from Redishred Capital Corp. (isin : CA7574891098)

Redishred Capital Corp. (“Redishred”, Or The “Company”) Announces Q1 2024 Results

MISSISSAUGA, ON / ACCESSWIRE / May 28, 2024 /

Quarterly Earnings Call:

8:30am EST, May 29, 2024, Participant call in number is 1-844-763-8274

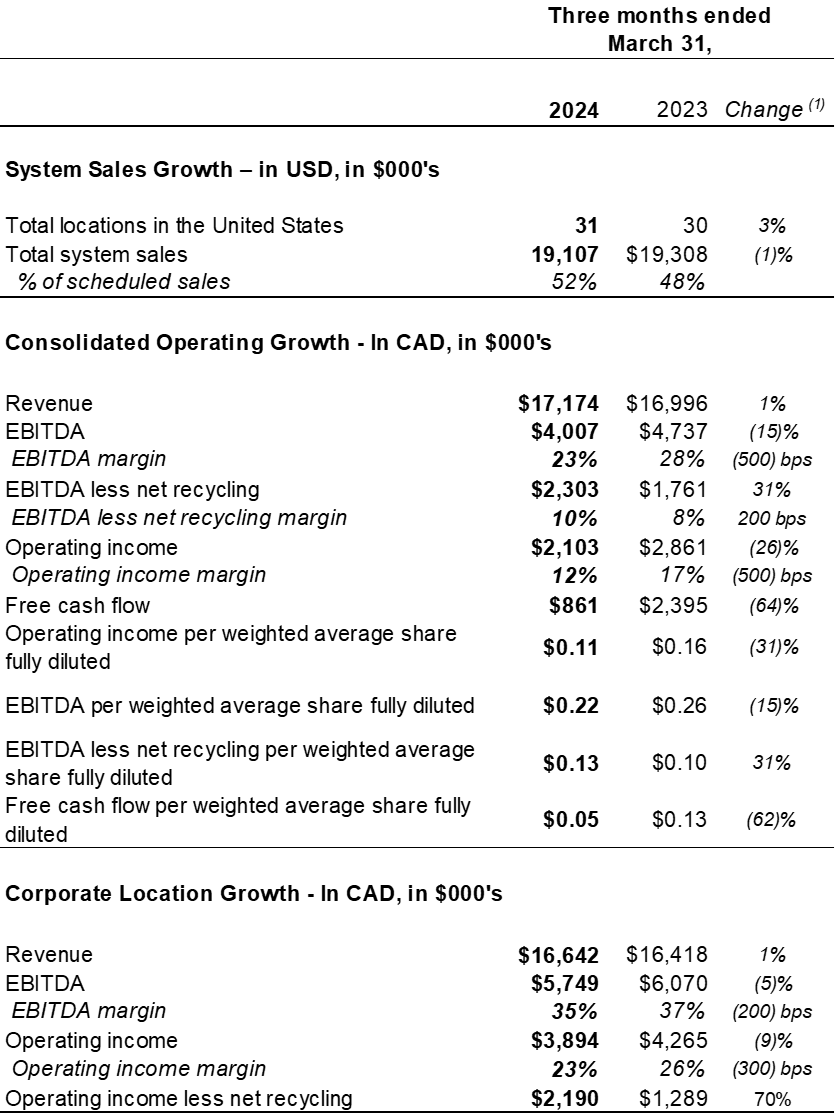

Management's Comments on Q1 2024

Jeffrey Hasham, the Company's Chief Executive Officer, noted "We are very pleased with our start to 2024, with Q1 2024 EBITDA of $4.0 million Canadian, even with lower paper prices. When we look at EBITDA less net recycling revenue, this was $2.3 million Canadian compared to $1.8 million Canadian in Q1 2023, which speaks to our continued operational improvements. From a revenue perspective, we continue to see demand for our shredding services, with shredding revenue growth of 12% versus Q1 2023. Proscan, our digital imaging business, also started the year strong with revenue growth of 47% versus Q1 2023.

I wanted to thank our employees, franchisees, management and board members for their hard work and contributions to the good start to the 2024 year."

Quarterly Highlights:

Consolidated Highlights:

- The Company generated revenue of $17.2 million CAD, with shredding revenue growing by $1.5 million CAD, or 12% versus Q1 2023.

