from Pampa Metals Corp. (isin : CA6976702069)

Pampa Metals Finalizes Follow-Up Diamond Drill Program at the Piuquenes Copper-Gold Porphyry Project

VANCOUVER, BC / ACCESSWIRE / January 12, 2024 / Pampa Metals Corp. ("Pampa Metals" or the "Company") (CSE:PM)(FSE:FIRA)(OTCQB®:PMMCF) is pleased to advise that it has finalized the follow-up diamond drill program designed to demonstrate Piuquenes Central's potential to host an orebody of 1,000 m depth and 300 - 500 m diameter.

Follow-Up Diamond Drill Program

Following the optioning of the Piuquenes Porphyry Copper-Gold Project (refer 30 November 2023 News Release), on-site preparatory works for a ~2,500m follow-up diamond drill program to test the depth and lateral extension of known mineralization at Piuquenes Central began on 20 December 2023.

This follow-up program of up to 4 drill holes, including two priority drillholes of ~850 - 900 m depth, will commence in mid-January 2024 and is summarized as follows:

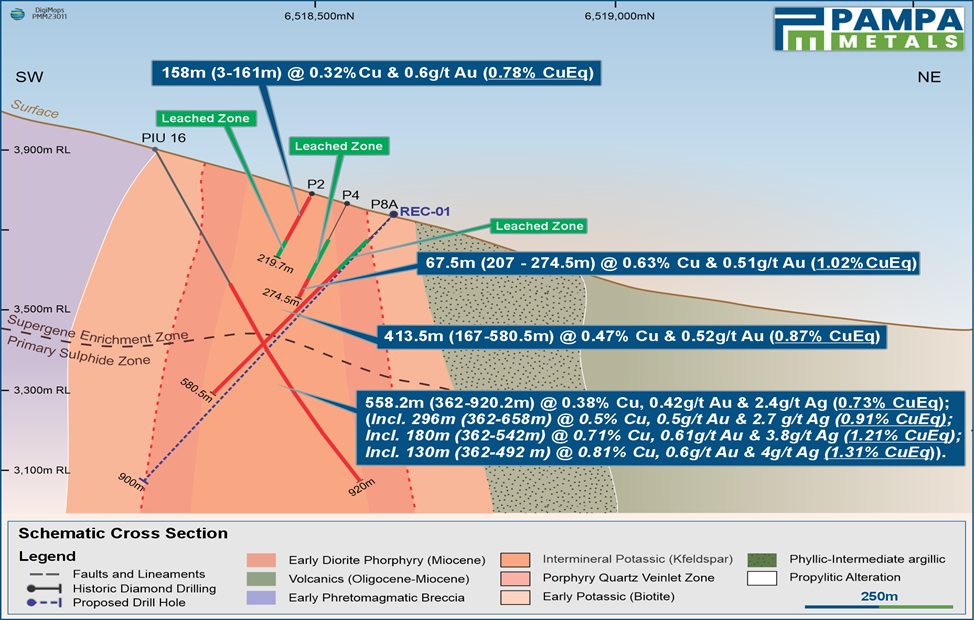

• Hole 1 (REC-01) (refer figure 1) is orientated along a northeast-southwest geological section, proximate to the historical P8A (Inmet) and PIU16-DDH01 (Anglo) drillholes and designed to extend the depth of known mineralization at the southwestern edge of Piuquenes Central porphyry.

