USD 26.89/oz Ag, CAD:USD=1.4533);

Spot case after-tax NPV5 of USD 1.41 billion (CAD 2.04 billion) and 79.5% IRR;

(Assuming2 USD 2,917/oz Au, USD 4.54/lb Cu, and USD 32.25/oz Ag (27 February, 2025));

Cabaçal Establishes a Mid-Tier Production Profile:

Average annual production of 141,000 AuEq ounces over 10 years;

First 5 years production of 178,000 AuEq ounces annually;

Low LOM All-In-Sustaining-Costs ("AISC") of USD 742/oz AuEq3;

Low initial CAPEX of USD 248 million (CAD 359 million) including pre-investment for expansion to 4.5 Mtpa from year 4;

Strong value proposition: Base case NPV5/Capex is 3.97 times, & initial capital repaid in 17 months; and

Maiden Cabaçal reserve of 41.7Mt at 0.63g/t Au, 0.44% Cu and 1.64g/t Ag declared, including 89% in the proven category.

1 Exchange Rate USD/CAD of 1.45330, 2 Spot prices on London close on 28, February, 2025, See Technical Note for AuEq equation.

LONDON, GB / ACCESS Newswire / March 10, 2025 / Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQX:MRRDF) ("Meridian" or the "Company") is pleased to announce the positive results of the Preliminary Feasibility Study ("PFS") led by Ausenco do Brasil Engenharia Ltda and Ausenco Engineering Canada ULC (together "Ausenco"), supported by GE 21 Mineral Consultants Ltd ("GE 21") for the advanced Cabaçal gold-copper-silver deposit in Brazil ("Cabaçal" or the "Project"). The PFS's findings (Figure 1, Tables 1 - 9) confirm the exceptional economic potential of Cabaçal, positioning it as Brazil's next mid-tier production asset with a parallel resource development program and exploration upside.

Meridian will host a Live Webcast to discuss the Cabaçal PFS Results on March 10, 2025 at 10:00 am EST (7:00 am PST). A presentation by management will be followed by Q&A. Conference Call Webcast and Dial in Details:

Webcast URL: https://www.webcaster4.com/Webcast/Page/2958/52165

Telephone Numbers: US/Canada Free: 888-506-0062 / International: 973-528-0011

Participant Access Code: 195524

Mr. Gilbert Clark, CEO, comments: "This study is a game-changer for our Company. We have demonstrated nearly 1 billion US dollars in post-tax value. That jumps to almost USD 1.5 billion using the spot gold & copper prices, confirming Cabaçal as a high-margin Au-Cu-Ag mine. It starts with over 178,000 gold-equivalent-ounces a year for 5 years and averages more than 141,000 ounces over the life of mine. We have shown these strong results using consensus long-term prices and low operating costs, while also planning ahead with a step up to 4.5-million-tonnes production. I believe it is just the beginning of what we can do in this highly prospective gold-copper-silver VMS belt."

"I want to thank all our shareholders. Your support and funding helped us build Brazil's top mine development team. Now, we are focused on adding more value. We are starting the Feasibility Study soon, working on the first resource estimate for Santa Helena, and exploring new opportunities. With our recent funding, we have the funding to make these milestones happen."

"With the strength of the PFS we are expanding the Executive team and the engineering owners team as we progress the Feasibility Study. Mr. David Halkyard has been appointed to the role of Senior Vice President - Finance, where he will be leading Cabaçal's project finance team. I have known David for well over a decade now and his wealth of international project finance experience is a key addition to the team. This transformational year for Meridian's shareholders has only just started."