- Consolidated EBITDA excluding the impact of net recycling revenue was $2.3 million CAD, growing by $0.5 million CAD, or 31% versus Q1 2023.

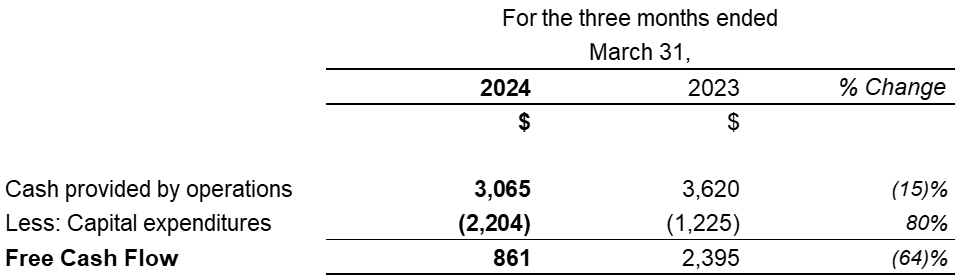

- The Company generated free cash flow of $0.9 million CAD, decreasing by 64% versus Q1 2023, primarily due to lower net recycling revenue due to lower commodity paper prices and timing of capital expenditures for shredding trucks.

- Consolidated EBITDA was $4.0 million CAD, declining by 15% versus Q1 2023, driven by lower net recycling revenue due to lower commodity paper prices.

Corporate Locations Highlights:

- Corporate location revenue grew 1% versus Q1 2023 to $16.6 million CAD (2% constant currency growth - US Dollars is the constant currency).

- Corporate location EBITDA declined by 5% versus Q1 2023 to $5.7 million CAD (5% constant currency decrease). The decline is driven by lower net recycling revenue due to lower commodity paper prices.

- Same corporate location EBITDA declined 7% versus Q1 2023 to $5.6 million CAD (7% constant currency decrease). The decline is driven by lower net recycling revenue due to lower commodity paper prices.

Acquisitions

- On January 2, 2024, the Company acquired the assets of MDK Recycling LLC ("MDK") for cash consideration of $0.7 million CAD and contingent consideration of $0.3 million CAD. MDK is a Michigan-based business which offers paper and hard drive shredding, product destruction, paper recycling and scanning services. The acquisition of MDK allows the Company to expand its geographical footprint in the Midwest to now encompass Michigan.

Capital Management:

- The Company generated $3.1 million CAD in cash from operations during Q1 2024.

- As at March 31, 2024, the Company has $1.5 million CAD in cash, $1 million CAD available on its demand operating line of credit, $20.3 million CAD available on its demand non-revolving re-advanceable term loan, and $6.0 million CAD available on its demand revolving re-advanceable interest only acquisition facility.

Financial Highlights:

- Change expressed as a percentage or basis point ("bp").

Revenue Growth in Q1 2024

The Company achieved 1% revenue growth during Q1 2024 versus Q1 2023 primarily due to acquisitions conducted and organic sales growth from new customers, partially offset by a decrease in recycling revenue from lower commodity paper prices.

