from Pelangio Exploration Inc. (NASDAQ:PGXPF)

Pelangio Exploration Provides Update on Activities in Ghana and Canada

TORONTO, ON / ACCESSWIRE / January 31, 2024 / Pelangio Exploration Inc. (TSXV:PX)(OTC PINK:PGXPF) ("Pelangio" or the "Company") is pleased to provide an update on 2023 activities and the outlook for 2024 for its projects in Ghana and Canada.

Highlights - 2023

- Exploration resumed at Pelangio's district scale Obuasi Project, adjacent to the giant high-grade Obuasi Mine

- Pelangio's Obuasi Project benefits from an agreement with TuNya Mineral Resources Ltd. ("TuNya") to provide both exploration expenditures and access to significant technical expertise

- The recently completed Manfo Project drill program extended mineralization in both the Pokukrom East and West deposits, demonstrating resource growth potential with continued step-out drilling

- Canada Nickel Company's ("Canada Nickel") significant discovery on its Mann Northwest property enhances interest in Pelangio's adjacent Mann property (2.2 km away)

- Barrick Gold Inc. ("Barrick") began exploration on Hemlo Explorer's Pic property, which surrounds Pelangio's Seeley Lake property

- First Mining Gold Corp ("First Mining") began exploration on Pelangio's Birch Lake property which is adjacent to First Mining's Springpole Gold Project

Outlook - 2024

- Obuasi project continues with the TuNya-funded exploration program on the Obuasi Project and will focus on two large target areas in the southwest corner of the property closest to the Obuasi Mine property, the Obuasi and NGA target areas

- TuNya's exploration program will also cover the Tarkwaian geology which has been under-explored to date

- Resource extension drilling and exploration drilling planned for the Manfo project

- Record Gold is expected to complete $250,000 of exploration at Pelangio's Grenfell property under the terms of the option agreement

- First Mining will complete further exploration at Pelangio's Birch Lake under the terms of the option agreement

- Barrick is continuing exploration on Hemlo's Pic Project including a 2,500 m drill program

- Pelangio is considering strategic opportunities for Canadian properties which are prospective for silver, zinc, nickel, copper, cobalt, chromium, and platinum group elements (PGEs)

"2023 provided very positive developments for Pelangio in Ghana and Canada," comments Ingrid Hibbard, President and CEO of Pelangio. "We're pleased to resume exploration at our Obuasi Project following settlement of outstanding litigation between vendors of two of the four concessions of the Obuasi property. We entered into an agreement with TuNya, which provides both exploration funding and access to a technical team with over 125 years of combined experience on the extremely prolific Ashanti gold belt, including significant experience at the Obuasi mine itself. We anticipate this additional knowledge to provide real value to the development of the next phase of exploration at Obuasi."

"In addition, our drill program at our Manfo Project on the Sefwi Belt in Ghana extended known mineralization at the southern ends of both the Pokukrom East and West deposits. Potential remains to establish additional extensions to the mineralization and to grow the Manfo resource with continued drilling at a number of the targets yet to be drilled around these deposits, plus exploration drill testing of multiple targets across the property.

"In Canada, several of our properties are benefitting from exploration completed by others. We anticipate exploration at both our Birch Lake and Grenfell properties to be completed by our option partners, First Mining and Record Gold, in 2024. Our Seeley property near Hemlo will benefit from exploration, including 2,500 m of drilling completed by Barrick on Hemlo Explorer's Pic Project. Our Mann property has benefitted from new data provided by the significant discovery made by Canada Nickel on its adjacent Mann Northwest Project."