PFS RESULTS SUMMARY

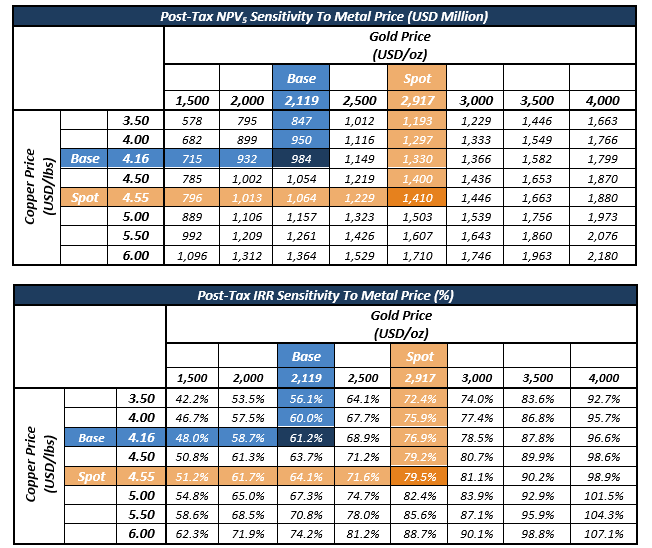

Table 1: Summary of Cabaçal PFS's NPV5 and IRR sensitivities to metal prices

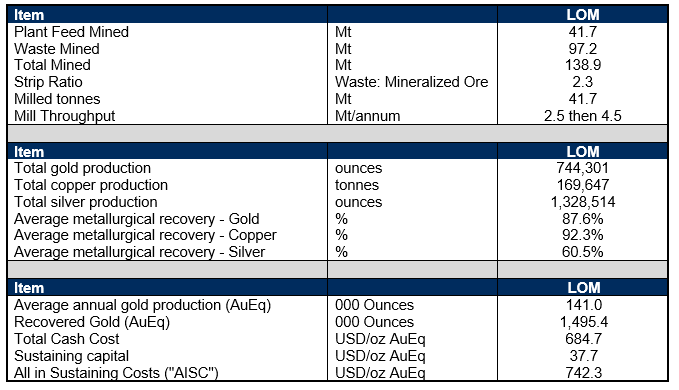

Table 2: PFS production summary

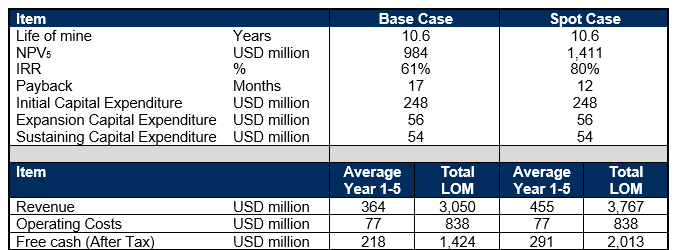

Table 3: Project economics at base case and spot case

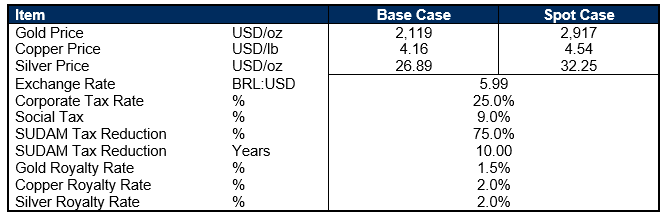

Table 4: Cabaçal PFS model inputs

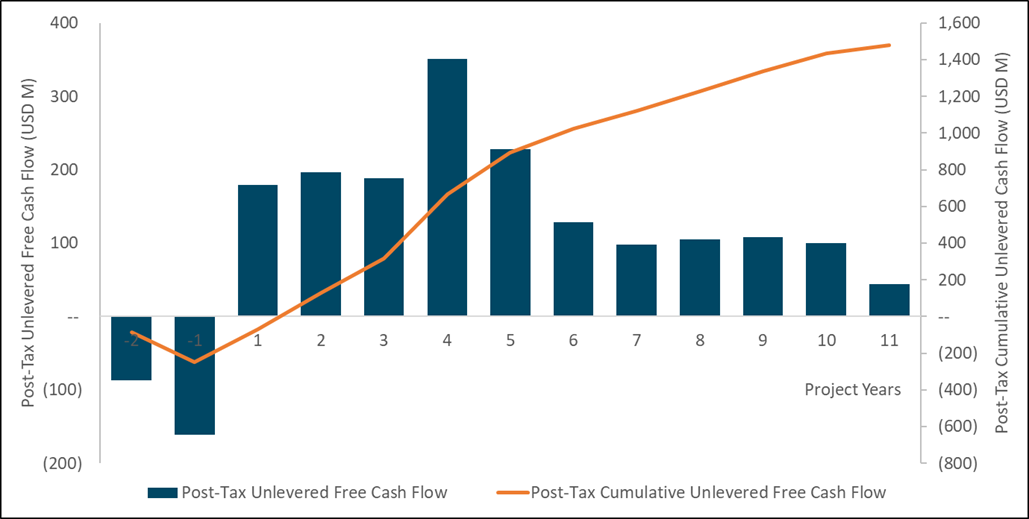

Figure 1: Cabaçal project annual and cumulative cash flow

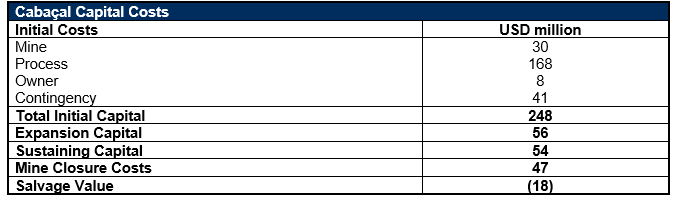

Table 5: PFS capital cost breakdown

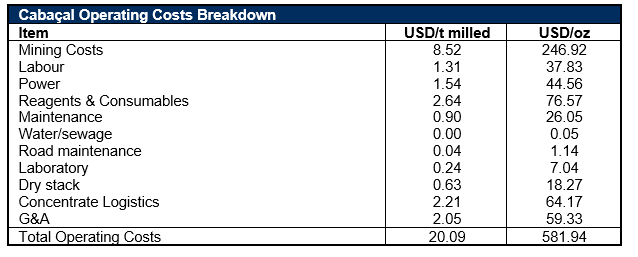

Table 6: PFS operating cost breakdown

Study Contributors

The PFS team was led by Ausenco, a global provider of consulting and engineering services for mining projects. Ausenco were supported by GE21 Consultoria Mineral Ltda (resource estimation, mine plan and schedule), SGS Lakefield Canada (metallurgy), Sete Soluções e Tecnologia Ambiental Ltda (environmental studies) and Hidrovia Hidrogeologia e Meio Ambiente Ltda (hydrological studies).