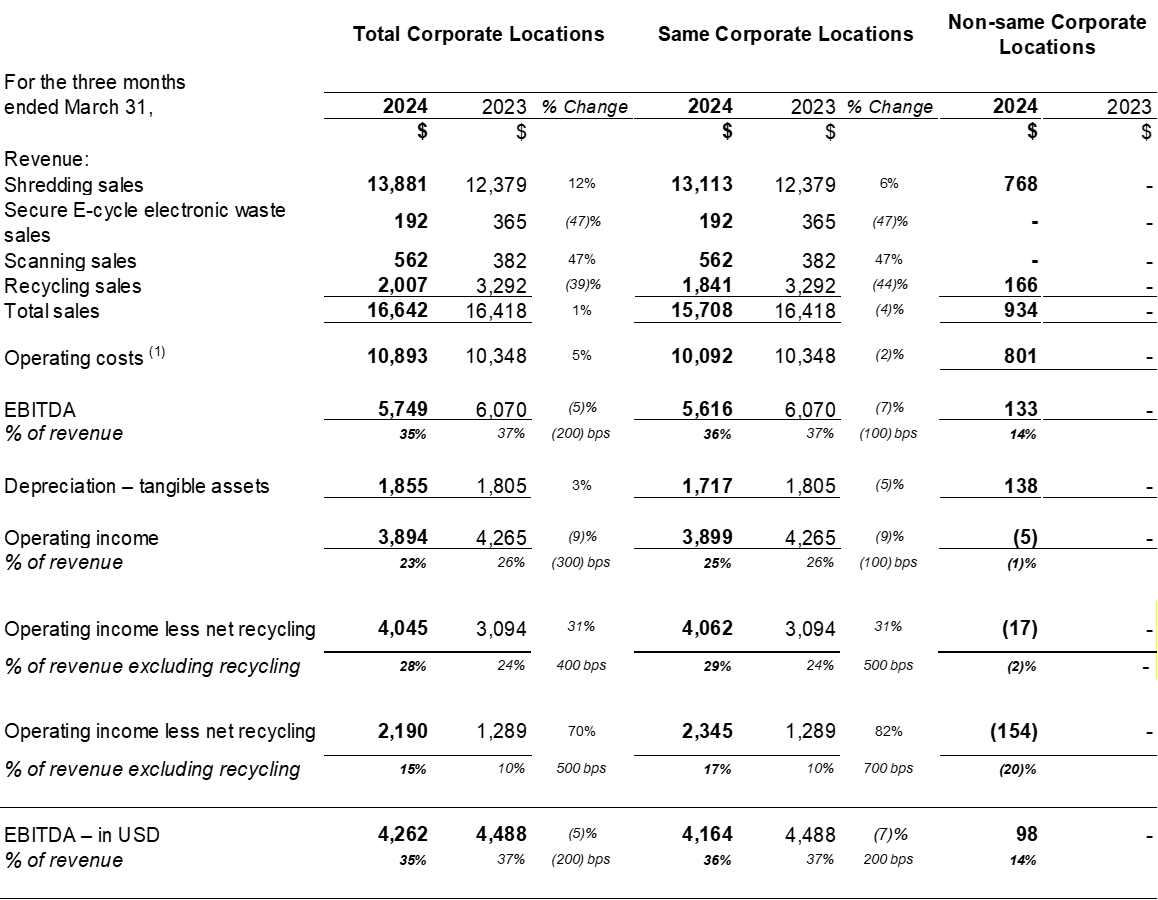

Corporate Locations Q1 2024 Performance

Total corporate location revenue grew by 1% and EBITDA declined by 5% in Q1 2024 versus Q1 2023. Revenue grew due to acquisitions conducted and organic sales growth from new customers partially offset by a decrease in recycling revenue from lower commodity paper prices. EBITDA declined due to the decrease in recycling revenue from lower commodity paper prices.

Same corporate location operating income, excluding the impact of net recycling revenue, grew 82% in Q1 2024 versus Q1 2023. Same corporate location shredding revenue grew by 6% in Q1 2024 versus Q1 2023, with same corporate location EBITDA declining by 7%, driven by decrease in paper commodity prices.

Note 1: During Q1 2024, acquisition/vendor-related consulting fees of $101 (Q1-2023 - $248) are included in the total and non-same corporate location operating costs.

Community and Social Commitment

Our locations under the PROSHRED® banner conduct numerous community shredding events. These events provide an opportunity for our clients, clients' employees, local businesses and local residents to ensure their personal and confidential materials are securely destroyed. In addition to helping to reduce identity theft, several of these events allow for donations to various not-for-profit organizations. PROSHRED® is also proud that 100% of the shredded material is recycled, as our continued goal is to foster the use of fewer trees in the production of all paper products. Future community shredding event locations can be found on our website, www.proshred.com. Our annual national Shred Cancer event was held in June of 2023 at various Proshred locations. These events are held to raise research funds for the American Institute for Cancer Research ("AICR"). It is our goal as a Company and Franchise System to support AICR in their endeavor to prevent cancer and possibly cure this disease. So far, PROSHRED® has raised over USD$243,000 for this cause. Please visit www.proshred.com/aicr for more information on this effort.

Non-IFRS Measures

There are measures included in this press release that do not have a standardized meaning under International Financial Reporting Standards ("IFRS") and therefore may not be comparable to similarly titled measures presented by other publicly traded companies. The Company includes these measures as a means of measuring financial performance of the Company.

- Total System Sales are sales generated by franchisees, licensees and corporately operated locations. The system sales generated by franchisees and licensees drive the Company's royalties. The system sales generated by corporate locations are included in the Company's revenue.

