from SouthGobi Resources Ltd. (isin : CA8443751059)

SouthGobi Announces Fourth Quarter and Full Year 2023 Financial and Operating Results

HONG KONG, CHINA / ACCESSWIRE / March 28, 2024 / SouthGobi Resources Ltd. (Hong Kong Stock Exchange ("HKEX"): 1878, TSX Venture Exchange ("TSX-V"): SGQ) (TSX-V:SGQ)(HK:1878) (the "Company" or "SouthGobi") today announces its financial and operating results for the quarter and the year ended December 31, 2023. All figures are in U.S. dollars ("USD") unless otherwise stated.

The Board of Directors (the "Board") wish to inform that the Company's independent auditors, BDO Limited, have completed their audit of the consolidated financial statements of the Company for the year ended December 31, 2023 in accordance with Canadian generally accepted auditing standards and would like to announce the audited annual results of the Company for the year ended December 31, 2023 together with the comparative figures for the previous year and the respective notes in this announcement.

Significant Events and Highlights

The Company's significant events and highlights for the year ended December 31, 2023 and the subsequent period to March 28, 2024 are as follows:

- Operating Results - In late 2022, the Company resumed its major mining operations, including coal mining, and the volume of coal production has gradually increased since then. The Company also resumed coal washing operations in April 2023. In response to the market demand, the Company has been mixing some higher ash content product with its semi-soft coking coal product and selling this mixed product to the market as processed coal.

The Company experienced an increase in the average selling price of coal from $65.7 per tonne in 2022 to $93.0 per tonne in 2023 as a result of improved market conditions in China, expansion of its sales network and diversification of its customer base.

- Financial Results - The Company recorded a $75.9 million profit from operations in 2023 compared to a $13.6 million profit from operations in 2022. The financial results for 2023 were impacted by the improved market conditions in China, expansion of its sales network and diversification of its customer base.

- Deferral Agreements - On October 13, 2023, the Company and JD Zhixing Fund L.P. ("JDZF") entered into an agreement (the "2023 November Deferral Agreement") pursuant to which JDZF agreed to grant the Company a deferral of (i) payment-in-kind interest ("PIK Interest") of approximately $4.0 million which are due and payable on November 19, 2023 under the Company's convertible debenture (the "Convertible Debenture"); and (ii) the management fees payable to JDZF on November 15, 2023, February 15, 2024, May 16, 2024 and August 15, 2024, respectively, under the amended and restated mutual cooperation agreement signed on April 23, 2019 (the "Amended and Restated Cooperation Agreement") (collectively, the "2023 November Deferred Amounts").

The principal terms of the 2023 November Deferral Agreement are as follows:

- Payment of the 2023 November Deferred Amounts will be deferred until August 31, 2024 (the "2023 November Deferral Agreement Deferral Date").

- As consideration for the deferral of the 2023 November Deferred Amounts which relate to the payment obligations arising from the Convertible Debenture, the Company agreed to pay JDZF a deferral fee equal to 6.4% per annum on the outstanding balance of such 2023 November Deferred Amounts, commencing on the date on which each such 2023 November Deferred Amounts would otherwise have been due and payable under the Convertible Debenture.

- As consideration for the deferral of the 2023 November Deferred Amounts which relate to payment obligations arising from the Amended and Restated Cooperation Agreement, the Company agreed to pay JDZF a deferral fee equal to 1.5% per annum on the outstanding balance of such 2023 November Deferred Amounts, commencing on the date on which each such 2023 November Deferred Amounts would otherwise have been due and payable under the Amended and Restated Cooperation Agreement.

- The 2023 November Deferral Agreement does not contemplate a fixed repayment schedule for the 2023 November Deferred Amounts or related deferral fees. Instead, the 2023 November Deferral Agreement requires the Company to use its best efforts to pay the 2023 November Deferred Amounts and related deferral fees due and payable under the 2023 November Deferral Agreement to JDZF. During the period beginning as of the effective date of the 2023 November Deferral Agreement and ending as of the 2023 November Deferral Agreement Deferral Date, the Company will provide JDZF with monthly updates of its financial status and business operations, and the Company and JDZF will on a monthly basis discuss and assess in good faith the amount (if any) of the 2023 November Deferred Amounts and related deferral fees that the Company may be able to repay to JDZF, having regard to the working capital requirements of the Company's operations and business at such time and with the view of ensuring that the Company's operations and business would not be materially prejudiced as a result of any repayment.

- If at any time before the 2023 November Deferred Amounts and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from JDZF prior to effecting such appointment, replacement or termination.

On March 19, 2024, the Company and JDZF entered into an agreement (the "2024 March Deferral Agreement") pursuant to which JDZF agreed to grant the Company a deferral of (i) the cash and PIK Interest, management fees, and related deferral fees in aggregate amount of $96.5 million which will be due and payable to JDZF on or before August 31, 2024 under the deferral agreement signed on March 24, 2023 (the "2023 March Deferral Agreement") and the 2023 November Deferral Agreement; (ii) semi-annual cash interest payment of $7.9 million payable to JDZF on May 19, 2024 under the Convertible Debenture; (iii) semi-annual cash interest payments of $8.1 million payable to JDZF on November 19, 2024 and the $4.0 million in PIK Interest shares issuable to JDZF on November 19, 2024 under the Convertible Debenture; and (iv) management fees in the aggregate amount of $2.2 million payable to JDZF on November 15, 2024 and February 15, 2025, respectively, under the Amended and Restated Cooperation Agreement (collectively, the "2024 March Deferred Amounts").

The effectiveness of the 2024 March Deferral Agreement and the respective covenants, agreements and obligations of each party under the 2024 March Deferral Agreement are subject to the approval (if any) from the TSX-V and requisite approval from the disinterested shareholders of the Company in accordance with applicable Canadian securities laws and the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the "Listing Rules"). The Company will be seeking approval of the 2024 March Deferral Agreement from disinterested shareholders at the Company's upcoming annual general meeting ("AGM") of shareholders, which will be held at a future date to be set by the Board.

The principal terms of the 2024 March Deferral Agreement are as follows:

- Payment of the 2024 March Deferred Amounts will be deferred until August 31, 2025 (the "2024 March Deferral Agreement Deferral Date").

- As consideration for the deferral of the 2024 March Deferred Amounts which relate to the payment obligations arising from the Convertible Debenture, the Company agreed to pay JDZF a deferral fee equal to 6.4% per annum on the outstanding balance of such 2024 March Deferred Amounts, commencing on the date on which each such 2024 March Deferred Amounts would otherwise have been due and payable under the Convertible Debenture.

- As consideration for the deferral of the 2024 March Deferred Amounts which relate to payment obligations arising from Amended and Restated Cooperation Agreement, the Company agreed to pay JDZF a deferral fee equal to 1.5% per annum on the outstanding balance of such 2024 March Deferred Amounts commencing on the date on which each such 2024 March Deferred Amounts would otherwise have been due and payable under the Amended and Restated Cooperation Agreement.

- The 2024 March Deferral Agreement does not contemplate a fixed repayment schedule for the 2024 March Deferred Amounts or related deferral fees. Instead, the 2024 March Deferral Agreement requires the Company to use its best efforts to pay the 2024 March Deferred Amounts and related deferral fees due and payable under the 2024 March Deferral Agreement to JDZF. During the period beginning as of the effective date of the 2024 March Deferral Agreement and ending as of the 2024 March Deferral Agreement Deferral Date, the Company will provide JDZF with monthly updates of its financial status and business operations, and the Company and JDZF will on a monthly basis discuss and assess in good faith the amount (if any) of the 2024 March Deferred Amounts and related deferral fees that the Company may be able to repay to JDZF, having regard to the working capital requirements of the Company's operations and business at such time and with the view of ensuring that the Company's operations and business would not be materially prejudiced as a result of any repayment.