GHANA

Manfo Project

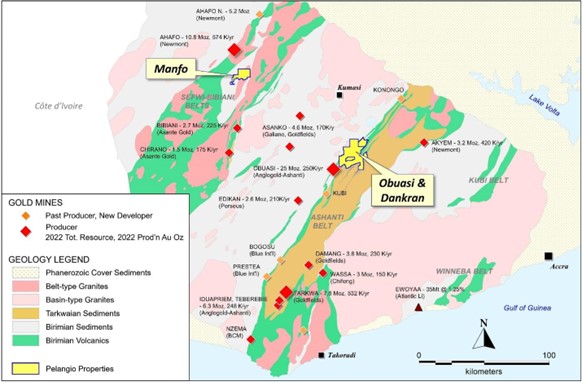

The 96 km² Manfo project, located in the Sefwi-Bibiani Belts 15 km southeast of Newmont's Ahafo gold mine and 40 km north of Asante Gold's Bibiani gold mine, has recently been Pelangio's exploration focus in Ghana. Refer to Figure 1. In 2013, SRK Consulting estimated the project hosts a gold mineral resource of 195,000 oz (at 1.52 g/t Au) Indicated and 298,000 oz (at 0.96 g/t Au) Inferred with the bulk of the resource contained in the two Pokukrom deposits.¹

In 2021, Pelangio identified opportunities to grow the project through step-out drill testing of open-ended mineralization in the known deposits to demonstrate possible extensions that would be further drilled for potential resource addition, plus drill testing of multiple exploration targets along and near the 9 km of mineralized structures within the property. A multi-phase 3,700 m diamond drill program was planned of which

1,423 m has been drilled to date.

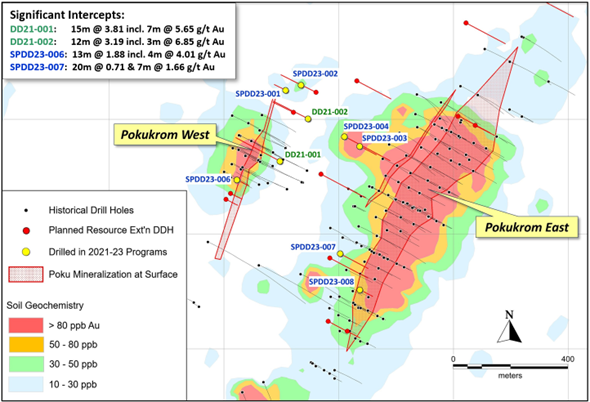

The 2023 drill program, detailed in Pelangio's July 24, 2023 news release, tested for strike and down-dip extensions in select areas of both Pokukrom East and West deposits, in addition to a soil plus auger gold geochemical target sitting on the western flank of Pokukrom East. The drill hole south of Pokukrom West returned an intercept of 1.88 g/t Au over 13 m, including 4.01 g/t over 4 m. The shallow oxide mineralization is still open further to the south and the potential remains to expand the Pokukrom West resource with further drilling to the south. The down-dip drill test at the shallower southern end of Pokukrom East intercepted 0.71 g/t Au over 20 m plus 1.66 g/t Au over 7 m, including 1 m of 8.43 g/t Au. The mineralization remains open down-dip in this area and there is potential to expand the resource to depth here.

The 2023 program followed the 2021 program at Pokukrom West. The first hole of the 2021 program was drilled in the midst of previous drilling to gain a better understanding of the structural controls on the mineralization. It returned an intercept of 3.81 g/t Au over 15 m, including 5.65 g/t Au over 7 m - better than surrounding holes. The second hole tested for the down-plunge continuation of the Pokukrom West lode. It returned an encouraging intercept of 3.19 g/t Au over 12 m, including 6.85 g/t Au over 3 m, demonstrating that the Pokukrom West deposit does in fact continue down-plunge. Table 1 summarizes the significant drill intercepts at Pokukrom from the 2021 and 2023 programs, and Figure 2 illustrates the drill hole locations.

