from Metallic Minerals Corp. (isin : CA59126M1068)

Metallic Minerals Announces Inaugural 18 Million Silver Equivalent Ounce NI 43-101 Mineral Resource Estimate for the Keno Silver Project in Yukon, Canada

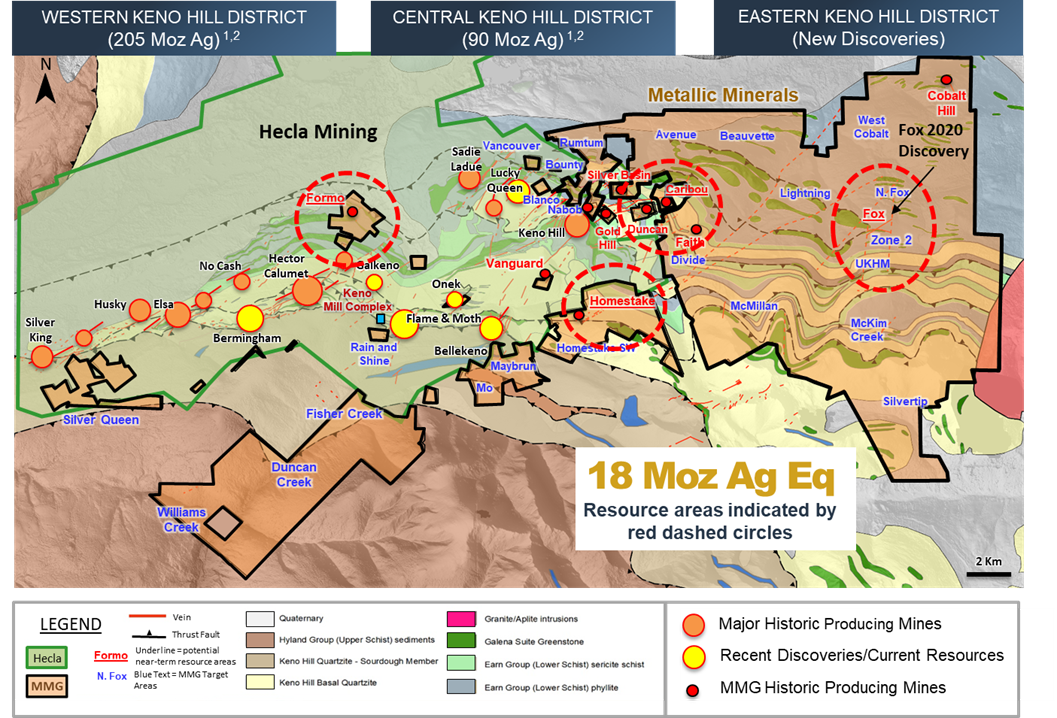

VANCOUVER, BC / ACCESSWIRE / February 26, 2024 / Metallic Minerals Corp. (TSX.V:MMG)(OTCQB:MMNGF) ("Metallic Minerals" or the "Company") is pleased to announce the first National Instrument 43-101 ("NI-43-101") mineral resource estimate (the "2024 Resource Estimate") on the Company's Keno Silver project, adjacent to Hecla Mining's ("Hecla") high-grade operations in the iconic Keno Silver District of Canada's Yukon Territory. The combined underground and in-pit total resource estimate from four separate deposits (Formo, Fox, Caribou and Homestake) comprises an Inferred Resource of 2.5 million tonnes ("Mt") at 223 grams per tonne ("g/t") silver equivalent ("AgEq") equating to 18.16 million ounces ("Moz") of contained silver equivalent. Significant resource expansion is anticipated with further drilling as each of these deposits are contained within 250 meters depth from surface and are open along strike in all directions and at depth where grades typically trend higher.

