from TDG Gold Corp. (isin : CA87190J1057)

TDG Gold Updates Mineral Resource Estimate for Shasta & Tailings, Toodoggone

WHITE ROCK, BC / ACCESSWIRE / January 8, 2025 / TDG Gold Corp. (TSXV:TDG) (the "Company" or "TDG") is pleased to announce an updated Mineral Resource Estimate1 ("MRE") incorporating the results of (1) its relogging, resampling and assay program of 2007 and 2010 historical diamond drillholes comprising ~3,250 metres ("m") at the former producing Shasta gold-silver ("Au-Ag") mine and (2) its 2024 drill program at the Tailings Storage Facility #1 ("TSF1") located adjacent to the Baker Mill. The key outcomes of the updated MRE are improved grades and a significant reduction in the estimated quantity of waste rock within the conceptual mineral resource limiting pit. An updated technical report will be filed on the Company's website and SEDAR within 45 calendar days of this disclosure.

Highlights: Updated Mineral Resource Estimate (see Table 1; below for details)

Indicated Mineral Resource of 515.8 thousand ounces ("koz") gold equivalent ("AuEq*") grading 1.35 grams per tonne ("g/t") AuEq*(see Table 1 below for grades by metal and Table 1 Notes for AuEq* calculation) contained within 11.9 million metric tonnes ("Mt").

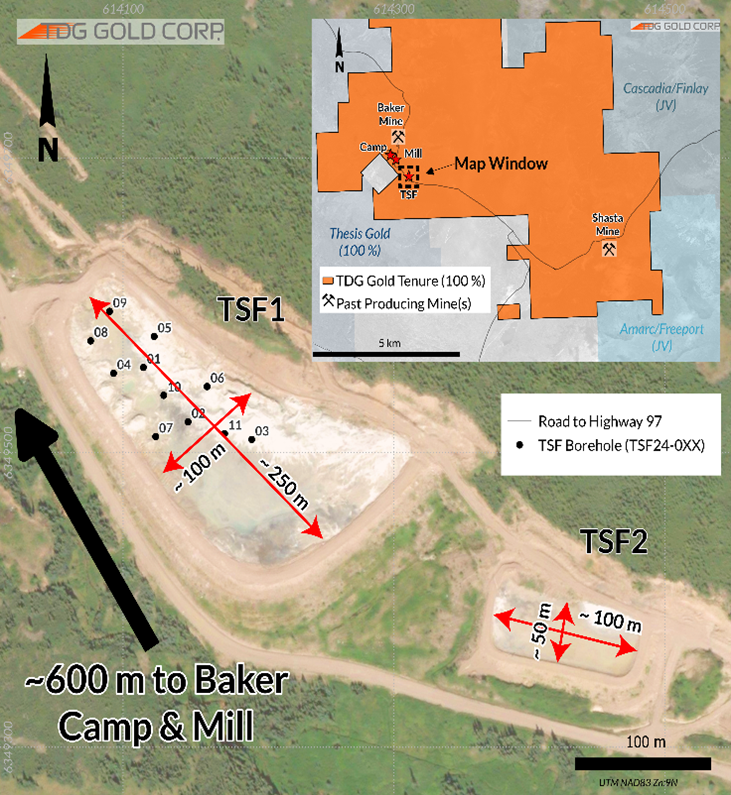

2Inferred Mineral Resource of 505.5 koz AuEq* grading 1.04 g/t AuEq2, contained within 15.14 Mt and including 12,120 oz AuEq* grading 1.37 g/t AuEq* contained within TSF1 (see Table 1 below for grades by metal and Table 1 Notes for AuEq* calculation).

Cut-off grade maintained at 0.4 g/t AuEq* cut-off grade ("COG") for the base case.

Significant silver contribution (14.2 million ounces ("Moz") Indicated / 14.3 Moz Inferred) included in the AuEq* ounces.