With a number of targets yet to be drilled in the planned resource step-out diamond drilling program around the Pokukrom deposits, potential remains to establish additional extensions to mineralization and potentially grow the resource with infill drilling. This would be followed with a resource estimation update for Manfo which, at a higher gold price than the US$1,450/oz used in the 2013 MRE, is expected to result in some addition to the Manfo project gold resource. In addition, a 7,000 m exploration air-core drilling program is planned to test up to 21 previously untested geological, geochemical, and structural targets along and near the 9 km long main structural corridor, which could yield satellite deposit discoveries that might also add significantly to the project. With a defined gold mineral resource and a number of opportunities remaining to add to it, Manfo continues to be Pelangio's priority in Ghana.

- The Manfo mineral resource estimation was conducted by SRK Consulting and published in June 2013. (Refer to the Mineral Resource Evaluation Technical Report, Manfo Gold Project, by SRK Consulting (Canada) Inc., released on June 21, 2013 and available on Pelangio's website). The resource estimation was made in accordance with National Instrument 43â101 â Standards of Disclosure for Mineral Projects at the time of the mineral resource estimation in 2013. NI 43-101 standards for disclosure have been amended multiple times since 2013 and as a result, Pelangio's 2013 resource estimate is no longer NI 43-101 compliant under the current standards.

Obuasi Project

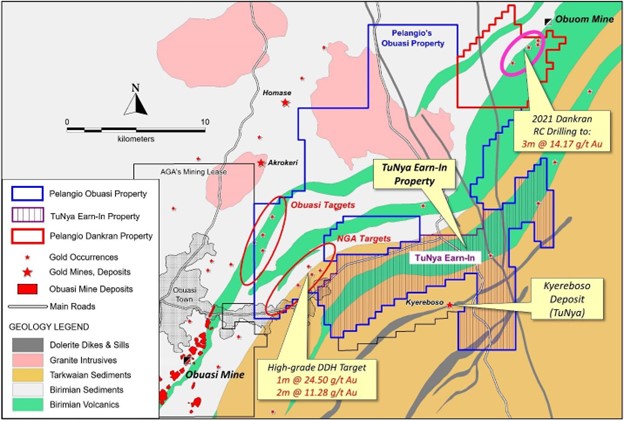

Pelangio's 100% owned Obuasi project covers 284 km² immediately adjacent to and on geological strike with AngloGold Ashanti's 25 Moz Obuasi Mine. Refer to Figures 1 and 3. The Obuasi project is also immediately adjacent to TuNya's property, which hosts the Kyereboso deposit. Obuasi was Pelangio's flagship project in Ghana from 2007 to 2011. With the recent litigation settlement and a recently signed binding letter of intent ("LOI") to option a portion of the Obuasi property to TuNya Mineral Resources, Pelangio is turning new focus to the Obuasi project.

Early exploration activity plus subsequent and more recent data reanalysis, prospectivity and targeting exercises prioritized two large principal target areas for follow-up exploration situated in the southwestern corner of the property closest to the Obuasi Mine property. The Obuasi Targets area covers the strike extension of geological stratigraphy along which the Obuasi deposits lie. The NGA Targets area straddles the main Birimian-Tarkwaian metasedimentary contact and has seen minimal drill testing by Pelangio, although two drill holes returned high grades over narrow widths, including 24.50 g/t Au over 1 m and 11.28 g/t Au over 2 m. This high-grade prospect will likely be one of the first revisited after completion of the work by TuNya.

Ongoing work on the Obuasi project will continue the desktop target development and ranking exercise, augmented by fieldwork to include a comprehensive review of drill core, detailed field mapping and a structural study. This effort will be conducted largely by TuNya's "Obuasi experts." Pelangio and TuNya's LOI includes an option for TuNya to earn into an 80% interest on the southern portion of Pelangio's Obuasi project covering principally Tarkwaian geology. For details, refer to Pelangio's July 31, 2023 news release. This allows TuNya to explore the Tarkwaian for extensions and additions to their Kyereboso deposit that could result in a more robust project for them, while Pelangio maintains a 20% interest in ground that was unlikely to be explored by Pelangio over the near term. In exchange, TuNya will undertake a comprehensive review of Pelangio's Obuasi property prospects, focusing on the Obuasi and NGA Target areas and utilizing their personnel who have considerable senior technical and management experience at the Obuasi Mine and elsewhere along the Ashanti Belt.