- If at any time before the 2024 March Deferred Amounts and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from JDZF prior to effecting such appointment, replacement or termination.

- 2023 March Deferral Agreement - On August 29, 2023, the Company convened a special meeting of shareholders during which the Company obtained the requisite approval from disinterested shareholders for the 2023 March Deferral Agreement.

- Additional Tax and Tax Penalty Imposed by the Mongolian Tax Authority ("MTA") - On July 18, 2023, SouthGobi Sands LLC ("SGS"), a wholly owned subsidiary of the Company received an official notice (the "Notice") issued by the MTA stating that the MTA had completed a periodic tax audit (the "Audit") on the financial information of SGS for the tax assessment years between 2017 and 2020, including transfer pricing, royalty, air-pollution fee and unpaid tax payables. As a result of the Audit, the MTA notified SGS that it is imposing a tax penalty against SGS in the amount of approximately $75.0 million. The penalty mainly relates to the different view on the interpretation of tax law between the Company and the MTA. Under Mongolian law, the Company had a period of 30 days from the date of receipt of the Notice to file an appeal in relation to the Audit. Subsequently the Company engaged an independent tax consultant in Mongolia to provide tax advice and support to the Company and filed an appeal letter in relation to the Audit with the MTA in accordance with Mongolian laws on August 17, 2023.

As at December 31, 2023, the Company recorded an additional tax and tax penalty in the amount of $85.1 million, which consists of a tax penalty payable of $75.0 million and a provision of additional late tax penalty of $10.1 million. The Company has paid the MTA an aggregate of $1.2 million in relation to the aforementioned tax penalty. According to Mongolian tax law, the MTA has a legal authority to demand payment from the Company irrespective of any potential appeal process that may change the aforesaid tax penalty. Based on the advice from tax professionals and the best estimate from the management, in the event that the Company's appeal is to be successful in future, it is probable that the Company may recover a portion of the tax penalty payable to the MTA, which is approximately $46.0 million. However, there are inherent uncertainties surrounding the development and outcome of the appeal. The Company cannot determine with virtually certainty the exact recoverability or recoverable amount of the tax penalty paid in future. If any subsequent event occurs that may impact the amount of the additional tax and tax penalty, an adjustment would be recognised in profit or loss and the carrying amount of the tax liabilities shall be adjusted.

On February 8, 2024, SGS received notice from the Tax Dispute Resolution Council ("TDRC") which stated that, after the TDRC's review, the TDRC issued a decision in relation to SGS' appeal of the Audit, and ordered that the audit assessments set forth in the Notice of July 18, 2023 be sent back to the MTA for review and re-assessment.

On February 22, 2024, SGS received another notice from the MTA stating that the MTA anticipates commencing the re-assessment process on or about March 7, 2024 and the duration of such process will be approximately 45 working days. Any decision of the MTA following the re-assessment process may not be conclusive as the Company retains the right to appeal such decision under Mongolian laws.

- Changes in Directors and Management

Mr. Gang Li: Mr. Li resigned as a non-executive director on May 8, 2023.

Mr. Dong Wang: Mr. Wang was removed as Chief Executive Officer and redesignated from an executive Director to a non-executive Director on May 15, 2023. He ceased to be a non-executive Director upon conclusion of the Company's AGM held on June 20, 2023.

Mr. Ruibin Xu: Mr. Xu was appointed as Chief Executive Officer on May 15, 2023 and elected as an executive director at the Company's AGM held on June 20, 2023.

Mr. Zaixiang Wen: Mr. Wen was appointed as a non-executive Director on May 17, 2023.

Ms. Chonglin Zhu: Ms. Zhu was appointed as Chief Financial Officer on February 2, 2024.

Mr. Alan Ho: Mr. Ho was redesignated from Chief Financial Officer to a new management position within the Company on February 2, 2024.

- Going Concern - Several adverse conditions and material uncertainties relating to the Company cast significant doubt upon the going concern assumption which includes the deficiencies in assets and working capital.

See section "Liquidity and Capital Resources" of this press release for details.

OVERVIEW OF OPERATIONAL DATA AND FINANCIAL RESULTS

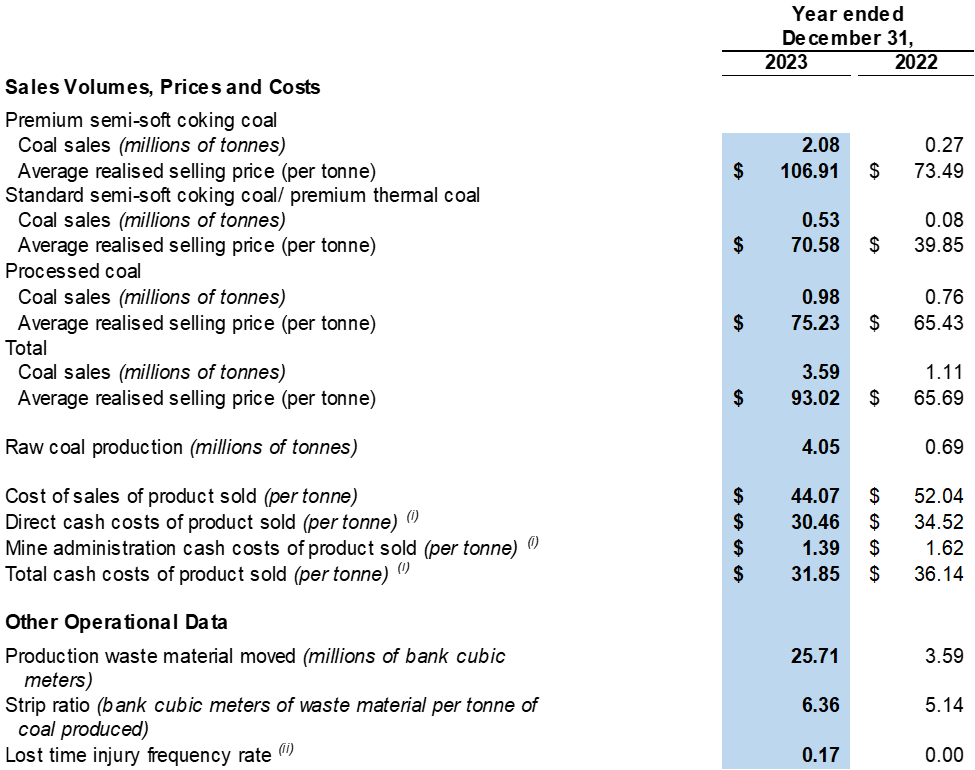

Summary of Annual Operational Data

- A Non-International Financial Reporting Standards ("non-IFRS") financial measure. Refer to "Non-IFRS Financial Measures" section. Cash costs of product sold exclude idled mine asset cash costs.

- Per 200,000 man hours and calculated based on a rolling 12-month average.