Subsequent campaigns, expected to commence in the 2024 field season, will focus on expansion through the drilling of extensions of current resource deposits, definition drilling of very prospective early-stage drilled targets and targeting of new discoveries at high-priority targets that have yet to be drill tested. This 2024 Resource Estimate is contained within four of 11 target areas that have returned positive results from initial drill testing to date, with 42 additional targets identified on the 171 square kilometer project since 2016 remaining, as yet, undrilled (see Figure 1).

PDAC 2024 Core Shacks and Exhibitor Hall

Metallic Minerals will be participating in the 2024 Prospectors and Developers Convention in Toronto. The Company invites investors to visit us in the Investors Exchange (Booth 3318) from March 3-6 as well as the Core Shack Booth 3116B March 5-6. In addition, Metallic Minerals, along with fellow Metallic Group companies, Stillwater Critical Minerals and Granite Creek Copper, and our Yukon Mining Alliance peers, will be participating in the Yukon Mining Alliance Core Shack to be held in the PDAC Investors Exchange at Booth 3310 from March 3-6.

2023 Resource Estimate Highlights

- Underground Inferred Mineral Resources include the Formo deposit containing 12.77 Moz AgEq (7.11 Moz of silver, 3,000 oz of gold, 36.02 Mlbs of lead, and 66.14 Mlbs of zinc) within 1.08 Mt grading 369 g/t AgEq (206 g/t silver, 0.08 g/t gold, 1.52% lead, and 2.79% zinc). The Formo deposit is directly adjacent to the Silver Trail highway (Highway 11) and power lines that feed the central Keno Hill mill which is operated by Hecla, the largest primary silver producer in Canada and the USA. The Formo deposit directly adjoins Hecla's Keno Hill property, where Hecla is actively mining the nearby Bermingham deposit.

- In-Pit Inferred Mineral Resources include Caribou, Fox and Homestake and contain 5.40 Moz AgEq (2.70 Moz of silver, 5,500 oz of gold, 8.86 Mlbs of lead, and 32.95 Mlbs of zinc) within 1.46 Mt grading 115 g/t AgEq (58 g/t silver, 0.12 g/t gold, 0.28 % lead, and 1.02 % zinc). Bulk tonnage operations in the district include the historic open pit production from the Silver King, Hector Calumet, Onek and other deposits (currently held by Hecla) and feature significantly lower development and operating costs than more selective underground mining methods1.

- The 2024 Resource Estimate represents the equivalent of several years of production through the Keno area mill based on production guidance provided by Hecla which is planning to mine up to 4 million ounces of silver at Keno in 20242.

- Having identified the productive structures and defined this very significant mineral resource, the Company expects to be able to add significant ounces during subsequent drill campaigns.

- The 2024 Resource Estimate was completed by SGS Geological Services ("SGS") based on 293 surface diamond core and reverse circulation drill holes totaling 17,654.6 meters.

Scott Petsel, Metallic Minerals' President, states, "We are very pleased to achieve this major milestone of an inaugural resource estimate for the Keno Silver project, which we see as having clear potential for major expansion within this world-class silver district, directly adjacent to one of the world's highest grade silver mines. Since the first acquisitions of Kenoproperties in 2016, the Company has worked diligently towards this announcement through a series of systematic advancements including successfully consolidating the current 171km2 property package, district-wide data compilation, target development and drill testing. With 42 early-stage targets developed on the property, 11 targets that have been drill tested with significant results, and now four target areas that have advanced to Inferred Resources, we see this milestone as a foundation from which there are very clear opportunities to quickly and efficiently grow the 2024 Resource Estimate with additional drilling, while continuing to advance early-stage targets to new discoveries."

"Metallic Minerals' combined Inferred mineral inventory, now including both the Keno Silver and La Plata projects, consists of 35.76 million ounces of silver and 1.2 billion pounds of copper. Further updates are expected in the coming weeks, including first drill results from the ongoing campaign at La Plata in Colorado which continue to be processed."

The 2024 Resource Estimate will be incorporated into an NI 43-101-compliant technical report for the Keno Silver project which will be available within 45 days.

Table 1. Keno Silver Project Mineral Resource Estimates, February 1, 2024.