Working with TuNya and their new products, Pelangio expects to be able to develop a more informed ranked target list for ongoing Obuasi exploration. At the same time, Pelangio plans to enhance this with improved geochemical and geophysical datasets through targeted auger drilling programs plus a high resolution airborne aeromagnetic survey covering the western third of the Obuasi property. As has been done in the past at Obuasi, upon completion of these programs, an AI (artificial intelligence) prospectivity platform can be utilized to generate smarter exploration targets with better, more detailed datasets. This work will be guided by the Obuasi expertise of TuNya's technical people, including a structural geologist, a geophysicist, and a GIS specialist. These efforts should ultimately delineate the very best targets for drill testing. Drill testing will initially be performed at shallow depths, followed by deeper probes as and where warranted.

Dankran Project

Pelangio entered into an option agreement to acquire the Dankran property adjacent to the Obuom mine and contiguous to the northeast corner of Pelangio's Obuasi property in late 2020.Refer to Figure 3. The Dankran project, which is now 100% owned by Pelangio, has shown evidence of high-grade gold potential on the Obuasi-Obuom trend from limited, shallow (<70 m vertical) RC drill testing, which warrants follow up drilling. While currently a lower priority than Pelangio's Manfo and Obuasi projects, the Dankran project represents an early-stage, high-grade gold exploration opportunity hosting 7 km of underexplored strike of the Ashanti Belt, 25 km away from the world-class Obuasi Mine.

CANADA

Birch Lake Project

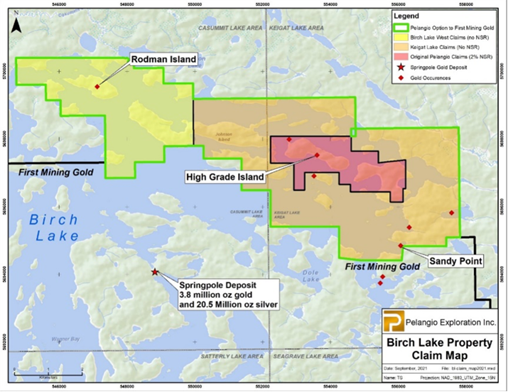

Pelangio's 100% owned Birch Lake Project is located within the Birch-Uchi Belt, 120 km northeast of Red Lake and contiguous with First Mining Gold's claims covering the Springpole deposit, approximately 3 km from the proposed open pit. See Figure 4. First Mining has an initial option to earn a 51% interest in the project by paying Pelangio $220,000, issuing 2,100,000 shares and spending $1,500,000 in exploration over seven years, since the signing of their earn-in agreement in 2021. First Mining has an additional option to increase its interest to 80% by spending an additional $1,750,000 in exploration and paying $400,000 in cash or shares over two years.

During 2022-2023, First Mining conducted mapping and geochemical sampling and flew the Birch Lake property with an electromagnetic and magnetic survey as part of an extensive district-wide airborne survey. One target was drilled and additional drilling is anticipated in 2024, dependent on weather conditions and permitting.

Grenfell Project

Pelangio's Grenfell property is located 10 km northwest of the Macassa Mine owned by Agnico-Eagle Mines Limited. In 2022, Pelangio granted Record Gold the option to acquire an 80% interest in the Grenfell property by paying Pelangio $60,000 and incurring $2,000,000 in exploration expenditures over five years. To maintain the option, Record Gold shall pay $60,000 and complete $250,000 of exploration expenditures by August 19, 2024.

Pelangio conducted two diamond drilling programs in 2020 and 2021 with notable drilling results of

1.32 g/t Au over 26.0m including 314 g/t Au over 1.74 m (uncut) and 10.95 g/t Au over 3.00 m including 23.40 g/t Au over 1.00 m.