Overview of Annual Operational Data

The Company experienced an increase in the average selling price of coal from $65.7 per tonne for 2022 to $93.0 per tonne for 2023, as a result of improved market conditions in China, expansion of its sales network and diversification of its customer base. The product mix for 2023 consisted of approximately 58% of premium semi-soft coking coal, 15% of standard semi-soft coking coal/premium thermal coal and 27% of processed coal compared to approximately 25% of premium semi-soft coking coal, 6% of standard semi-soft coking coal/premium thermal coal and 69% of processed coal in 2022.

The Company's unit cost of sales of product sold decreased from $52.0 per tonne in 2022 to $44.1 per tonne in 2023. The decrease was mainly driven by the economies of scale due to increased sales.

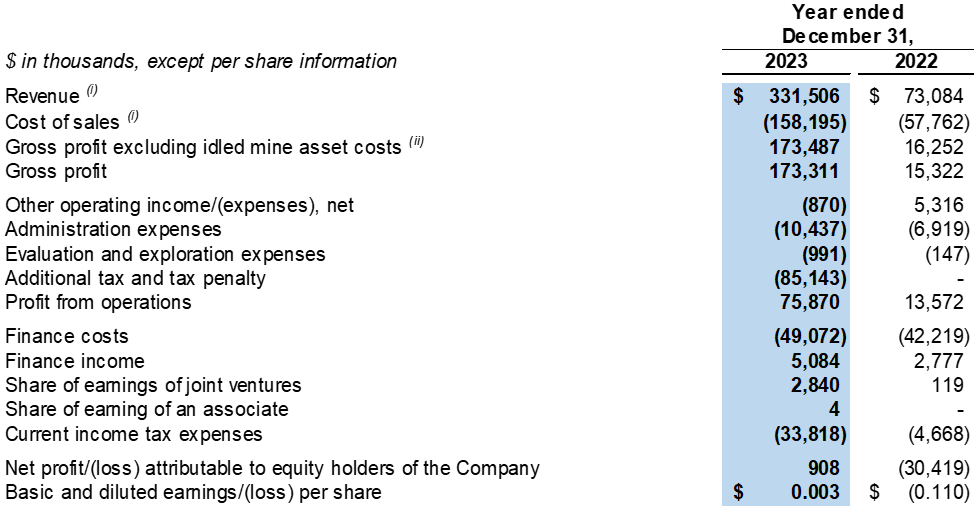

Summary of Annual Financial Results

- Revenue and cost of sales related to the Company's Ovoot Tolgoi Mine within the Coal Division operating segment. Refer to note 2 of the selected information from the notes to the consolidated financial statements in this press release for further analysis regarding the Company's reportable operating segments.

- A Non-IFRS financial measure. Refer to "Non-IFRS Financial Measures" section. Idled mine asset costs represents the depreciation expense relates to the Company's idled plant and equipment.

Overview of Annual Financial Results

The Company recorded a $75.9 million profit from operations in 2023 compared to a $13.6 million profit from operations in 2022. The financial results were impacted by increased sales volume and improvement in the Company's average realised selling price.

Revenue was $331.5 million in 2023 compared to $73.1 million in 2022. The increase was due to (i) coal export volumes through the Ceke Port of Entry gradually increased since the second quarter of 2023; and (ii) the Company experienced an increase in the average selling price of coal from $65.7 per tonne for 2022 to $93.0 per tonne for 2023, as a result of improved market conditions in China, expansion of its sales network and diversification of its customer base.

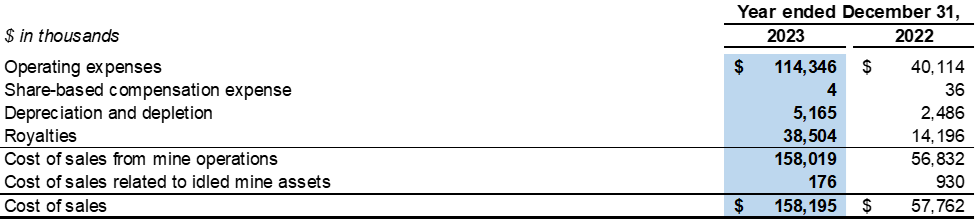

Cost of sales was $158.2 million in 2023 compared to $57.8 million in 2022. Cost of sales consists of operating expenses, share-based compensation expense, equipment depreciation, depletion of mineral properties, royalties and idled mine asset costs. Operating expenses in cost of sales reflect the total cash costs of product sold (a Non-IFRS financial measure, refer to section "Non-IFRS Financial Measures" for further analysis) during the year.

Operating expenses in cost of sales were $114.3 million in 2023 compared to $40.1 million in 2022. The overall increase in cost of sales was primarily due to the increased sales.

Cost of sales related to idled mine assets in 2023 included $0.2 million related to depreciation expenses for idled equipment (2022: $0.9 million).

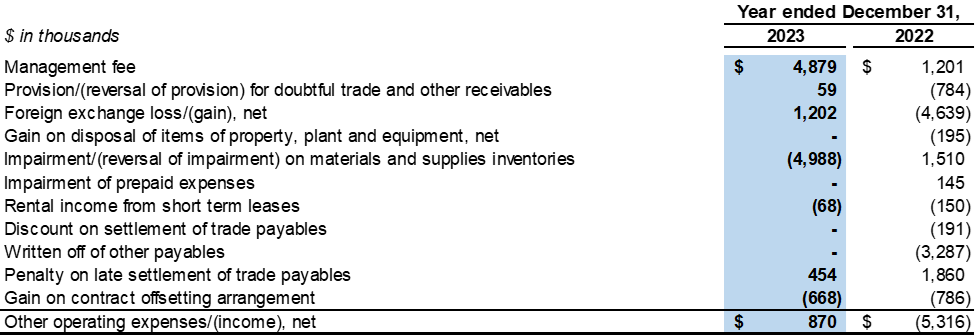

Other operating expenses was $0.9 million in 2023 (2022: other operating income of $5.3 million). Management fee of $4.9 million and foreign exchange loss of $1.2 million were recorded and largely offset by reversal of impairment on materials and supplies inventories of $5.0 million.

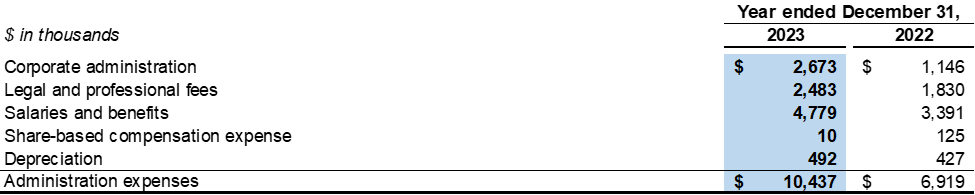

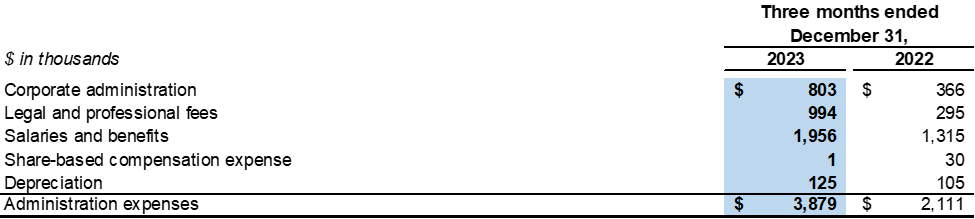

Administration expenses were $10.4 million in 2023 as compared to $6.9 million in 2022, as follows:

Administration expenses were higher for 2023 compared to 2022, mainly due to increase in corporate administration expenses and salaries and benefits as a result of expansion of operation since the second quarter of 2023.