Deposit | Cut-off Grade (AgEq g/t) | Tonnes | AgEq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | AgEq (Moz) | Ag (Moz) | Au (oz) | Pb (Mlbs) | Zn (Mlbs) |

Formo | 150 | 1,075,000 | 369 | 206 | 0.08 | 1.52 | 2.79 | 12.77 | 7.11 | 3,000 | 36.02 | 66.14 |

Caribou | 50 | 589,000 | 149 | 94 | 0.09 | 0.50 | 0.82 | 2.82 | 1.78 | 2,000 | 6.46 | 10.60 |

Fox | 50 | 793,000 | 83 | 28 | 0.02 | 0.09 | 1.26 | 2.11 | 0.73 | 500 | 1.53 | 22.04 |

Homestake | 50 | 78,000 | 187 | 77 | 1.10 | 0.50 | 0.18 | 0.47 | 0.19 | 3,000 | 0.87 | 0.31 |

Total | 50/150 | 2,535000 | 223 | 120 | 0.1 | 0.8 | 1.77 | 18.16 | 9.81 | 8,500 | 44.88 | 99.08 |

Notes to Table 1 reported values:

- The base-case AgEq Cut-off grades consider metal prices of $22.50/oz Ag, $1,800/oz Au, $1.00/lb Pb and $1.30/lb Zn, and considers metal recoveries of 95% for Ag, 50% for Au, 94% for Pb and 88% for Zn.

- AgEq = Ag ppm + (((Au ppm x Au price/gram) + (Pb% x Pb price/t) + (Zn% x Zn price/t))/Ag price/gram) at the above assumed metal prices.

Keno Deposit Mineral Resource Estimate Notes (Table 1):

- The effective date of the Keno deposit Mineral Resource Estimate is February 1, 2024.

- The Mineral Resource Estimates were estimated by Allan Armitage, Ph.D., P. Geo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101.

- The classification of the current Mineral Resource Estimate into Inferred Mineral Resources is consistent with current 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves.

- All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

- The Mineral Resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction.

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The Keno Mineral Resource Estimate is based on a validated database which includes data from 293 surface diamond, RC and RAB drill holes totalling 17,654.63 m, and 292 surface and underground channels (Formo) for 450.43 m. The resource database totals 5,429 assay intervals representing 6,734.09 m of data.

- The Mineral Resource Estimate is based on 29 three-dimensional ("3D") resource models for Fox (19), Caribou (4), Formo (4) and Homestake (2), constructed in Leapfrog. Grades for Ag, Au, Pb and Zn were estimated for each mineralization domain using 1.5 metre capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains.

- Average density values were assigned to each domain based on a database of 54 samples.

- Based on their size, shape and orientation, it is envisioned that the Caribou, Fox and Homestake deposits of the Keno project may be mined using open-pit mining methods. Mineral Resources are reported at a base case cut-off grade of 50 g/t AgEq. The in-pit Mineral Resource grade blocks are quantified above the base case cut-off grade, above the constraining pit shell, below topography and within the constraining mineralized domains (the constraining volumes).

- The results from the pit optimization, using the pseudoflow optimization method in Whittle 4.7.4, are used solely for the purpose of testing the "reasonable prospects for economic extraction" by an open pit and do not represent an attempt to estimate Mineral Reserves. There are no Mineral Reserves on the Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade.

- It is envisioned that the Formo deposit may be mined using underground mining methods. Mineral Resources for Formo are reported at a base case cut-off grade of 150 g/t AgEq. The mineral resource grade blocks were quantified above the base case cut-off grade, below surface and within the constraining mineralized wireframes (considered mineable shapes).

- Based on the size, shape, general thickness and orientation of the Formo mineralized structures, it is envisioned that the deposits may be mined using a combination of underground mining methods including sub-level stoping (SLS) and/or cut and fill (CAF) mining.

