from Sokoman Minerals Corp (isin : CA83410M1014)

Sokoman Minerals Drilling Update - Moosehead Gold Project, Central Newfoundland

A New Mineralized Structure, the 552 Zone, Intersected in Four Holes; Remains Open

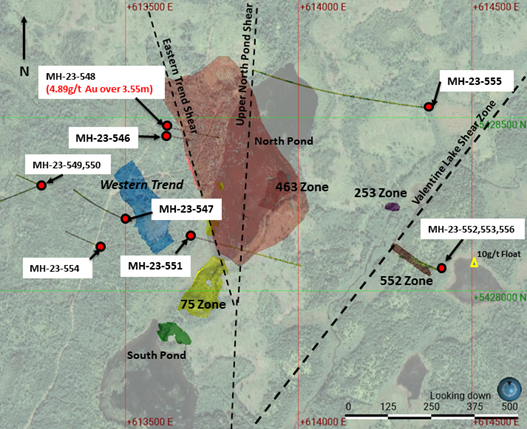

ST. JOHN'S, NL / ACCESSWIRE / November 2, 2023 / Sokoman Minerals Corp. (TSXV:SIC)(OTCQB:SICNF) is pleased to provide an update on the ongoing drilling program at the 100%-owned Moosehead project. Diamond drilling has identified a new mineralized structure 200 m to the east of the Eastern Trend, the furthest east of any mineralization located to date. Dubbed the 552 Zone, after the first hole that cut it, it has an apparent east-west strike, making it close to perpendicular to the Eastern Trend, suggesting that it lies in a similar structural setting as the 463 Zone but above the Eastern Trend, in the hanging wall, whereas the 463 Zone lies in the footwall of the Eastern Trend.

Tim Froude, President and CEO of Sokoman, says: "While not exhibiting high grade to date, the fact that the 552 Zone structure has gold in it is good news as we know we can get variable grades interspersed with higher grades in all zones at Moosehead. On this property, we drill first for structure and then seek out the grade. I am extremely pleased with this development since we see sulphide minerals, commonly associated with the higher-grade Au, including boulangerite and sphalerite and we are looking forward to evaluating this new zone. The presence of gold-bearing structures in MH-23-555 is also very significant as it is a wide step-out hole and confirms the presence of mineralizing fluids in this area and extends the Eastern Trend to the east. We expect to go over the 100,000 m mark in the ongoing Phase 6 program sometime this month and look forward to continued drilling at Moosehead."

The mineralized quartz 552 Zone has been intersected in all four holes (552, 553, 556, and 557) completed, with assays received for three of the four. Boulangerite and sphalerite, minerals associated with Au on the Moosehead property, are noted. The best grade intersected to date is 1.41 g/t Au over 2.9 m in DDH 553 with 1.15 g/t over 2.95 m in DDH 552. The 552 Zone has been tested by two sections of two holes each drilled from the same setup giving a 10-m strike-length, over a vertical range of approximately 25 m. The drilling tested a resistivity high noted in the winter Alpha IP survey with several second-order targets also identified in the general area. A Noranda float sample from the late 1980s, that assayed 10.3 g/t Au, is located close to the 552 Zone. The 552 Zone remains open with approximately 2500 m of drilling planned to test along strike and to depth.

Results include three holes in the Eastern Trend footwall, testing for near surface mineralization in the same orientation as the vein set in the deeper 463 Zone. The 463 Zone returned an earlier intercept of 39.60 m grading 12.50 g/t Au, including 10.5 m @ 41.97 g/t Au (see December 15, 2022 press release). The best results, from MH-23-548, gave 4.89 g/t Au over 3.55 m from 185.75 m downhole (see Table 1 below) ~250 m NW of, and 150 m vertically above, the 463 Zone with a second zone intersected in DDH 548, giving 0.95 g/t Au over 4.20 m. Drilling will continue to test the footwall environment which remains very prospective for additional gold-bearing structures.

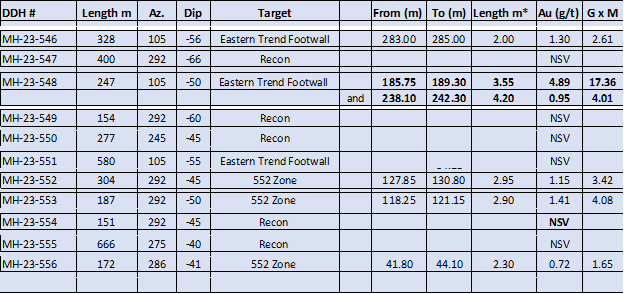

Table 1 - Assay Results

*Core length - true widths are estimated to be approximately half the core length

Plan view of recent drilling

Reconnaissance holes MH-23-547, 549, 550, and 554 were drilled to test IP targets. Hole MH-23-555 was a 100 m step-out testing the down-plunge projection of the Eastern Trend to the north. There are several zones of deformation in the hole with the strongest structure occurring from 586.4 m - 592.7 m. Here strongly deformed and broken quartz veins and vein fragments occur within a pyritized and broken, light-grey sediment. A second zone of weak deformation occurs from 464.4 m - 475.8 m with upwards of 20% stockwork and stylolitic textured quartz veins. This zone contains anomalous gold with occasional traces of pyrite, sphalerite, and arsenopyrite with a best assay of 0.93 g/t Au over 0.40 m. The presence of multiple structures with mineralogy similar to high-grade zones elsewhere on the property is significant, additional drilling will be recommended for this area.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

Samples, including duplicates, blanks, and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes the whole sample being crushed to -10 mesh, and then pulverized to 95% -150 mesh. The total sample is weighed and screened to 150 mesh; the +150 mesh fraction is fire-assayed for Au, and a 30 g subsample of the -150 mesh fraction is fire-assayed for Au; with a calculated weighted average of total Au in the sample reported as well. One blank and one industry-approved standard for every twenty samples submitted is included in the sample stream. Random duplicates of selected samples are analyzed in addition to the in-house standard and duplicate policies of Eastern Analytical Ltd. All reported assays are uncut.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland and Labrador, Canada. The Company's primary focus is its portfolio of gold projects; the 100% flagship, advanced-stage Moosehead, as well as the Crippleback Lake; and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland. Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims - 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada's newest and rapidly-emerging gold districts. In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. The agreement provides for Piedmont to earn up to 62.5% of the Killick Lithium Project (formerly Golden Hope project) by funding up to $12 million in exploration expenses and issuing $10 million common shares in 3 stages. The Killick Lithium Project has been transferred to Killick Lithium Inc. (Killick), a 100%-owned subsidiary of Vinland Lithium Inc. (Vinland). Newly created Vinland has received $2 million in financing from Piedmont for a 19.9% interest, with the balance of ownership between Sokoman and Benton. Sokoman and Benton will continue to operate the exploration efforts at Killick through the earn-in stages. Sokoman and Benton will retain a royalty of 2% NSR on future production. Piedmont will have exclusive marketing rights for the promotion and sale of any lithium products produced from the Project on a life-of-mine basis, and the right of first refusal on 100% offtake rights to the lithium concentrates.

The Company also retains a 1% NSR interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to Thunder Gold Corp (formerly White Metal Resources Inc.), and in Labrador, the Company has a 100% interest in the Iron Horse (Fe) project which has Direct Shipping Ore (DSO) potential.

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for past financial support of the Moosehead Project through the Junior Exploration Assistance Program.

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

SOURCE: Sokoman Minerals Corp.

View source version on accesswire.com:

https://www.accesswire.com/798716/sokoman-minerals-drilling-update--moosehead-gold-project-central-newfoundland