The Company continued to minimise evaluation and exploration expenditures in 2023 in order to preserve the Company's financial resources. Evaluation and exploration activities and expenditures in 2023 were limited to ensuring that the Company met the Mongolian Minerals Law requirements in respect of its mining licenses.

Finance costs were $49.1 million and $42.2 million in 2023 and 2022, respectively, which primarily consisted of interest expense on the $250.0 million Convertible Debenture.

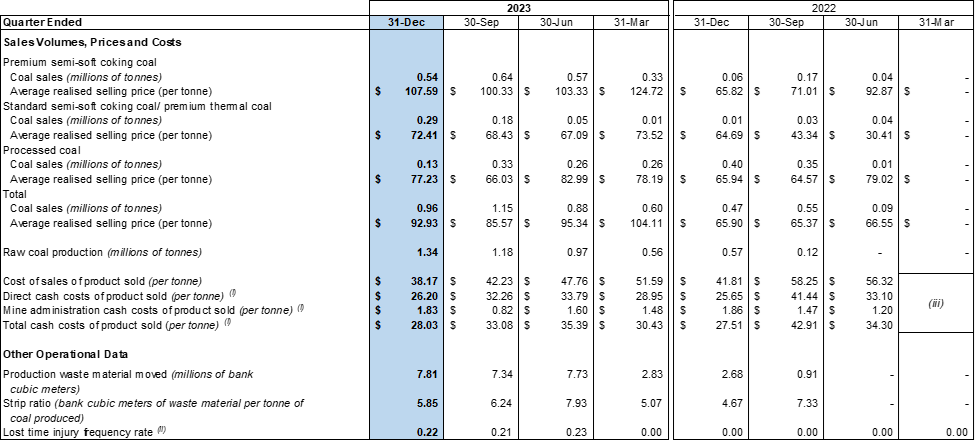

Summary of Quarterly Operational Data

- A Non-IFRS financial measure. Refer to "Non-IFRS Financial Measures" section. Cash costs of product sold exclude idled mine asset cash costs.

- Per 200,000 man hours and calculated based on a rolling 12-month average.

- Not presented as nil sales was noted for the quarter.

Overview of Quarterly Operational Data

The Company experienced an increase in the average selling price of coal from $65.9 per tonne in the fourth quarter of 2022 to $92.9 per tonne in the fourth quarter of 2023, as a result of improved market conditions in China. The product mix for the fourth quarter of 2023 consisted of approximately 56% premium semi-soft coking coal, 30% standard semi-soft coking coal/premium thermal coal and 14% of processed coal compared to approximately 13% premium semi-soft coking coal, 1% standard semi-soft coking coal/premium thermal coal and 86% of processed coal in the fourth quarter of 2022.

The Company sold 1.0 million tonnes for the fourth quarter of 2023, compared to 0.5 million tonnes for the fourth quarter of 2022.

The Company's unit cost of sales of product sold decreased from $41.8 per tonne in the fourth quarter of 2022 to $38.2 per tonne in the fourth quarter of 2023. The decrease was mainly driven by the economies of scale due to increased sales.

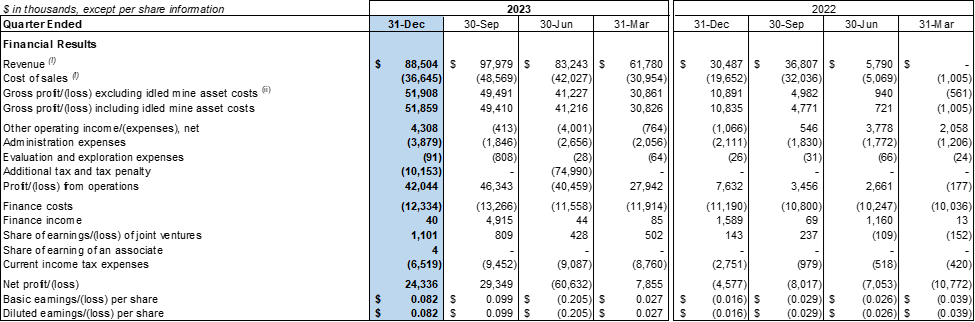

Summary of Quarterly Financial Results

The Company's annual financial statements are reported under IFRS Accounting Standards issued by the International Accounting Standards Board. The following table provides highlights, extracted from the Company's annual and interim financial statements, of quarterly financial results for the past eight quarters:

- Revenue and cost of sales relate to the Company's Ovoot Tolgoi Mine within the Mongolian Coal Division operating segment. Refer to note 2 of the selected information from the notes to the consolidated financial statements in this press release for further analysis regarding the Company's reportable operating segments.

- A non-IFRS financial measure, idled mine asset costs represents the depreciation expense relates to the Company's idled plant and equipment.

Overview of Quarterly Financial Results

The Company recorded a $42.0 million profit from operations in the fourth quarter of 2023 compared to a $7.6 million profit from operations in the fourth quarter of 2022. The financial results for the fourth quarter of 2023 were impacted by (i) the higher selling price achieved by the Company; and (ii) increased sales experienced by the Company following the reopening of the Ceke Port of Entry during the second quarter of 2022.

Revenue was $88.5 million in the fourth quarter of 2023 compared to $30.5 million in the fourth quarter of 2022. The increase was due to: (i) an increase in coal export volumes through the Ceke Port of Entry since the second quarter of 2023; and (ii) the Company experienced an increase in the average selling price of coal from $65.9 per tonne in the fourth quarter of 2022 to $92.9 per tonne in the fourth quarter of 2023 as a result of improved market conditions in China, expansion of its sales network and diversification of its customer base.

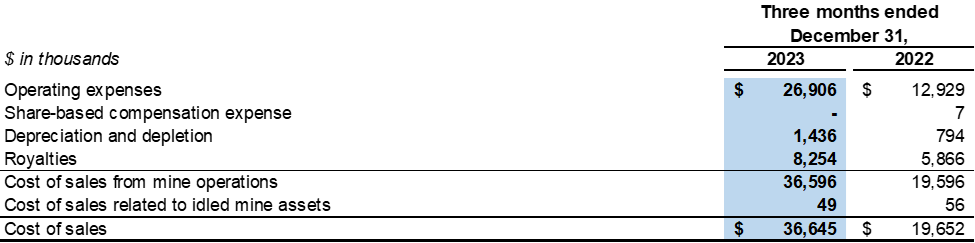

Cost of sales was $36.6 million in the fourth quarter of 2023 compared to $19.7 million in the fourth quarter of 2022. The increase in cost of sales in the fourth quarter of 2023 was mainly due to the effect of increased sales volume.

Cost of sales consists of operating expenses, share-based compensation expense, equipment depreciation, depletion of mineral properties, royalties and idled mine asset costs. Operating expenses in cost of sales reflect the total cash costs of product sold (a Non-IFRS financial measure, refer to section "Non-IFRS Financial Measures" for further analysis) during the quarter.

Cost of sales related to idled mine assets in the fourth quarter of 2023 included $0.1 million related to depreciation expenses for idled equipment (fourth quarter of 2022: $0.1 million).