- Same Location are indicators of performance of corporately operated locations that have been in the system for equivalent periods in both the current period and the comparative period.

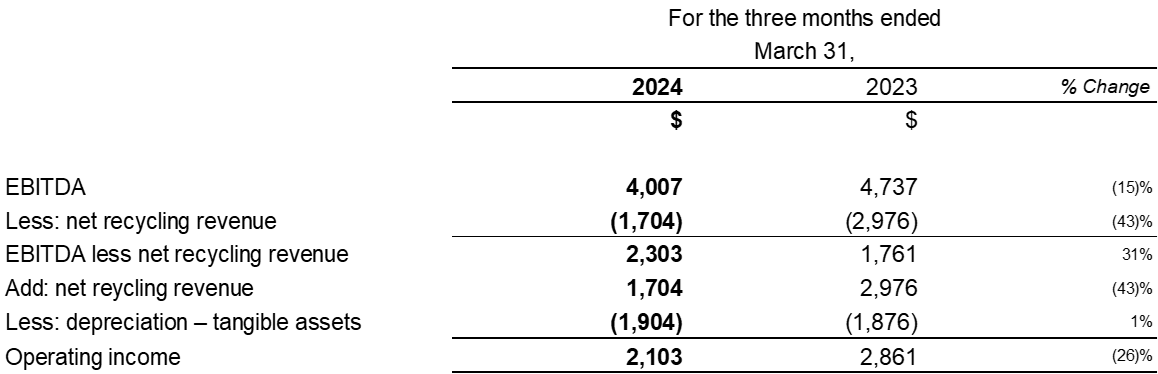

- Consolidated EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Consolidated EBITDA also excludes government assistance, re-measurements of contingent consideration, foreign exchange gains and losses, and gains and losses on disposal of tangible assets. A reconciliation between net income and consolidated EBITDA is provided below.

- Consolidated EBITDA less Net Recycling is defined as the consolidated EBITDA excluding the impact of corporate location recycling sales, net of paper baling costs. A reconciliation between net income and consolidated EBITDA less net recycling is provided below.

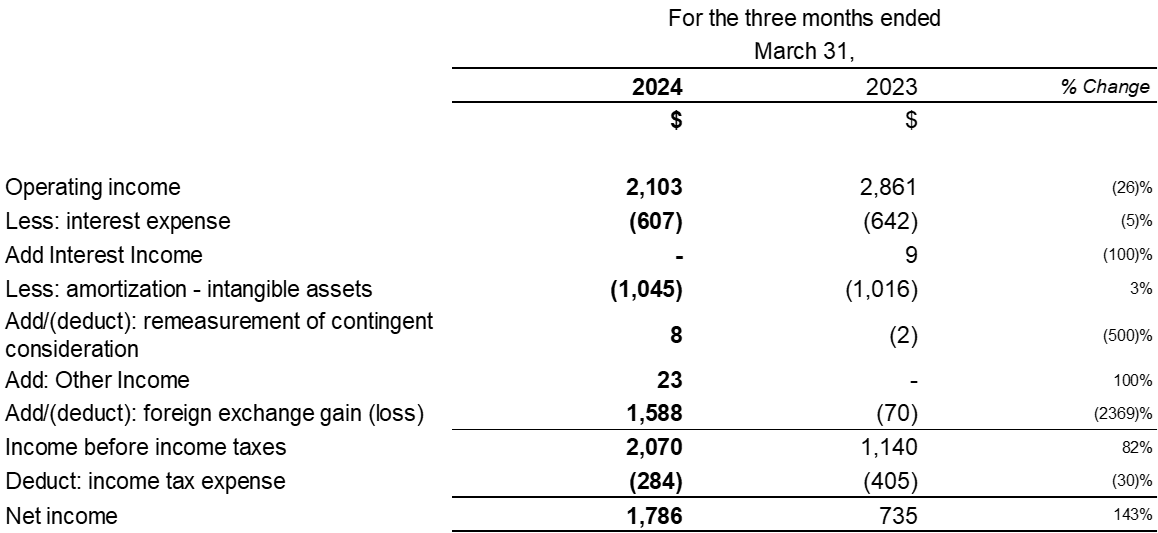

- Consolidated Operating Income is defined as revenues less all operating expenses, including depreciation on tangible assets. Amortization for intangible assets has not been included in this calculation. A reconciliation between net income and consolidated operating income is provided below.