Cabaçal Resource and Reserve Estimates1

Table 7: Cabaçal Gold-Copper Project Open Pit Mineral Resource (Effective Date November 15th, 2024, 0.19 g/t AuEq cut-off)

Resource Classification | Average Value | Metal Content | |||||||

Mass | Au | Cu | Ag | Au Equiv. | Au | Cu | Ag | Au Equiv. | |

Mt | g/t | % | g/t | g/t | koz | kt | koz | Moz | |

Measured | 43.68 | 0.59 | 0.41 | 1.53 | 1.03 | 834.16 | 178.80 | 2,152.32 | 1.44 |

Indicated | 7.75 | 0.28 | 0.33 | 1.32 | 0.64 | 70.15 | 25.68 | 328.40 | 0.16 |

Meas & Ind | 51.43 | 0.55 | 0.40 | 1.50 | 0.97 | 904.31 | 204.47 | 2,480.72 | 1.60 |

Notes related to the Mineral Resource Estimate:

Measured and Indicated Resource estimate reported inside open pit constrains. Inferred category was not classified inside open pit constrains.

The mineral resource estimates were prepared in accordance with the CIM Standards, and the CIM Guidelines, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

Mineral Resources are not ore reserves and are not demonstrably economically recoverable.

Grades reported using dry density.

The effective date of the MRE was November 15th, 2024.

The QP responsible for the Mineral Resources is geologist Leonardo Soares (MAIG #5180).

The MRE numbers provided have been rounded to the estimate relative precision. Values cannot be added due to rounding.

The MRE is delimited by Mining license areas.

The MRE was estimated using ordinary kriging in 10m x 10m x 5m blocks with sub-blocks of 5.0m x 2.5m x 1.25m.

The MRE report table was produced in Leapfrog Geo software.

The MRE was restricted by a pit shell defined using metal prices of 2,119 US$/oz Au, Mining cost of 2.11 US$/ton mined, processing cost of 8.20 US$/ ton processed, metallurgical recovery calculated block by block based on metallurgical tests, G&A costs of 1.66 US$/ton processed, and 1.64 US$/ton processed logistics.

Equivalent Gold grade was calculated with the following formulae: AuEq = (Au_grade * %Au_Recovery) + (1.346*(Cu_grade * %Cu_Recovery)) + (0.013*(Ag _grade * %Ag_Recovery)).

1 See Meridian news release September 26, 2022 https://meridianmining.co/press-releases/

Table 8: Cabaçal Gold-Copper Project Underground Mineral Resource Estimate (Effective Date November 15th, 2024, 0.96 g/t AuEq cut-off)

Resource Classification | Average Value | Metal Content | |||||||

Mass | Au | Cu | Ag | Au Equiv. | Au | Cu | Ag | Au Equiv. | |

Mt | g/t | % | g/t | g/t | koz | kt | koz | Moz | |

Inferred | 0.26 | 0.96 | 0.49 | 1.36 | 1.47 | 8.15 | 1.29 | 11.54 | 0.012 |

Notes related to the Mineral Resource Estimate:

Inferred Resource estimate reported inside underground grade shell.

The mineral resource estimates were prepared in accordance with the CIM Standards, and the CIM Guidelines, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

Mineral Resources are not ore reserves and are not demonstrably economically recoverable.

Grades reported using dry density.

The effective date of the MRE was November 15th, 2024.

The QP responsible for the Mineral Resources is geologist Leonardo Soares (MAIG #5180).

The MRE numbers provided have been rounded to the estimate relative precision. Values cannot be added due to rounding.

The MRE is delimited by Mining tenement areas.

The MRE was estimated using ordinary kriging in 10m x 10m x 5m blocks with sub-blocks of 5.0m x 2.5m x 1.25m.

The MRE report table was produced in Leapfrog Geo software.

The MRE was restricted by an underground optimized stopes defined using metal prices of 2,119 US$/oz Au, Mining cost of 32.0 US$/ton mined, processing cost of 8.20 US$/ ton processed, metallurgical recovery calculated block by block based on metallurgical tests, G&A costs of 1.66 US$/ton processed, and 1.64 US$/ton processed logistics.

Equivalent Gold grade was calculated with the following formulae: AuEq = (Au_grade * %Au_Recovery) + (1.346*(Cu_grade * %Cu_Recovery)) + (0.013*(Ag _grade * %Ag_Recovery)).

Estimates are based on the Technical Report titled, "Independent Technical Report, Mineral Resource Estimate for the Cabaçal Gold-Copper Project, State of Mato Grosso, Brazil". The Mineral Resource estimate in the table above was prepared by specialist group, GE21 Consultoria Mineral ("GE21").

Mineral Resources are not mineral reserves and do not have demonstrated economic viability; and

Minor variations may occur during the addition of rounded numbers.

The Mineral Resource estimate included in the PFS is reported according to the classification criteria set out in the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards for Mineral Resources and Reserves ("CIM Definition Standards"). These standards are internationally recognized and allow the reader to compare the Mineral Resource with that reported for similar projects.

The Initial Mineral Reserve estimate for Cabaçal was carried out by GE21 Mineral Consulting and is based on the Mineral Resource Statement with an effective date of February 11, 2025. Mineral Resources are inclusive of Mineral Reserves (Table 9).