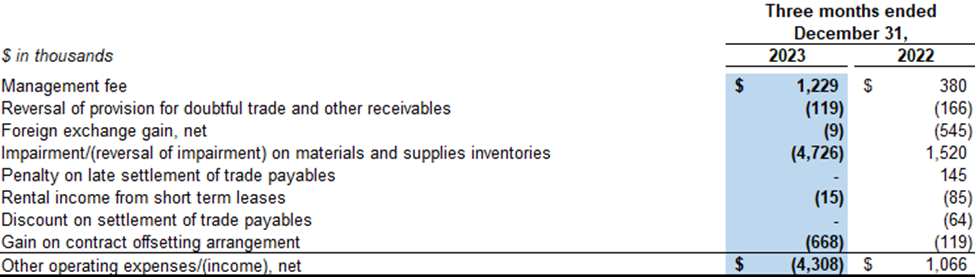

Other operating income was $4.3 million in the fourth quarter of 2023 (fourth quarter of 2022: other operating expenses of $1.1 million). A reversal of impairment on materials and supplies inventories of $4.7 million and gain on a contract offsetting arrangement of $0.7 million were recorded and offset by management fee of $1.2 million in the fourth quarter of 2023. (fourth quarter of 2022: foreign exchange gain of $0.5 million and impairment on materials and supplies inventories of $1.5 million).

Administration expenses increased from $2.1 million in the fourth quarter of 2022 to $3.9 million in the fourth quarter of 2023, due to an increase in legal and professional fees and salaries and benefits incurred during the quarter.

The Company continued to minimise evaluation and exploration expenditures in the fourth quarter of 2023 in order to preserve the Company's financial resources. Evaluation and exploration activities and expenditures in the fourth quarter of 2023 were limited to ensuring that the Company met the Mongolian Minerals Law requirements in respect of its mining licenses.

Finance costs were $12.3 million in the fourth quarter of 2023 compared to $11.2 million in the fourth quarter of 2022, which primarily consisted of interest expense on the $250.0 million Convertible Debenture.

LIQUIDITY AND CAPITAL RESOURCES

Liquidity and Capital Management

The Company has in place a planning, budgeting and forecasting process to help determine the funds required to support the Company's normal operations on an ongoing basis and its expansionary plans.

Costs reimbursable to Turquoise Hill Resources Limited ("Turquoise Hill")

Prior to the completion of a private placement with Novel Sunrise Investments Limited on April 23, 2015, Rio Tinto plc ("Rio Tinto") was the Company's ultimate parent company. In the past, Rio Tinto sought reimbursement from the Company for the salaries and benefits of certain Rio Tinto employees who were assigned by Rio Tinto to work for the Company, as well as certain legal and professional fees incurred by Rio Tinto in relation to the Company's prior internal investigation and Rio Tinto's participation in the tripartite committee. Subsequently Rio Tinto transferred and assigned to Turquoise Hill its right to seek reimbursement for these costs and fees from the Company.

On January 20, 2021, the Company and Turquoise Hill entered into a settlement agreement, whereby Turquoise Hill agreed to a repayment schedule in settlement of certain secondment costs in the amount of $2.8 million (representing a portion of the TRQ Reimbursable Amount) pursuant to which the Company agreed to make monthly payments to Turquoise Hill in the amount of $0.1 million per month from January 2021 to June 2022. The Company is contesting the validity of the remaining balance of the TRQ Reimbursable Amount claimed by Turquoise Hill.

As at December 31, 2023, the amount of reimbursable costs and fees claimed by Turquoise Hill (the "TRQ Reimbursable Amount") amounted to $6.3 million (such amount is included in the trade and other payables).

Additional tax and tax penalty imposed by the MTA

On July 18, 2023, SGS received the Notice issued by the MTA stating that the MTA had completed the Audit on the financial information of SGS for the tax assessment years between 2017 and 2020, including transfer pricing, royalty, air-pollution fee and unpaid tax payables. As a result of the Audit, the MTA notified SGS that it is imposing a tax penalty against SGS in the amount of approximately $75.0 million. The penalty mainly relates to the different view on the interpretation of tax law between the Company and the MTA. Under Mongolian law, the Company had a period of 30 days from the date of receipt of the Notice to file an appeal in relation to the Audit. Subsequently the Company engaged an independent tax consultant in Mongolia to provide tax advice and support to the Company and filed an appeal letter in relation to the Audit with the MTA in accordance with Mongolian laws on August 17, 2023.

As at December 31, 2023, the Company recorded an additional tax and tax penalty in the amount of $85.1 million, which consists of a tax penalty payable of $75.0 million and a provision of additional late tax penalty of $10.1 million. The Company has paid the MTA an aggregate of $1.2 million in relation to the aforementioned tax penalty. According to Mongolian tax law, the MTA has a legal authority to demand payment from the Company irrespective of any potential appeal process that may change the aforesaid tax penalty. Based on the advice from tax professionals and the best estimate from the management, in the event that the Company's appeal is to be successful in future, it is probable that the Company may recover a portion of the tax penalty payable to the MTA, which is approximately $46.0 million. However, there are inherent uncertainties surrounding the development and outcome of the appeal. The Company cannot determine with virtually certainty the exact recoverability or recoverable amount of the tax penalty paid in future. If any subsequent event occurs that may impact the amount of the additional tax and tax penalty, an adjustment would be recognised in profit or loss and the carrying amount of the tax liabilities shall be adjusted.

On February 8, 2024, SGS received notice from the TDRC which stated that, after the TDRC's review, the TDRC issued a decision in relation to SGS' appeal of the Audit, and ordered that the audit assessments set forth in the Notice of July 18, 2023 be sent back to the MTA for review and re-assessment.

On February 22, 2024, SGS received another notice from the MTA stating that the MTA anticipates commencing the re-assessment process on or about March 7, 2024 and the duration of such process will be approximately 45 working days. Any decision of the MTA following the re-assessment process may not be conclusive as the Company retains the right to appeal such decision under Mongolian laws.

Going concern considerations

The Company's consolidated financial statements have been prepared on a going concern basis which assumes that the Company will continue to operate until at least December 31, 2024 and will be able to realise its assets and discharge its liabilities in the normal course of operations as they come due. However, in order to continue as a going concern, the Company must generate sufficient operating cash flows, secure additional capital or otherwise pursue a strategic restructuring, refinancing or other transactions to provide it with sufficient liquidity.

Several adverse conditions and material uncertainties cast significant doubt upon the Company's ability to continue as a going concern and the going concern assumption used in the preparation of the Company's consolidated financial statements. The Company had a deficiency in assets of $141.3 million as at December 31, 2023 as compared to a deficiency in assets of $142.5 million as at December 31, 2022 while the working capital deficiency (excess current liabilities over current assets) reached $218.8 million as at December 31, 2023 compared to a working capital deficiency of $184.7 million as at December 31, 2022.

Included in the working capital deficiency as at December 31, 2023 are significant obligations, represented by trade and other payables of $60.2 million and an additional tax and tax penalty of $83.9 million.

The Company may not be able to settle all trade and other payables on a timely basis, and as a result any continuing postponement in settling of certain trade and other payables owed to suppliers and creditors may result in potential lawsuits and/or bankruptcy proceedings being filed against the Company. Furthermore, there is no guarantee that the Company will be successful in its negotiations with the MTA, or any appeal, in relation the Audit. Except as disclosed elsewhere in this press release, no such lawsuits or proceedings were pending as at March 28, 2024. However, there can be no assurance that no such lawsuits or proceedings will be filed by the Company's creditors in the future and the Company's suppliers and contractors will continue to supply and provide services to the Company uninterrupted.