- The base-case AgEq Cut-off grade considers metal prices of $22.50/oz Ag, $1,800/oz Au, $1.00/lb Pb and $1.30/lb Zn, and considers metal recoveries of 95% for Ag, 50% for Au, 94% for Pb and 88% for Zn.

- The pit optimization and base case cut-off grade of 50 g/t AgEq considers a mining cost of US$2.20/t mined, and processing, treatment, refining, G&A and transportation cost of USD$25.00/t of mineralized material.

- The underground base case cut-off grade of 150 g/t AgEq a mining cost of US$65.00/t mined, and processing, treatment, refining, G&A and transportation cost of USD$25.00/t of mineralized material.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Figure 1. Keno Silver Project Showing Inferred Resource Area Locations

Sensitivity Analysis

In addition to the base case scenario presented in Table 1 above, Table 2 and Table 3 below, provide sensitivity analyses which demonstrates the variation in grade, tonnage and contained metal for the 2024 Resource Estimate at various cut-off grades for both the open pit scenarios at the Caribou, Fox and Homestake deposits and the more selective underground mining scenario at the Formo deposit. Different cut-off grades may be employed depending on variations in prevailing metal prices and mining costs.

Table 2. Underground Mineral Resource Estimate for the Formo Deposit at Various AgEq Cut-off Grades, February 1, 2024

Cut-off Grade (AgEq g/t) | Tonnes | AgEq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | AgEq (Moz) | Ag (Moz) | Au (oz) | Pb (Mlbs) | Zn (Mlbs) |

80 | 1,548,000 | 291 | 159 | 0.09 | 1.20 | 2.22 | 14.48 | 7.93 | 4,000 | 40.9 | 75.8 |

90 | 1,457,000 | 304 | 167 | 0.09 | 1.25 | 2.32 | 14.24 | 7.80 | 4,000 | 40.0 | 74.7 |

100 | 1,386,000 | 314 | 173 | 0.09 | 1.29 | 2.40 | 14.02 | 7.70 | 4,000 | 39.4 | 73.3 |

120 | 1,263,000 | 334 | 185 | 0.09 | 1.37 | 2.53 | 13.58 | 7.50 | 4,000 | 38.2 | 70.6 |

150 | 1,075,000 | 369 | 206 | 0.08 | 1.52 | 2.79 | 12.77 | 7.11 | 3,000 | 36.0 | 66.1 |

200 | 869,000 | 416 | 234 | 0.09 | 1.71 | 3.12 | 11.63 | 6.53 | 2,000 | 32.8 | 59.7 |

250 | 708,000 | 459 | 260 | 0.08 | 1.89 | 3.42 | 10.46 | 5.91 | 2,000 | 29.5 | 53.4 |

300 | 570,000 | 504 | 284 | 0.09 | 2.08 | 3.77 | 9.24 | 5.21 | 2,000 | 26.1 | 47.3 |

Note: Values in these tables reported above and below the base-case cut-off 150 g/t AgEq (highlighted) for in-pit Mineral Resources should not be misconstrued with a Mineral Resource Statement. The values are only presented to show the sensitivity of the block model estimates to the selection of the base case cut-off grade. All values are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

Table 3. In-Pit Mineral Resource Estimate, combined Caribou, Fox and Homestake deposits, at Various AgEq Cut-off Grades, February 1, 2024

Cut-off Grade (AgEq g/t) | Tonnes | AgEq (g/t) | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | AgEq (Moz) | Ag (Moz) | Au (oz) | Pb (Mlbs) | Zn (Mlbs) |

30 | 1,787,000 | 101 | 50 | 0.10 | 0.24 | 0.93 | 5.82 | 2.87 | 6,000 | 9.4 | 36.8 |

40 | 1,642,000 | 107 | 53 | 0.11 | 0.25 | 0.98 | 5.66 | 2.80 | 6,000 | 9.1 | 35.4 |

50 | 1,460,000 | 115 | 58 | 0.12 | 0.28 | 1.02 | 5.40 | 2.70 | 5,500 | 8.9 |