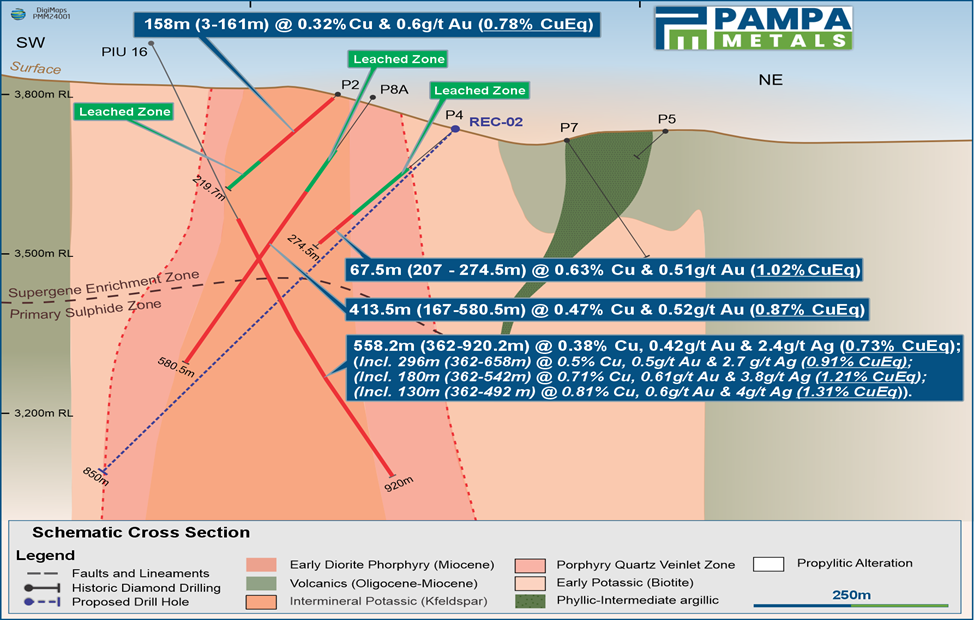

• Hole 2 (REC-02) (refer figure 2) is orientated along an east-west section, proximate to the historical P4 and P2 drillholes (Inmet) and designed to test the lateral extension of the mineralized body, primarily along the western edge of the Piuquenes Central porphyry.

• A 3rd and possibly a 4th hole will focus on extending known depth to the northeast and southeast edges of the Piuquenes Central mineral body and seek to validate a potential mineral column of 1,000 m depth and 300 - 500 m diameter.

Joseph van den Elsen, the Company's President and CEO, stated: "We are very pleased to have been able to swiftly identify and secure the Piuquenes copper-gold porphyry project and immediately mobilize on the first of an aggressive, multi-campaign exploration program testing its exceptional potential. We look forward to driving significant shareholder value over the short, medium, and long-term as we first test the depth and lateral extension of the reported high-grade intervals of open mineralization (558.2 m @ 0.38% Cu, 0.42 g/t Au & 2.4 g/t Ag (0.73% CuEq)* incl. 130 m @ 0.81% Cu, 0.6 g/t Au & 4 g/t Ag (1.31 % CuEq)* - refer 5 December 2023 News Release) at Piuquenes Central, and thereafter Piuquenes East and other targets from our growing pipeline."

Figures 1 & 2: Piuquenes Central Schematic Cross Sections

The latest Company Presentation can be accessed at https://pampametals.com/investor/.

ON BEHALF OF THE BOARD

Joseph van den Elsen | President & CEO

INVESTORS CONTACT

Joseph van den Elsen | President & CEO

Joseph@pampametals.com

ABOUT PAMPA METALS

Pampa Metals is a post-discovery copper-gold-molybdenum porphyry exploration company listed on the Canadian Stock Exchange (CSE:PM), Frankfurt (FSE:FIRA), and OTC (OTCQB:PMMCD) exchanges.

In November 2023, the Company announced it had entered into an Option and Joint Venture Agreement for the acquisition of an 80% interest in the Piuquenes Copper-Gold Porphyry Project in San Juan Province, Argentina.

Historical intervals of significant copper and gold mineralization at Piuquenes Central (refer 5 December 2023 News Release) include:

- 413.5 m (167-580.5 m) @ 0.47% Cu and 0.52 g/t Au (0.87% CuEq)*; and

- 558.2 m (362-920.2 m EOH) @ 0.38% Cu, 0.42 g/t Au and 2.4 g/t Ag (0.73% CuEq)*

including 130 m (362-492 m) @ 0.81% Cu, 0.6 g/t Au and 4 g/t Ag (1.31 % CuEq)*

Qualified Person

Technical information in this news release has been approved by Mario Orrego G. Mr. Orrego G. is a Geologist, a Registered Member of the Chilean Mining Commission and a Qualified Person as defined by National Instrument 43-101. Mr. Orrego G. is a consultant to the Company.

* %CuEq values are calculated based on copper and gold metal prices: Cu = US$3.20/lb, Au = US$1,700/oz and Ag = US$ 20/oz. The formula utilized to calculate %CuEq is: Cu Eq Grade (%) = Cu Head Grade (%) + [(Au Head Grade (g/t) / 31.104) * (Au Price (US$/oz) / Cu Price (US$/lb) / 22.04) + [(Ag Head Grade (g/t) / 31.104) * (Ag Price (US$/oz) / Cu Price (US$/lb) / 22.0.

Neither the CSE nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENT

This news release contains certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that Pampa Metals expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects" and similar expressions, or that events or conditions "will" or "may" occur. These statements are subject to various risks. Although Pampa Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance and actual results may differ materially from those in forward-looking statements.

SOURCE: Pampa Metals Corp.

View the original press release on accesswire.com