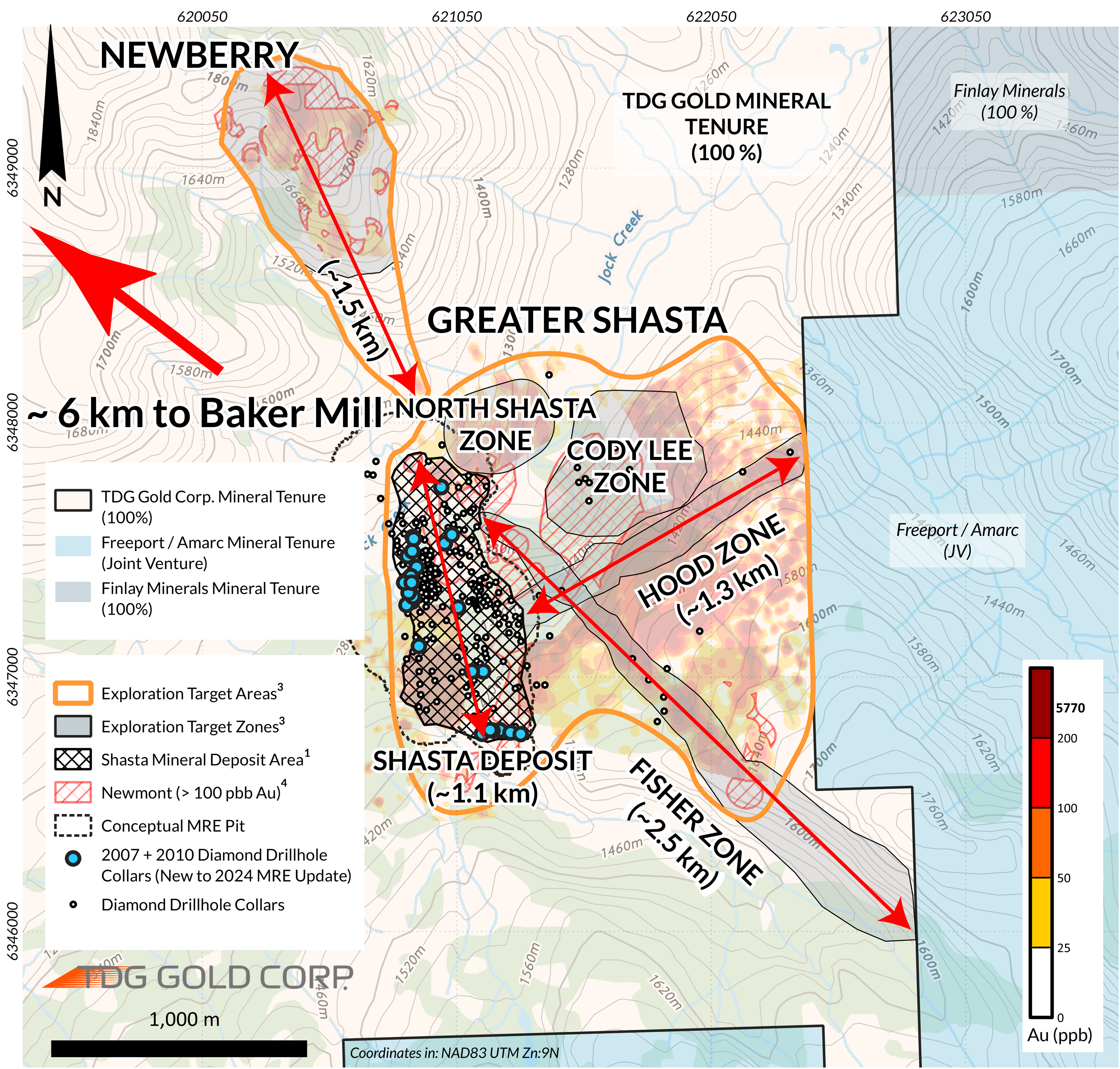

MRE conceptual pit outline extends to within 100 m of the Newberry exploration target zone3 which has never been drill tested (Figure 1).