In the past, the Company has customarily entered into cooperation agreements with the local custom office in Mongolia on an annual basis to facilitate the Company's export of coal into China. The Company's most recently executed cooperation agreement expired on November 23, 2023. While the Company has applied with the local Mongolian custom office to renew its cooperation agreement, the Company has not yet been able to renew its cooperation agreement as of the date hereof due to administrative delay on the part of the local Mongolian custom office. Consistent with prior years when there has been a temporary lapse under the cooperation agreement, the Company has continued to be able to export its coal products into China in the normal course without any negative impact on its operations since November 23, 2023. While the Company expects the renewal of the cooperation agreement to be approved by the second quarter of 2024, there can be no certainty that the renewal will be approved within such timeframe or at all.

There are significant uncertainties as to the outcomes of the above events or conditions that may cast significant doubt on the Company's ability to continue as a going concern and, therefore, the Company may be unable to realise its assets and discharge its liabilities in the normal course of business. Should the use of the going concern basis in preparation of the consolidated financial statements be determined to be not appropriate, adjustments would have to be made to write down the carrying amounts of the Company's assets to their realisable values, to provide for any further liabilities which might arise and to reclassify non-current assets and non-current liabilities as current assets and current liabilities, respectively. The effects of these adjustments have not been reflected in the consolidated financial statements. If the Company is unable to continue as a going concern, it may be forced to seek relief under applicable bankruptcy and insolvency legislation.

For the purpose of assessing the appropriateness of the use of the going concern basis to prepare the financial statements, management of the Company has prepared a cash flow projection covering a period of 12 months from December 31, 2023. The cash flow projection has considered the anticipated cash flows to be generated from the Company's business during the period under projection including cost saving measures. In particular, the Company has taken into account the following measures for improvement of the Company's liquidity and financial position, which include: (a) entering into the 2024 March Deferral Agreement with JDZF on March 19, 2024 for a deferral of the 2024 March Deferred Amounts; (b) communicating with vendors in agreeing repayment plans of the outstanding payable; (c) continuously assessing through communication with the MTA its acceptability to a prolonged settlement schedule of the outstanding tax payable and making settlement based on that assessment and the liquidity position of the Company; (d) obtaining an avenue of financial support from an affiliate of the Company's major shareholder for a maximum amount of $127.0 million (equivalent to RMB 900 million) during the period covered in the cash flow projection; and (e) obtained a new terminal agreement with Shiveekhuren Terminal LLC in March 2024, allowing for the subcontracting of coal transportation to China customers via alternative transportation channel in the event of a suspension of coal exports due to an expired cooperation agreement. Regarding these plans and measures, there is no guarantee that the suppliers and the MTA would agree the settlement plan as communicated by the Company. Nevertheless, after considering the above, the directors of the Company believe that there will be sufficient financial resources to continue its operations and to meet its financial obligations as and when they fall due in the next 12 months from December 31, 2023 and therefore are satisfied that it is appropriate to prepare the consolidated financial statements on a going concern basis.

Factors that impact the Company's liquidity are being closely monitored and include, but are not limited to, restrictions on the Company's ability to import its coal products for sale in China, Chinese economic growth, market prices of coal, production levels, operating cash costs, capital costs, exchange rates of currencies of countries where the Company operates and exploration and discretionary expenditures.

As at December 31, 2023 and December 31, 2022, the Company was not subject to any externally imposed capital requirements.

Convertible Debenture

In November 2009, the Company entered into a financing agreement with China Investment Corporation (together with its wholly-owned subsidiaries and affiliates, "CIC") for $500 million in the form of a secured, convertible debenture bearing interest at 8.0% (6.4% payable semi-annually in cash and 1.6% payable annually in the Company's Common Shares) with a maximum term of 30 years. The Convertible Debenture is secured by a first ranking charge over the Company's assets, including shares of its material subsidiaries. The financing was used primarily to support the accelerated investment program in Mongolia and for working capital, repayment of debts, general and administrative expenses and other general corporate purposes.

On March 29, 2010, the Company exercised its right to call for the conversion of up to $250.0 million of the Convertible Debenture into approximately 21.5 million shares at a conversion price of $11.64 (CA$11.88).

Deferral Agreements

On May 13, 2022, the Company and CIC entered into an agreement (the "2022 May Deferral Agreement"), pursuant to which CIC agreed to grant the Company a deferral of (i) semi-annual cash interest payments of $7.9 million payable to CIC on May 19, 2022; and (ii) the management fee which would have been payable to CIC on February 14, 2022 and August 14, 2022 (the "2022 Deferred Management Fees") under the Amended and Restated Cooperation Agreement (collectively, the "2022 Deferred Amounts").

The principal terms of the 2022 May Deferral Agreement are as follows:

- Payment of the 2022 Deferred Amounts will be deferred until August 31, 2023.

- As consideration for the deferral of the 2022 Deferred Amounts which relate to the payment obligations arising from the Convertible Debenture, the Company agreed to pay CIC a deferral fee equal to 6.4% per annum on the 2022 Deferred Amounts payable under the Convertible Debenture, commencing on May 19, 2022.

- As consideration for the deferral of the 2022 Deferred Management Fees, the Company agreed to pay CIC a deferral fee equal to 2.5% per annum on the outstanding balance of the 2022 Deferred Management Fees payable under the Amended and Restated Cooperation Agreement, commencing on the date on which each such 2022 Deferred Management Fee would otherwise have been due and payable under the Amended and Restated Cooperation Agreement.

- The Company agreed to provide CIC with monthly updates regarding its operational and financial affairs.

- If at any time before the 2022 Deferred Amounts and related deferral fee are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from CIC prior to effecting such appointment, replacement or termination.

- The Company and CIC agreed that nothing in the 2022 May Deferral Agreement prejudices CIC's rights to pursue any of its remedies at any time pursuant to the prior deferral agreements.

Following the completion of the CIC Sale Transaction on August 30, 2022, the respective rights and obligations of CIC under (i) the Convertible Debenture and related security documents; (ii) the Amended and Restated Cooperation Agreement and related documents; (iii) the deferral agreements between CIC, the Company and certain of its subsidiaries in connection with the deferral of interest payments and other outstanding fees under the Convertible Debenture and the Amended and Restated Cooperation Agreement; and (iv) the security holders agreement between the Company, CIC and a former shareholder of the Company, were assigned to JDZF.

On November 11, 2022, the Company and JDZF entered into an agreement (the "2022 November Deferral Agreement") pursuant to which JDZF agreed to grant the Company a deferral of: (i) semi-annual cash interest payments of $7.1 million payable to JDZF on November 19, 2022 and the $1.1 million in PIK Interest shares issuable to JDZF on November 19, 2022 under the Convertible Debenture (the "2022 November Deferral Interest"); and (ii) the management fees payable to JDZF on November 15, 2022, February 15, 2023, May 16, 2023 and August 15, 2023 under the Amended and Restated Cooperation Agreement (the "2022 November Deferred Management Fees").

The principal terms of the 2022 November Deferral Agreement are as follows:

- Payment of the 2022 November Deferred Interest and the 2022 November Deferred Management Fees will be deferred until November 19, 2023.

- As consideration for the deferral of the 2022 November Deferred Interest, the Company agreed to pay JDZF a deferral fee equal to 6.4% per annum on the 2022 November Deferred Interest payable under the Convertible Debenture, commencing on November 19, 2022.