Table 9: Cabaçal Copper-Gold Project - Mineral Reserves Estimate (Effective Date - February 11th, 2025)

Reserve Classification | Average Value | Material Content | |||||

Mass | Au | Ag | Cu | Au | Ag | Cu | |

Mt | g/t | g/t | % | k oz | k oz | M lb | |

Proven | 37.11 | 0.67 | 1.64 | 0.45 | 797.10 | 1,962.66 | 364.90 |

Probable | 4.59 | 0.36 | 1.57 | 0.40 | 52.77 | 231.75 | 40.48 |

Proven & Probable | 41.70 | 0.63 | 1.64 | 0.44 | 849.88 | 2,194.41 | 405.38 |

Notes:

Mineral Reserves estimates were prepared in accordance with the CIM Standards.

Mineral Reserves are the economic portion of the Measured and Indicated Mineral Resources.

Mineral Reserves were estimated by Porfírio Cabaleiro BSc (Min Eng), FAIG, a GE21 associate, who meets the requirements of a "Qualified Person" as established by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014) ("the CIM Standards").

The Mineral Reserves are reported with an effective date of February 11, 2025.

The reference point at which the Mineral Reserves are defined is the point where the ore is delivered from the open pit to the crushing plant.

Mineral Reserves were estimated using the Geovia Whittle 4.3 software and following the geometric and economic parameters.

Geometric and economic parameters include: Mine recovery of 97% and dilution 3%, Copper, Gold, Silver selling cost of US$4.16/lb, US$ 2,119/oz, US$26.89/oz, respectively, Mining costs of US$ 2.98 per ton for mineralization and waste, Processing costs of US$ 9.83 per ton of ore feed, General and Administrative (G&A) costs of US$2.11 per ton of process ore, Copper, Gold, Silver selling cost of US$2.77 per ton of process ore. Exchange rate: $1.00 = R$5.50, Specific values for the Deposit: Pit slope angles ranging from 35° to 54°, Metal recoveries are based on the following formulae:

Copper ð ðð = 3.906 Ln(ðºðððð) + 95.27 up to 3.0% copper. Above 3.0% Cu a cap of 97% recovery was applied

Gold ð ðð = 5.402 â ð¿ð(ðºðððð) + 88.66 up to 4.0g/t gold. Above 4.0g/t Au a cap of 97% recovery was applied

Silver ð ðð = 30.354 â ð¿ð(ðºðððð) + 43.691 up to 4.0g/t silver. Above 4.0g/t Ag a cap of 87.6% recovery was applied

Mining

10.6-years shallow open pit mining operation proposed with total feed inventory of 41.70 Mt;

High-grade year 1 mill feed of 1.45 g/t gold and 0.54% copper with average grade LOM of 0.63 g/t gold, 0.44% copper, and 1.64 g/t silver; and

Low life-of-mine strip ratio of 2.33.

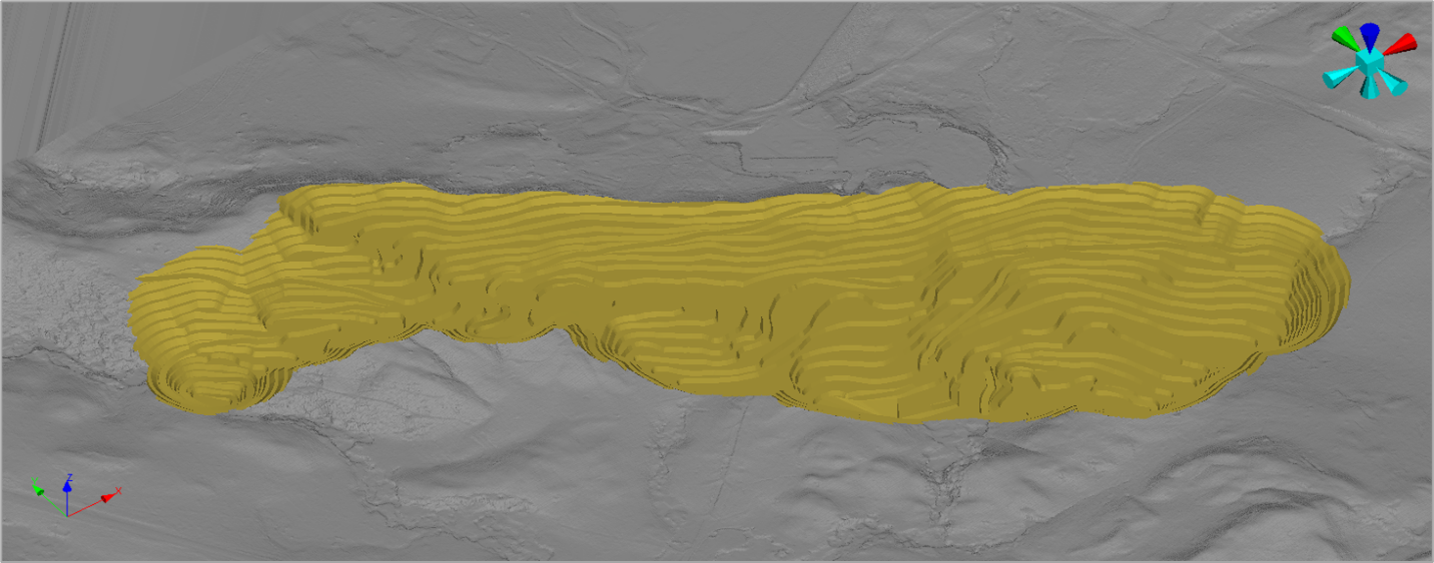

Cabaçal will be mined using the open pit method (Figure 2) in 3 alternating shifts, operating 24 hours a day, 365 days a year. The mining movements were designed to produce enough RoM to feed an ore processing plant with a nominal capacity of 2.50 Mtpa for the first three years, 4.50 Mtpa for the last 7.6 years and a total LOM of 10.6 years of production.