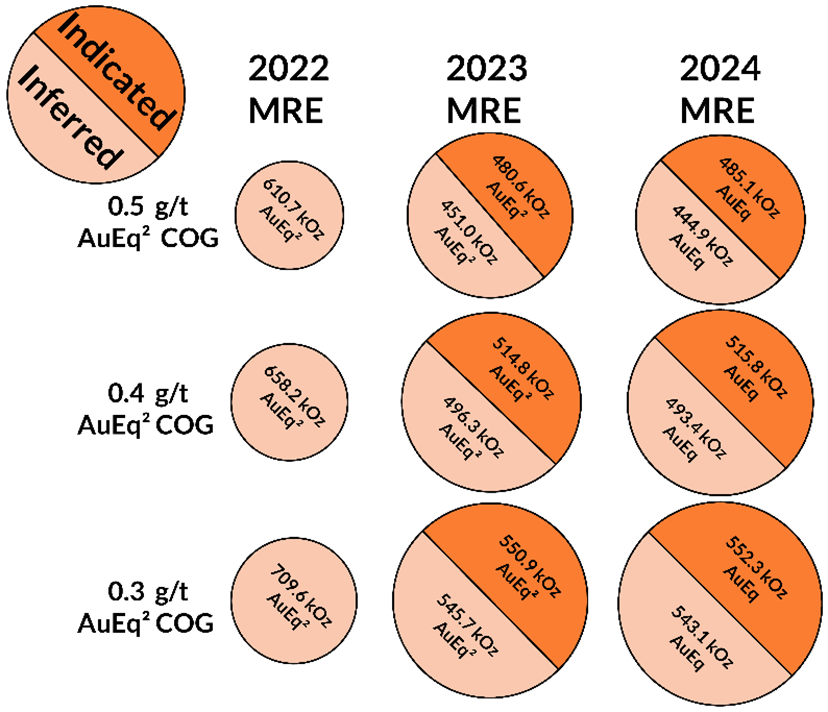

MRE shows continuity and consistency, with an increased COG resulting in a relatively minor reduction in the pit-constrained AuEq* ounces within the Shasta deposit, while increasing the grade (Table 1). The MRE for TSF1 is an inaugural estimate.

Shasta deposit remainsopen at depth and along strike3 (see TDG news release March 20, 2023).

MRE does not include any of the Greater Shasta-Newberry3 satellite exploration target zones, or any of the second Tailings Storage Facility,located adjacent to TSF13 (Figure 2).

Fletcher Morgan, TDG's CEO, commented: "TheShasta mineral resource demonstrates continuity and consistency across the deposit and ~25% of the estimated AuEq* is contributed by silver. There are known parts of the deposit that merit further HQ drilling, as both infill and larger diameter core have consistently increased the grade of the areas drilled. However, the greater opportunity is testing for potential extensions to the mineralized system, particularly the 2.5 kilometre ‘Fisher Zone3' extending from Shasta to the boundary with the Freeport-Amarc JV ground to southeast (Figure 1); and the Newberry exploration target area3 immediately north of the Shasta MRE, which has never been drill tested.

The calculated 12,100 AuEq* ounces within TSF1 is in line with the historical4 production records at Baker-Shasta from 1981-2012 and is located within our Baker-Shasta Permitted Mine Area. The definition of an inaugural Inferred2 MRE at TSF1 represents an opportunity to convert a potential liability into a net asset by demonstrating a path to reasonable prospects for eventual economic extraction."

2Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable their classification as Mineral Reserves. However, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Measured or Indicated Mineral Resources with continued exploration and additional data.

Table 1 - Shasta Updated 2024 Mineral Resource Estimate including Sensitivity (base case highlighted)*

Class | AuEq | In Situ Tonnage and Grade | AuEq* | Au | Ag | ||||

AuEq* | Au | Ag | NSR | ||||||

(g/t) | Mt | (g/t) | (g/t) | (g/t) | ($CDN) | (koz) | (koz) | (koz) | |

Indicated (Shasta) | 0.30 | 15.169 | 1.13 | 0.86 | 31.2 | 101 | 552.3 | 417.2 | 15,231 |

0.35 | 13.327 | 1.24 | 0.94 | 34.4 | 111 | 533.1 | 402.6 | 14,718 | |

0.40 | 11.881 | 1.35 | 1.02 | 37.3 | 120 | 515.8 | 389.3 | 14,256 | |

0.45 | 10.710 | 1.45 | 1.10 | 40.2 | 129 | 499.8 | 377.1 | 13,832 | |

0.50 | 9.743 | 1.55 | 1.17 | 42.9 | 138 | 485.1 | 365.9 | 13,438 | |

1.00 | 4.580 | 2.50 | 1.89 | 69.3 | 223 | 368.5 | 278.0 | 10,207 | |

Inferred | 0.30 | 19.331 | 0.87 | 0.65 | 24.9 | 78 | 543.1 | 405.9 | 15,469 |

0.35 | 16.927 | 0.95 | 0.71 | 27.0 | 85 | 518.1 | 387.9 | 14,683 | |

0.40 | 14.865 | 1.03 | 0.78 | 29.1 | 92 | 493.4 | 370.2 | 13,888 | |

0.45 | 12.930 | 1.12 | 0.85 | 31.4 | 100 | 467.0 | 351.1 | 13,066 | |

0.50 | 11.482 | 1.21 | 0.91 | 33.5 | 107 | 444.9 | 335.2 | 12,374 | |

1.00 | 4.388 | 2.02 | 1.56 | 51.9 | 180 | 284.5 | 219.6 | 7,323 | |

Inferred | |||||||||

N/A | 0.276 | 1.37 | 0.97 | 45.0 | 122 | 12.1 | 8.6 | 398 | |

*Notes to the MRE table:

The Mineral Resource estimate has been prepared by Sue Bird, P.Eng., an independent Qualified Person. The effective date of the mineral resource estimate is December 29, 2024.