- As consideration for the deferral of the 2022 November Deferred Management Fees, the Company agreed to pay JDZF a deferral fee equal to 1.5% per annum on the outstanding balance of the 2022 Deferred Management Fees payable under the Amended and Restated Cooperation Agreement, commencing on the date on which each such 2022 November Deferred Management Fees would otherwise have been due and payable under the Amended and Restated Cooperation Agreement.

- If at any time before the 2022 November Deferred Interest and the 2022 November Deferred Management Fees and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from JDZF prior to effecting such appointment, replacement or termination.

- The Company agreed to comply with all of its obligations under the prior deferral agreements assigned to JDZF.

- The Company and JDZF agreed that nothing in the 2022 November Deferral Agreement prejudices JDZF's rights to pursue any of its remedies at any time pursuant to the prior deferral agreements.

On March 24, 2023, the Company and JDZF entered into the 2023 March Deferral Agreement pursuant to which JDZF agreed to grant the Company a deferral of the (i) a deferral of the cash interest payment of approximately US$7.9 million payable to JDZF on May 19, 2023 under the Convertible Debenture; (ii) a deferral of the cash interest, management fees, and related deferral fees of approximately US$8.7 million payable to JDZF on or before August 31, 2023 under the deferral agreement dated May 13, 2022; (iii) the cash and PIK Interest, and related deferral fees of approximately US$13.5 million due and payable to JDZF on or before August 31, 2023 under the deferral agreement dated July 30, 2021; and (iv) the cash and PIK Interest, management fees, and related deferral fees of approximately US$110.4 million which are due and payable to JDZF on or before August 31, 2023 under the deferral agreement dated November 19, 2020 (the "2023 March Deferred Amounts").

The effectiveness of the 2023 March Deferral Agreement and the respective covenants, agreements and obligations of each party under the 2023 March Deferral Agreement were subject to the approvals from the Toronto Stock Exchange ("TSX") and the disinterested shareholders of the Company in accordance with the requirements of Section 501(c) of the TSX Company Manual and the Listing Rules. The requisite shareholder approvals for the 2023 March Deferral Agreement were obtained at a special meeting of shareholders convened on August 29, 2023.

The principal terms of the 2023 March Deferral Agreement are as follows:

- Payment of the 2023 March Deferred Amounts will be deferred until August 31, 2024.

- As consideration for the deferral of the 2023 March Deferred Amounts which relate to the payment obligations arising from the Convertible Debenture, the Company agreed to pay JDZF a deferral fee equal to 6.4% per annum on the outstanding balance of such 2023 March Deferred Amounts, commencing on the date on which each such 2023 March Deferred Amounts would otherwise have been due and payable under the Convertible Debenture.

- As consideration for the deferral of the 2023 March Deferred Amounts which relate to payment obligations arising from the Amended and Restated Cooperation Agreement, the Company agreed to pay JDZF a deferral fee equal to 1.5% per annum on the outstanding balance of such 2023 March Deferred Amounts commencing on the date on which each such 2023 March Deferred Amounts would otherwise have been due and payable under the Amended and Restated Cooperation Agreement.

- The 2023 March Deferral Agreement does not contemplate a fixed repayment schedule for the 2023 March Deferred Amounts or related deferral fees. Instead, the 2023 March Deferral Agreement requires the Company to use its best efforts to pay the 2023 March Deferred Amounts and related deferral fees due and payable under the 2023 March Deferral Agreement to JDZF. During the period beginning as of the effective date of the 2023 March Deferral Agreement and ending as of August 31, 2024, the Company will provide JDZF with monthly updates of its financial status and business operations, and the Company and JDZF will on a monthly basis discuss and assess in good faith the amount (if any) of the 2023 March Deferred Amounts and related deferral fees that the Company may be able to repay to JDZF, having regard to the working capital requirements of the Company's operations and business at such time and with the view of ensuring that the Company's operations and business would not be materially prejudiced as a result of any repayment.

- If at any time before the 2023 March Deferred Amounts and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from JDZF prior to effecting such appointment, replacement or termination.

On October 13, 2023, the Company and JDZF entered into the 2023 November Deferral Agreement pursuant to which JDZF agreed to grant the Company a deferral of the 2023 November Deferred Amounts.

The principal terms of the 2023 November Deferral Agreement are as follows:

- Payment of the 2023 November Deferred Amounts will be deferred until the 2023 November Deferral Agreement Deferral Date.

- As consideration for the deferral of the 2023 November Deferred Amounts which relate to the payment obligations arising from the Convertible Debenture, the Company agreed to pay JDZF a deferral fee equal to 6.4% per annum on the outstanding balance of such 2023 November Deferred Amounts, commencing on the date on which each such 2023 November Deferred Amounts would otherwise have been due and payable under the Convertible Debenture.

- As consideration for the deferral of the 2023 November Deferred Amounts which relate to payment obligations arising from Amended and Restated Cooperation Agreement, the Company agreed to pay JDZF a deferral fee equal to 1.5% per annum on the outstanding balance of such 2023 November Deferred Amounts commencing on the date on which each such 2023 November Deferred Amounts would otherwise have been due and payable under the Amended and Restated Cooperation Agreement.

- The 2023 November Deferral Agreement does not contemplate a fixed repayment schedule for the 2023 November Deferred Amounts or related deferral fees. Instead, the 2023 November Deferral Agreement requires the Company to use its best efforts to pay the 2023 November Deferred Amounts and related deferral fees due and payable under the 2023 November Deferral Agreement to JDZF. During the period beginning as of the effective date of the 2023 November Deferral Agreement and ending as of the 2023 November Deferral Agreement Deferral Date, the Company will provide JDZF with monthly updates of its financial status and business operations, and the Company and JDZF will on a monthly basis discuss and assess in good faith the amount (if any) of the 2023 November Deferred Amounts and related deferral fees that the Company may be able to repay to JDZF, having regard to the working capital requirements of the Company's operations and business at such time and with the view of ensuring that the Company's operations and business would not be materially prejudiced as a result of any repayment.

- If at any time before the 2023 November Deferred Amounts and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from JDZF prior to effecting such appointment, replacement or termination.

On March 19, 2024, the Company and JDZF entered into the 2024 March Deferral Agreement pursuant to which JDZF agreed to grant the Company a deferral of the 2024 March Deferred Amounts.

The effectiveness of the 2024 March Deferral Agreement and the respective covenants, agreements and obligations of each party under the 2024 March Deferral Agreement are subject to the Company providing notice and obtaining approval (if required) from the TSX-V and requisite approval from the disinterested shareholders of the Company in accordance with applicable Canadian securities laws and the Listing Rules. The Company will be seeking approval of the 2024 March Deferral Agreement from disinterested shareholders at the Company's upcoming AGM of shareholders, which will be held at a future date to be set by the Board.

The principal terms of the 2024 March Deferral Agreement are as follows:

- Payment of the 2024 March Deferred Amounts will be deferred until 2024 March Deferral Agreement Deferral Date.

- As consideration for the deferral of the 2024 March Deferred Amounts which relate to the payment obligations arising from the Convertible Debenture, the Company agreed to pay JDZF a deferral fee equal to 6.4% per annum on the outstanding balance of such 2024 March Deferred Amounts, commencing on the date on which each such 2024 March Deferred Amounts would otherwise have been due and payable under the Convertible Debenture.