The mining will operate with a block model of 10x10x5m and slope angle in the hanging wall of 54° inter ramp of the fresh rock and following the mineralized material slope in the footwall.

Mining operations mechanical blasting, loading and haulage will be fully outsourced. Ore is relatively soft with an average Bond ball mill work index of 11.8 (metric)- blasting will be conducted with a load ratio of 200 g/t for mineralized material and 155 g/t for waste. A dilution factor of 3% and mining recovery of 97% were considered. The transport distance from the mine to the RoM yard varies from 1.58 km in the pre-stripping to a maximum of 1.98 km in year 8. For the waste the transport distance will range from 1.96 km to 2.61 km in year 10.

The transport of ore and waste will be carried out by 55 t trucks manufactured in Brazil, a fact that contributes to the reduction in the OPEX costs. For work associated with these trucks, 74 t hydraulic excavators were dimensioned, which means 5.9 passes per truck loaded with mineralized material and 5.8 passes per truck loaded with waste.

Trucks will transport ore for discharge directly into the crusher or to the RoM stockpile. A 30.3 t wheel loader will be used to recover ore from the RoM stockpile as needed. The waste will be sent directly to the 3 projected waste dumps, each trip being directed to the pile closest to the pit region in mining activities at that time. From the 5th year onwards mining in the southeast extension of the pit will have been completed. There is an opportunity to return part of the waste material to this area in the Mine, with the possibility to reduce costs and footprint.

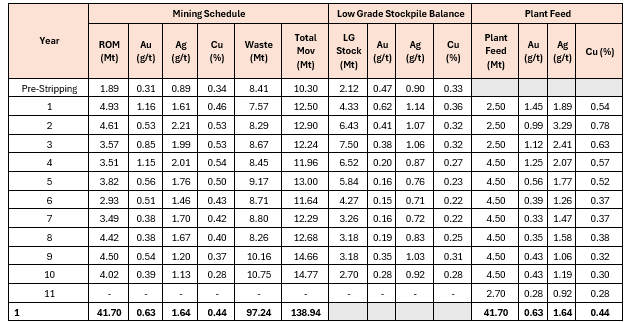

The table below shows the annual mining plan (0.25 g/t AuEq. cut-off) starting with pre-stripping and an ore feeding plan to the process plant. A mining plan was adopted that allows the plant to be fed with high gold content equivalent ore in the first four years of production, storing low-grade ore (LG) to be fed later in the mine life. This allowed the elaboration of a plan optimizing the economic model of the project.

Table 10: Cabaçalmining schedule

97% of recovery and 3% dilution was applied in resource

Figure 2: The final pit shell of the Cabaçal mine.