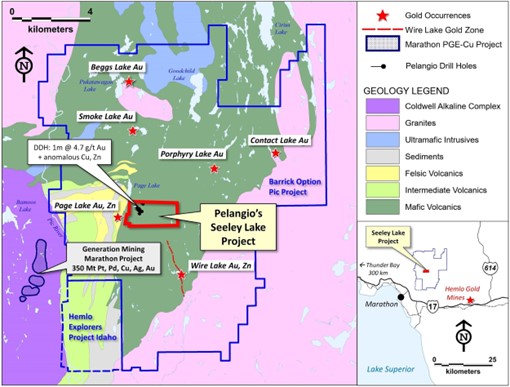

Seeley Project

Pelangio's 100% owned Seeley Project located near Hemlo, Ontario, is surrounded by the Pic Project owned by Hemlo Explorers. See Figure 5. Previous work on the project by Pelangio in 1997 and 2008 included gold results of 4.71 g Au/t over 1 m and 4.85 g Au/t over 2 m, associated with anomalous copper and zinc values, and indicated alteration and a geologic setting similar to that found with volcanic-associated massive sulfide (VMS) deposits, which are frequently sources of metals such as copper, lead, and zinc. In 2009 mapping, prospecting and soil sampling resulted in seven anomalies around previous Pelangio drilling. The geological mapping and whole rock analysis indicated potential for gold deposits and identified ultramafic rocks anomolous in nickel. Notably, Barrick is completing a 2,500 m drill program on Hemlo Explorer's Pic project.

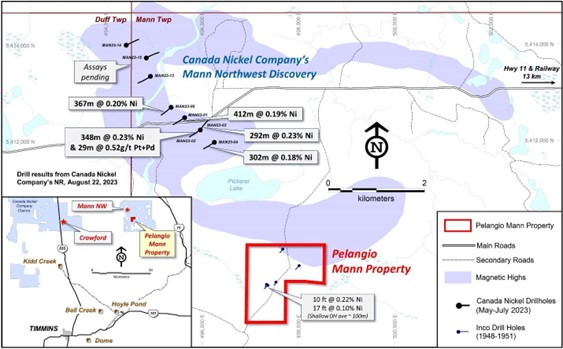

Mann Project

Pelangio's 100% owned Mann project has come to the forefront with a recent nearby discovery by Canada Nickel Company. Canada Nickel is advancing their 2 billion tonne Crawford nickel project and aggressively exploring multiple properties in the district. The Mann Property is located in Mann Township, 50 km northeast of the City of Timmins, and covers an area of approximately 2 km². Pelangio's patented claims (mining and surface rights) cover a portion of a large ultramafic intrusive complex that is prospective for nickel, copper, cobalt, chromium and PGEs close to where Canada Nickel has just reported assays from a significant new discovery on their Mann Northwest Property surrounding Pelangio's patented claims (see Canada Nickel's August 22, 2023 release). See Figure 6.

Canada Nickel drilled eight holes from May to July 2023, testing 2.7 km of strike. Each hole returned multi-hundred-meter-wide intersections of "strongly serpentinized peridotite, dunite and pyroxenite with fine mineralization throughout." Canada Nickel reported assays from five of the eight holes drilled which were all mineralized with significant nickel, platinum and palladium values returning up to 348.5 m of 0.23% Ni and 0.04 g/t Pt+Pd including 33 m of 0.31% Ni and 0.057 g/t Pt+Pd. This hole also ended with 28.9 m of 0.52 g/t Pt+Pd. Canada Nickel's drill holes are located 2.2 km from Pelangio's Mann property boundary. The Mann patents cover historical airborne electromagnetic anomalies that experienced limited shallow drill testing by Inco from 1948 to 1951 and returned significant nickel values over narrow widths. Given the very significant nearby discovery by Canada Nickel, Pelangio is currently considering exploration programs to evaluate the potential of the property.

Qualified Person

Mr. Kevin Thomson, P.Geo. (Ontario, #0191), is a qualified person within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Thomson approved the technical data disclosed in this release.