Mineral Resources are reported using the 2014 CIM Definition Standards and were estimated in accordance with the CIM 2019 Best Practices Guidelines, as required by NI43-101.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that all Mineral Resources will be converted into Mineral Reserves.

The Mineral Resource has been confined by a "reasonable prospects of eventual economic extraction" pit using the following assumptions, which were estimated from comparable projects:

Au price of US$2,250/oz, Ag price of US$25/oz at an exchange rate of 0.74 US$ per CDN$;

a 1.5 % NSR royalty;

93 % metallurgical recovery for Au, based on past TDG test work, historical mill records4 and nearby project comparables6;

86 % recovery for Ag based on nearby project comparables6 and, while prior MREs assumed somewhat lower Ag recoveries based on historical mill records4 and limited past TDG test work , test work was not optimized for Ag recoveries. Further, test work at comparable projects indicate that improvement could be expected;

99.9 % payable Au; 95.0 % payable Ag; US$7.00/oz Au and US$3.00/oz Ag offsite costs (refining, transport and insurance);

Mining costs of CDN$4.00/tonne mineralized material;

Processing Costs of CDN$15/tonne and G&A of CDN$8.00/tonne processed;

Pit slopes of 45 degrees.

The resulting NSR equation is: NSR (CDN$) = 95.79*Au Grade*0.93 + 0.92*Ag Grade*0.86

The resulting AuEq equation is: AuEq = Au + Ag*0.00887

The bulk density of the deposit is based on 2021 & 2022 measurements and is assumed to be 2.61 throughout the deposit and 2.00 for overburden.

Numbers may not sum due to rounding.

Figure 1: Shasta Plan Map with MRE Resource-limiting Pit Outline

Figure 2: Tailings Storage Facility 1 & 2

Overview

The 2024 MRE update was based on the incorporation of ~3,250 m of historical diamond drilling from the 2007 (16 drillholes now included) and 2010 (10 drillholes now included) drill campaigns. These drillholes were not included in prior MRE calculations as collars could not accurately be validated and/or assay data was not recovered as part of the acquisition. However, TDG has since: (i) re-logged, re-sampled and assayed the cores (where available) with modern assaying techniques, and (ii) completed a comprehensive data validation and ground-truthing to confidently place those collars in 3D space. This endeavour was one of the ‘low hanging fruit' objectives from the Shasta MRE forward plan (see TDG news release May 01, 2023). The result is an increase in grade and decrease in tonnage (Figure 3). Additionally, metal prices and NSR derived costs have been updated to reflect a higher price environment.

Figure 3 - 2022 vs. 2023 vs. 2024 MRE Visual Comparison.

Note: the 2022, 2023 and 2024 MREs each have their own set of assumptions and modifying factors and are not directly comparable estimates, but this figure is provided for illustration purposes.

Mineral Resource overview

The Shasta deposit mineral resource database consists of 367 drillholes with 19,896 assay intervals from 1983 through 2022 drilling. This represents 23,936 m of assayed intervals at an average interval of 1.3 m per assay interval. Approximately 50 % of all assayed interval lengths of core used in the mineralized domains is comprised of TDG's modern, HQ diameter, oriented, diamond drill core from 2021 and 2022. The remaining assay intervals from the mineralized domains are from historical4,5 drilling. All data used for the MRE has been validated statistically to show no significant bias, either by twinned drillholes in 2021 or through statistical comparison of historical4,5 data with TDG drilling using Point Validation. Historical collar locations have also been validated by field validation of collar locations.

Two mineralized domains were generated based on: (i) the major north-south Shasta fault system as well as, (ii) the northwest trending, sub-vertical JM zone. The block model has a block size of 5 m x 5 m x 5 m to correspond to expected selective mining unit, with interpolation of Au and Ag by Inverse Distance Cubed ("ID3"). The interpolations were limited by the domain boundaries and were clipped to the overburden surface. Historical mine workings4 were removed from the in-situ mineral MRE.

There are no other known factors or issues that materially affect the MRE other than normal risks faced by mining projects in the province of British Columbia, Canada, in terms of environmental, permitting, taxation, socio-economic, marketing, and political factors and additional risk factors as listed in the "Cautionary Note Regarding Forward-Looking Information" section below.