Metallurgical Testing

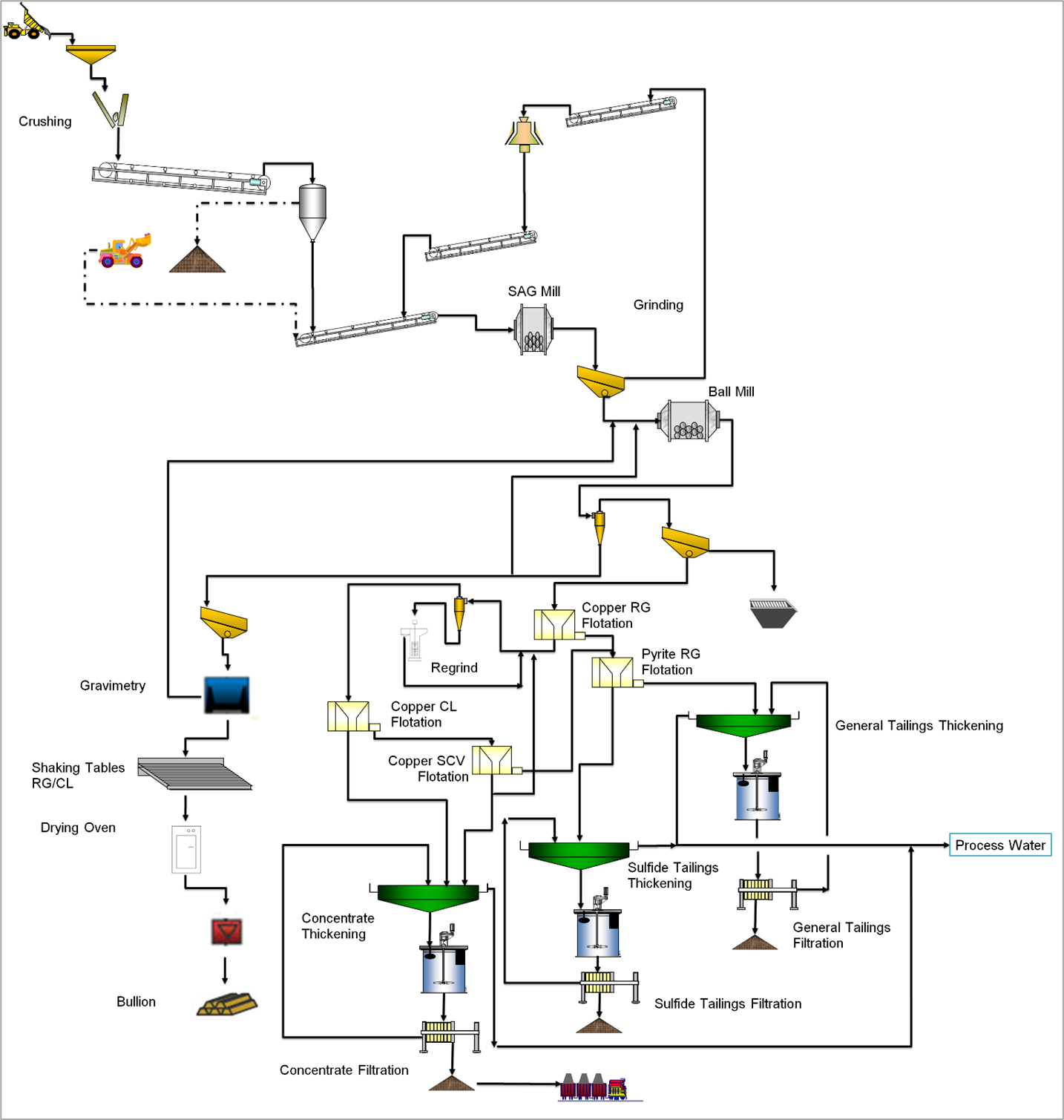

The Cabaçal PFS project envisages two mined products will be generated at Cabaçal:

Gold and silver in doré bars; and

Copper and gold concentrate.

The beneficiation process is simple due to relatively clean ore, with low impurities and an absence of organic material. This results in amenability to flotation at a relatively coarse grind of 200 μm, with rapid kinetics of the Cabaçal mine's chalcopyrite, allowing for a simple flotation flowsheet to give copper recoveries up to 95% to a clean concentrate. Gold is recovered via gravity circuit (concentrator and shaking tables), and via flotation, with copper. The rougher tailings are treated in a pyrite flotation stage, with the main objective of separating most of the sulfur in a low mass stream, reducing the risks of final tails dewatering and disposal. Both tailings' streams are filtered for disposal. Rougher concentrate is reground and refloated in a cleaner circuit, consisting of a vertimill and a Jameson Cell, with the concentrate reporting to the dewatering circuit.

Three test work programs have been completed since 2022. They are summarized as follows:

In 2022, a new drilling campaign and test work program was completed, where Meridian drilled ten metallurgical holes. Seven of these holes were used for sample selection to confirm historical performance with a new round of test work at SGS Lakefield, Canada. The holes provided samples from the four known main VMS systems, namely the Central Copper Zone, the Eastern Copper Zone, the Southern Copper Zone and the Cabaçal Northwest Extension. Most of the samples were within the expected head grade range for the deposit. Comminution, gravity and flotation tests were run on samples from different metallurgical domains, as well on a master composite sample.

In 2023, 23 variability samples from across the deposit (including nine through the vertical profile of drill hole CD-228) were collected, covering oxidized, transition and sulfides zones. Samples were tested at SGS Lakefield, Canada. In this program, all samples were subjected to Bond ball mill work index and SMC testing. In addition, metallurgical samples were tested for flotation flowsheet and reagent dosage optimization and, once optimal flowsheet was defined, variability samples were tested to generate enough information to create recovery curves for the project. Thickening and filtration tests were also performed.

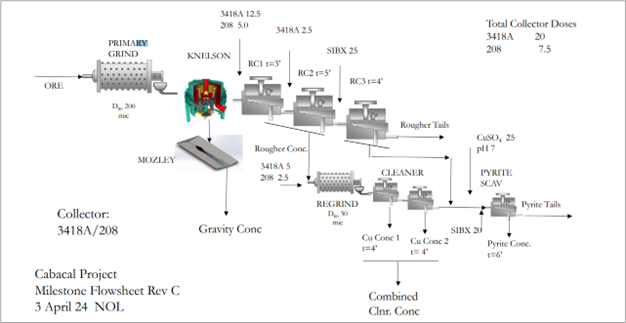

In 2024, a revised process flowsheet labelled RevC was developed with the main differences to the PEA flowsheet being:

The use of copper and gold specific collectors Aerophine 3148A and Aero 208 to replace PAX in rougher flotation;

Extended rougher float time; and

Pyrite minerals were then floated from the rougher tails for separate storage.

The new flowsheet (Figure 3) was tested on the same samples and master composites selected for the PEA as well as additional samples that filled in gaps in the grade curve, represented the variability of the deposit from top to bottom and added data on the oxide and transition zones of the deposit.