- As consideration for the deferral of the 2024 March Deferred Amounts which relate to payment obligations arising from Amended and Restated Cooperation Agreement, the Company agreed to pay JDZF a deferral fee equal to 1.5% per annum on the outstanding balance of such 2024 March Deferred Amounts commencing on the date on which each such 2024 March Deferred Amounts would otherwise have been due and payable under the Amended and Restated Cooperation Agreement.

- The 2024 March Deferral Agreement does not contemplate a fixed repayment schedule for the 2024 March Deferred Amounts or related deferral fees. Instead, the 2024 March Deferral Agreement requires the Company to use its best efforts to pay the 2024 March Deferred Amounts and related deferral fees due and payable under the 2024 March Deferral Agreement to JDZF. During the period beginning as of the effective date of the 2024 March Deferral Agreement and ending as of the 2024 March Deferral Agreement Deferral Date, the Company will provide JDZF with monthly updates of its financial status and business operations, and the Company and JDZF will on a monthly basis discuss and assess in good faith the amount (if any) of the 2024 March Deferred Amounts and related deferral fees that the Company may be able to repay to JDZF, having regard to the working capital requirements of the Company's operations and business at such time and with the view of ensuring that the Company's operations and business would not be materially prejudiced as a result of any repayment.

- If at any time before the 2024 March Deferred Amounts and related deferral fees are fully repaid, the Company proposes to appoint, replace or terminate one or more of its chief executive officer, its chief financial officer or any other senior executive(s) in charge of its principal business function or its principal subsidiary, the Company will first consult with, and obtain written consent (such consent shall not be unreasonably withheld) from JDZF prior to effecting such appointment, replacement or termination.

Ovoot Tolgoi Mine Impairment Analysis

The Company determined that indicators of impairment existed for its Ovoot Tolgoi Mine cash generating unit as at December 31, 2023. The impairment indicators were the uncertainty of future coal price in China and cooperation agreement expired with Mongolian custom.

Therefore, the Company conducted an impairment test whereby the carrying value of the Company's Ovoot Tolgoi Mine cash generating unit was compared to the recoverable amount (being the "fair value less costs of disposal") using a discounted future cash flow valuation model. The Company's cash flow valuation model takes into consideration the latest available information to the Company, including but not limited to, sales prices, sales volumes, washing production, operating costs and life of mine coal production estimates as at December 31, 2023. The carrying value of the Company's Ovoot Tolgoi Mine cash generating unit was $157.1 million as at December 31, 2023.

Key estimates and assumptions incorporated in the valuation model included the following:

- Coal resources and reserves as estimated by an independent third-party engineering firm;

- Sales price estimates from an independent market consulting firm;

- Forecastedsales volumes in line with production levels as reference to the mine plan;

- Life-of-mine coal production, strip ratio, capital costs and operating costs; and

- A post-tax discount rate of 17% based on an analysis of the market, country and asset

- specific factors.

Key sensitivities in the valuation model are as follows:

- For each 1% increase/(decrease) in the long term price estimates, the calculated fair value of the cash generating unit increases/(decreases) by approximately $15.7/(15.7) million;

- For each 1% increase/(decrease) in the post-tax discount rate, the calculated fair value of the cash generating unit (decreases)/increases by approximately $(12.7)/13.7 million;

- For each 1% increase/(decrease) in the cash mining cost estimates, the calculated fair value of the cash generating unit (decreases)/increases by approximately $(8.0)/8.1 million; and

- For each 1% increase/(decrease) in Mongolian inflation rate, the calculated fair value of the cash generating unit (decreases)/increases by approximately $(2.3)/2.3 million.

The impairment analysis did not result in the identification of an impairment loss or an impairment reversal and no charge or reversal was required as at December 31, 2023. A decline of 5% (2022: 18%) in the long-term price estimates, an increase of more than 8% (2022: 26%) in the post-tax discount rate, an increase of 10% (2022: 33%) in the cash mining cost estimates or an increase of 41% (2022: 95%) in Mongolian inflation rate may trigger an impairment charge on the cash generating unit. The Company believes that the estimates and assumptions incorporated in the impairment analysis are reasonable; however, the estimates and assumptions are subject to significant uncertainties and judgments.

REGULATORY ISSUES AND CONTINGENCIES

Class Action Lawsuit

In January 2014, Siskinds LLP, a Canadian law firm, filed a class action (the "Class Action") against the Company, certain of its former senior officers and directors, and its former auditors (the "Former Auditors"), in the Ontario Court in relation to the Company's restatement of certain financial statements previously disclosed in the Company's public fillings (the "Restatement").

To commence and proceed with the Class Action, the plaintiff was required to seek leave of the Court under the Ontario Securities Act ("Leave Motion") and certify the action as a class proceeding under the Ontario Class Proceedings Act. The Ontario Court rendered its decision on the Leave Motion on November 5, 2015, dismissing the action against the former senior officers and directors and allowing the action to proceed against the Company in respect of alleged misrepresentation affecting trades in the secondary market for the Company's securities arising from the Restatement. The action against the Former Auditors was settled by the plaintiff on the eve of the Leave Motion.

Both the plaintiff and the Company appealed the Leave Motion decision to the Ontario Court of Appeal. On September 18, 2017, the Ontario Court of Appeal dismissed the Company's appeal of the Leave Motion to permit the plaintiff to commence and proceed with the Class Action. Concurrently, the Ontario Court of Appeal granted leave for the plaintiff to proceed with their action against the former senior officers and directors in relation to the Restatement.

The Company filed an application for leave to appeal to the Supreme Court of Canada in November 2017, but the leave to appeal to the Supreme Court of Canada was dismissed in June 2018.

In December 2018, the parties agreed to a consent Certification Order, whereby the action against the former senior officers and directors was withdrawn and the Class Action would only proceed against the Company.

To date, counsel for the plaintiffs and defendant have completed: (i) all document production; (ii) oral examinations for discovery; and (iii) counsel for the plaintiffs have served their expert reports on liability and damages. Counsel for the plaintiffs and defendant have agreed on the case management judge, who has ordered certain motions brought by the defendant and the plaintiffs to commence on May 13 and 14, 2024. Further discovery motions before an Associate Justice has been scheduled for August 7-9, and September 17, 2024.

Following the determination of the motions and any subsequent order to re-attend examinations, counsel for the defendant will serve responding expert reports on liability and damages approximately one month following any re-examinations/further examinations are completed. Counsel for the plaintiff and defendant have requested a further case conference to set a new trial date following the undertakings motion and serving of expert reports. The Company has urged a trial as early as possible.

The Company firmly believes that it has a strong defense on the merits and will continue to vigorously defend itself against the Class Action through independent Canadian litigation counsel retained by the Company for this purpose. Due to the inherent uncertainties of litigation, it is not possible to predict the final outcome of the Class Action or determine the amount of potential losses, if any. However, the Company has determined that a provision for this matter as at December 31, 2023 and 2022 was not required.

Toll Wash Plant Agreement with Ejin Jinda

In 2011, the Company entered into an agreement with Ejin Jinda, a subsidiary of China Mongolia Coal Co. Ltd., to toll-wash coal from the Ovoot Tolgoi Mine. The agreement had a duration of five years from the commencement of the contract and provided for an annual washing capacity of approximately 3.5 million tonnes of input coal.

Under the agreement with Ejin Jinda, which required the commercial operation of the wet washing facility to commence on October 1, 2011, the additional fees payable by the Company under the wet washing contract would have been $18.5 million. At each reporting date, the Company assesses the agreement with Ejin Jinda and has determined it is not p