- Consolidated Free Cash Flow is defined as cash provided by operating activities net of capital expenditures. The calculation of Consolidated Free Cash Flow that begins with cash provided by operating activities is provided below.

- Capital Expenditures is defined as the purchase of tangible and intangible assets, net of proceeds received from their disposal.

- Corporate Location EBITDA is defined as earnings for corporately operated locations before interest, taxes, depreciation and amortization and also excludes items identified under the definition of Consolidated EBITDA above.

- Corporate Location Operating Income is the operating income generated by corporately operated locations. The operating income generated is inclusive of depreciation on tangible assets, including trucks, right-of-use-assets and secure collection containers. It does not include amortization related to intangibles assets and interest expense.

- Corporate Location Operating Income less Net Recycling is the corporate location operating income excluding the impact of corporate location recycling sales, net of paper baling costs.

- Corporate Location EBITDA less Net Recycling is the corporate location EBITDA excluding the impact of corporate location recycling sales, net of paper baling costs.

- Margin is the percentage of revenue that has turned into EBITDA or Operating Income. Margin is defined as EBITDA or operating income divided by revenue.

- Constant currency is a measure of growth before foreign currency translation impacts. It is defined as the current period results in CAD currency using the foreign exchange rate in the equivalent prior year period. This allows for period over period comparisons of business performance excluding the impact of currency fluctuations.

Reconciliation of EBITDA and EBITDA less net recycling to Operating Income

Reconciliation of Operating Income to Net Income

Reconciliation of Consolidated Free Cash Flow with Cash Provided by Operations

Financial Statements

Redishred's March 31, 2024, Financial Statements and Management's Discussion and Analysis will be available on www.sedar.com and www.redishred.com.

About Redishred Capital Corp.

Redishred Capital Corp. ("Redishred") is the owner of the PROSHRED®, PROSCAN and secure e-Cycle brands, trademarks and intellectual property in the United States. Redishred digitizes, secures, shreds and recycles confidential documents and proprietary materials for thousands of customers in the United States in all industry sectors. Redishred is a pioneer in the mobile document destruction and recycling industry and has the ISO 9001:2015 certification. It is Redishred's vision to be the ‘system of choice' in providing digital retention, secure shredding and recycling services on a global basis. Redishred Capital Corp. grants PROSHRED` and PROSCAN franchise businesses in the United States and by way of a license arrangement in the Middle East. Redishred also operates seventeen corporate businesses directly. The Company's plan is to grow its business by way of both franchising and the acquisition and operation of information security businesses that generate stable and recurring cash flow through a scheduled client base, continuous paper recycling and concurrent unscheduled shredding service.

FOR FURTHER INFORMATION PLEASE CONTACT:

Redishred Capital Corp. (TSX.V - KUT)

Jeffrey Hasham, MBA, CPA, CA

Chief Executive Officer

Jeffrey.hasham@redishred.com

www.redishred.com

Phone: (416) 849-3469 Fax: (905) 812-9448

or,

Redishred Capital Corp. (TSX.V - KUT)

Harjit Brar, CPA, CA

Senior Vice President and Chief Financial Officer

harjit.brar@redishred.com

www.redishred.com

Phone: (437) 328-6639 Fax: (905) 812-9448

Note: Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward looking statements that reflect the current expectations of management of Redishred and Redishred's future results, performance, achievements, prospects and opportunities. Wherever possible, words such as "may", "will", "estimate", "believe", "expect", "intend" and similar expressions have been used to identify these forward looking statements. These statements reflect current beliefs and are based on information currently available to management of Redishred. Forward looking statements necessarily involve known and unknown risks, uncertainties and other factors. A number of factors, including those discussed in Redishred's 2023 Management Discussion and Analysis under "Risk Factors", could cause actual results, performance, achievements, prospects or opportunities to differ materially from the results discussed or implied in the forward looking statements. These factors should be considered carefully and a reader should not place undue reliance on the forward looking statements. There can be no assurance that the expectations of management of Redishred will prove to be correct. Readers are cautioned that such forward looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from these statements. Redishred can give no assurance that actual results will be consistent with these forward-looking statements.

SOURCE: Redishred Capital Corp.

View the original press release on accesswire.com