In addition, a gold deportment study was conducted as well as TIMA-X mineral characterisation of the master composite. Tailings settling/thickener testing showed it responded well to BASF Magnafloc 155 flocculant.

Updated grade recovery curves were developed at the completion of the testwork.

Figure 3: The RevC process flowsheet developed for the PFS

Additional test work is recommended to define primary grind size (200 vs 150 microns). Also, pilot plant tests are planned for the next phase of the project to reduce risks of the project and generate enough sample for further testing (vendor, environmental, etc.).

Mineral Processing

Primary crushing capacity for 4.5 Mtpa at plant start up;

2.5 Mtpa mill capacity using a single stage SAG mill designed with conventional flowsheet for the first three years;

Comminution capacity is increased to 4.5 Mtpa with the addition of a ball mill from the fourth year onward. Additional flotation cells, thickening and filtering capacity are also included in the expansion; and

Primary grind size of 200 microns throughout.

Based on the SGS test work results, Ausenco designed a new process plant to process 2.5 Mtpa of run-of-mine (RoM) feed from the Cabaçal open pit in the first three years then, with an expansion in year three of the plant operation, processing 4.5 Mtpa of RoM from the fourth year onward. The process comprises crushing and grinding to reduce the RoM ore to primary grind of 80% passing (k80) of 200 microns (µm). Approximately 30% of the mill feed is sent to a gravity separation circuit to recover free gold. Tailings from the gravity circuit are recycled to grinding. Grinding circuit product feeds copper flotation in conventional cells. Copper rougher concentrate is reground and then cleaned in a Jameson cell to produce final concentrate. Copper flotation tailings are floated to generate a pyrite/high sulphide concentrate and low sulphide tailings streams for separate filtration and disposal. The Process flowsheet is illustrated in Figure 4, and the proposed Plant Layout in Figure 5 - 6.

Figure 4: Cabaçal Process flowsheet diagram - 4.5 Mtpa expansion case

Figure 5: Cabaçal process plant layout

Figure 6: Cabaçal process plant layout in 3D

Access and infrastructure

Cabaçal is well supported by existing public infrastructure. It is located in the State of Mato Grosso, Brazil. It is accessed by sealed roads approximately 320 km west-north-west of the state capital Cuiabá, then a 35km all-weather gravel road from the Company's administrative base in the town of São José dos Quatro Marcos.

The region is currently supplied by a high-voltage 34.5kV power line. Several hydroelectric power stations operate in the region. A potential route for the construction of an 138kVA electric line of sufficient capacity for the Cabaçal project from the Araputanga substation to the Project area has been identified, extending over 22 km.

Subject to permitting, water is potentially available from the nearby Cabaçal river. The process facility aims to recover and re-use as much process water as possible. All rainwater that comes in contact with mining operations is planned to be collected and either used on site or treated to required standards then released.

Mine services and labour are readily available, primarily from nearby towns.

Infrastructure associated with the historic Cabaçal Mine has been removed from site, aside from some old buildings which have been converted to field offices and core processing / storage facilities. The PFS therefore assumes that the new Cabaçal mine is effectively a greenfield project.

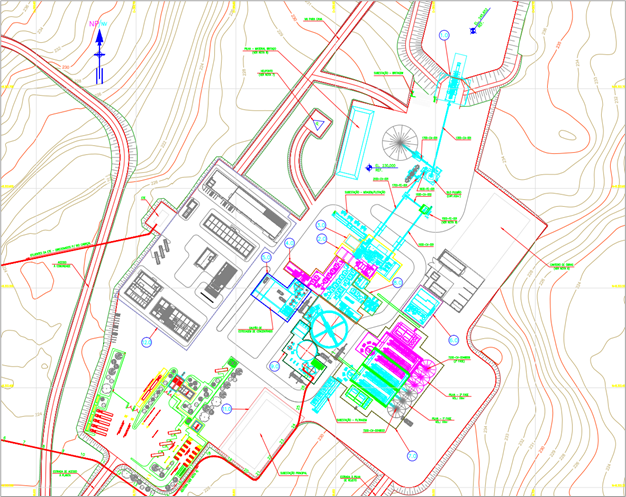

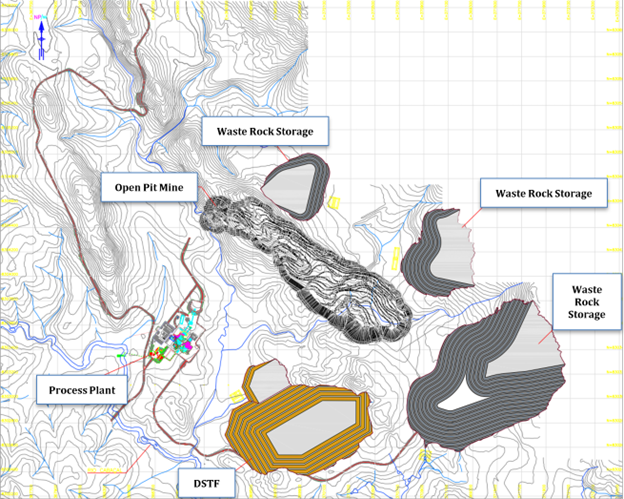

The Cabaçal site plan is shown in Figure 7. The major project facilities include the open pit mines, dry storage tailings facility, waste rock facilities, mine services and access roads. Site selection took into consideration the following factors:

Locate the infrastructure looking to minimize to the maximum possible the environmental impacts;

Locate the process plant on competent flat ground and in an area with minimal potential to be mineralized;

Locate the process plant and other facilities at a safe distance from the mine pit and blasting operations; and

Locate the process plant and waste storage facilities to minimise transport distances.