About Pelangio

Pelangio acquires and explores world-class land packages on strategic gold belts in Ghana, West Africa, and Canada. In Ghana, the Company is exploring its two 100% owned camp-sized properties: the 100 km2 Manfo property, the site of seven near-surface gold discoveries, and the 284 km2 Obuasi property, located 4 km on strike and adjacent to AngloGold Ashanti's prolific high-grade Obuasi Mine, as well as its Dankran property located adjacent to its Obuasi property. In Canada, the company has several gold properties and two critical minerals properties. See www.pelangio.com for further details.

For additional information, please visit our website at www.pelangio.com, or contact:

Ingrid Hibbard, President and CEO

Tel: 905-336-3828 / Toll-free: 1-877-746-1632 / Email: info@pelangio.com

Appendix

Figure 1. Location of Pelangio's Gold Projects in southwest Ghana

Table 1: Significant Results of the 2021 and 2023 Diamond Drilling Programs at Manfo

DHID | Prospect | AZIM(°) | DIP(°) | EOH(m) | FROM(m) | TO(m) | LENGTH(m) | AU(g/t)* | |

| DD21-001 | Poku W. | 297 | -50 | 121.5 | 110 | 125 | 15 | 3.81 | |

including | 112 | 119 | 7 | 5.65 | |||||

| DD21-002 | Poku W. | 297 | -60 | 231.7 | 211 | 223 | 12 | 3.19 | |

including | 216 | 219 | 3 | 6.85 | |||||

| SPDD23-006 | Poku W. | 117 | -45 | 74 | 2 | 15 | 13 | 1.88 | |

including | 11 | 15 | 4 | 4.01 | |||||

35 | 37 | 2 | 0.71 | ||||||

| SPDD23-007 | Poku E. | 117 | -55 | 174 | 90 | 119 | 20 | 0.71 | |

including | 90 | 96 | 6 | 1.32 | |||||

137 | 144 | 7 | 1.66 | ||||||

including | 138 | 139 | 1 | 8.43 | |||||

* Assay composites using a 0.4 g/t Au cut-off. Intervals of internal dilution do not exceed 2m < 0.4 g/t Au.

Figure 2. 2021 and 2023 Drilling on the Pokukrom Deposits, Manfo Project

Figure 3. Location of Pelangio's Obuasi and Dankran Projects in Relation to AngloGold Ashanti's Obuasi Mine

Figure 4. Pelangio Birch Lake Project

Figure 5. Pelangio's Seeley Lake Project

Figure 6. Location of Pelangio's Mann Property in Relation to Canada Nickel's New Mann Northwest Discovery

Forward Looking Statements

Certain statements herein may contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Forward-looking statements or information appear in a number of places and can be identified by the use of words such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate" or "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include statements regarding the Company's strategy of acquiring large land packages in areas of sizeable gold mineralization, and the Company's ability to complete the planned exploration programs. With respect to forward-looking statements and information contained herein, we have made numerous assumptions, including assumptions about the state of the equity markets. Such forward-looking statements and information are subject to risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statement or information. Such risks include the changes in equity markets, share price volatility, volatility of global and local economic climate, gold price volatility, political developments in Ghana and Canada, increases in costs, exchange rate fluctuations, speculative nature of gold exploration, including the risk that favourable exploration results may not be obtained, delays due to COVID-19 safety protocols, and other risks involved in the gold exploration industry. See the Company's annual and quarterly financial statements and management's discussion and analysis for additional information on risks and uncertainties relating to the forward-looking statement and information. There can be no assurance that a forward-looking statement or information referenced herein will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Also, many of the factors are beyond the control of the Company. Accordingly, readers should not place undue reliance on forward- looking statements or information. We undertake no obligation to reissue or update any forward-looking statements or information except as required by law. All forward-looking statements and information herein are qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Pelangio Exploration Inc.

View the original press release on accesswire.com