Figure 7: Cabaçal mine site layout

Several areas have been identified to store waste rock from the mine. Three waste rock storage facilities (WRSF) have been selected for the PFS. The tailings will be filtered to produce a dry cake that will be trucked from the filter plant and stacked in the dry stack tailings facility (DSTF). The DSTF has been designed to international standards for the PFS. Initial studies indicate that waste rock and tailings are potentially non-acid generating. Detailed waste material characterisation studies are planned for optimization of the long-term storage facility design for construction, safe operation and eventual closure.

Environmental, Permitting & Stakeholder Engagement

Meridian commenced baseline environmental and social impact data collection of the Cabaçal project in January 2022 and completed the studies in November 2023. The company Sete Soluções e Tecnologia Ambiental Ltda (SETE) was hired to conduct the environmental studies, Hidrovia Hidrogeologia e Meio Ambiente Ltda to perform hydrogeological studies and Totem Consultoria em Arqueologia Ltda to deal with the archaeological studies. The studies were summarized by SETE in the Environmental Impact Study (EIA) and Environmental Impact Report (RIMA), which concluded with the following opinion "...based on the project information, the knowledge acquired from the environmental analysis prepared, the environmental impacts assessed and the availability of prevention, mitigation, control, compensation and environmental monitoring mechanisms for the proposed project, which will be further detailed in the PCA (Environmental Control Plan), during the Installation License phase, the environmental licensing of the Cabaçal project is considered feasible, as proposed by the company. It is also possible to state that measures aimed at preventing, controlling, mitigating, compensating and monitoring negative impacts will be able to generate adequate responses to the predicted impacts, so that the interference of the project in the environment occurs within limits considered acceptable by current environmental legislation and by society."

Ongoing environmental monitoring of the Cabaçal project site is underway in order to continue to build up environment data for the baseline models.

The EIA/RIMA reports were filed with the Mato Grosso State Environmental Secretariat - SEMA (the agency responsible for the environmental licensing process) on December 2, 2023. The licensing process is now following the regulated pathway and has already undergone the Public Hearing held on September 19, 2024, and the field inspection carried out by a multidisciplinary technical team from SEMA, which attested to the veracity of the information contained in the EIA/RIMA. The process is currently undergoing final analysis by SEMA technicians with the next step being the issue of the Technical Recommendation Opinion to support the Cabaçal Preliminary License (LP).

Meridian also undertakes its own stakeholder engagement processes which commenced on acquiring the Cabaçal project in 2021. The Cabaçal project is located within farming land, with no artisanal mining activity. Aside from local farms, there are no settlements or population clusters within the project's active area. The nearest indigenous land is located 80km distant from Cabaçal to the northwest (Terra Indígena Figueiras). The project is located more than 25 km away from areas classified as Quilombolas (settlements first established by escaped slaves in Brazil, whose descendants have recognized land rights). No areas classified as of special tourist importance are present. Since the commencement of activities, the Company has established formal exploration access agreements with 65 landholders and continues to engage with others progressively as geological survey activities require.

Upside and optimization

The PFS results provide an estimate of the potential economic value of the mineral resources defined to November 15th, 2024. In completing the PFS, a number of opportunities were identified that would potentially enhance the Cabaçal project, subject to completing the necessary assessment. Some of this work is already underway. These include:

Resource infill and extensional drilling continues following the cut-off of November 15th, 2024. The primary aim is to test select areas where historical data was lost from the mine environment.

The Cabaçal deposit has inferred underground resources that remain open and with further infill drilling, may represent targets for potential conversion to indicated resources to assess potential for development.

The project sits in a mine corridor of 11km of prospective ground extending to Santa Helena to the southeast, with numerous targets. Exploration drilling will progressively test the targets generated and geophysics and geochemistry will be used to identify additional targets more broadly through the 50km belt.

A geotechnical study of the Cabaçal pit was conducted, analyzing rock and soil samples using compressive strength and consistency tests. The test results indicated a general friction angle ranging from 35° in the saprolite to 54° in the fresh rock. In the pit areas, fresh rock occurs near the surface, at a maximum depth of 16 meters, leading to the adoption of a conservative value of 48° for the general angle. Opportunities to further optimize pit will angles will be reviewed further following any new data gathered in the 2025 drill program.

Future mining activities above and around existing voids areas were analyzed using advanced geotechnical analysis based on 3D modelling and finite element simulations. These analyses demonstrated that, while the overall stability of the Cabaçal pit is maintained, areas with a slab thickness below 5 meters require special attention. The tests and analyses indicated that mining activities above the voids can be conducted safely. Above 10 meters, there is no significant risk, however, for areas below 5 meters, increased monitoring and precautionary measures are necessary. As a preventive approach, rigorous inspections an