Mineral Resource growth potential & Forward Plan

The Shasta Deposit still has many avenues for further improvements, including in-fill drilling to improve the confidence and continuity and potentially improve grade and/or classification as well as test the zones of known mineralized extension. Additionally, the Greater Shasta-Newberry project offers potential for the discovery of new mineralized zones3 that could increase the existing 2024 MRE. Such potential endeavours include:

‘Scout' Drilling. Using a small mobile drill to drill test the Greater Shasta area following up on historical drilling and exploration that suggest additional proximal zones of mineralization, adjacent to the Shasta Deposit (Fisher, Hood, Cody Lee and North Shasta Zones3)

Expansion Potential. The Shasta Deposit remains open along the strike and at depth, beyond the known and defined mineralized zones3. Further diamond drilling could unlock more mineralization to be incorporated into the Shasta Deposit MRE.

‘Upgrade' Drilling. From data analysis, replacing historical holes (small diameter, historical assay methods) with modern, HQ (large diameter) diamond drilling coupled with modern precious metal assays has the potential to increase grade and confidence by providing more representative samples.

Metallurgical testing. TDG has initiated Phase 1 metallurgical testing of core samples collected from the Shasta Project in order to optimize metallurgical recoveries and support future economic studies.

Economic Studies. To take the known mineral deposit area in accordance with NI 43-101 and advance through studies to evaluate potential economic scenarios.

Steven Kramar, TDG's VP Exploration, commented: "Our systematic review of Greater Shasta continued throughout 2024, incorporating ~4,500 m of historical diamond drill core information that we recovered in 2023, in addition to the ~3,250 m of 2007 and 2010 specific information. We're now ready to launch a scout drill campaign, having identified multiple target locations to evaluate the four known extensions3 to the Shasta mineral deposit area with a priority focus on the Fisher Zone3. Our aim would be to follow-up with HQ diamond drilling to rapidly add additional mineral resources3 that offer the best potential to improve the overall scale and economics of the project. A similar approach would apply for expanding the high-grade gold Mets mining lease3. We continue to believe that Greater Shasta-Newberry & Mets, in combination, represent a compelling opportunity for the definition of a substantial global mineral resource in an established mining district."

Data Verification

TDG followed industry standard Quality Assurance/Quality Control ("QA/QC") protocols for the 2021 and 2022 drill programs by inserting blind certified reference materials ("CRMs"), field duplicates and blanks into the sample stream of core samples at sufficient proportions to primary core samples. QA/QC is maintained internally at the lab through rigorous use of internal CRMs, blanks, and duplicates.

If a QA/QC sample returned an unacceptable value an investigation into the results is triggered and, when deemed necessary, the samples that were tested in the batch with the failed QA/QC sample were re-tested.

The drill cores from 2021 and 2022 drilling were delivered to the core shack at TDG's Baker Mine site, and processed by geologists who inserted QA/QC samples into the sampling sequence. The drill core was cut in half (1/2 HQ core) and placed in zip-tied polyurethane bags, then in security-sealed rice bags before being delivered directly from the Baker Mine site to Bandstra Transportation Systems in Prince George, B.C., enroute to either:

SGS' laboratory in Burnaby, B.C., for preparation and analysis of 2021 drillcore samples. Samples were prepared and analyzed following procedures summarized in Table 2, where information about methodology can be found on the SGS Canada Website, in the analytical guide (here).

ALS' preparation facility in Kamloops, B.C., and ultimately to the ALS' laboratory in North Vancouver, B.C., for 2022 and 2023 drillcore samples. Samples were prepared and analyzed following procedures summarized in Table 2, where information about methodology can be found on the ALS Global website, in the analytical guide (here).

Table 2 - 2021 & 2022 Assay Methodology

Year | Lab | Method (Au) | Method (Ag) | Method (Overlimit - Au) | Method (Overlimit - Ag) |

2021 | SGS | GO_FAI50V10 | GE_IMS40Q12 | N/A | GO_ICP42Q100/GO_FAG37V |

2022 | ALS | AU-ICP22 | MEMS61 | Au-GRA22 | Ag-GRA22 |

2023 | ALS | AU-ICP22 | MEMS61 | Au-GRA22 | Ag-GRA22 |

Historical4,5 data were verified using Point Validation, by interpolating the Au and Ag grades to locations of the historical4,5 data for comparison. In addition, two of the 2021 drillholes were twins of historical4,5 drilling. Based on these analyses, the historical4,5 drilling for years 1983 to 2006 show no significant bias.

Drill collar validation was completed using handheld (GARMIN GPSMAP64 or equivalent) GPS equipment, selecting a subset of historical4,5 collars to validate positions inherited from the historical4,5 database. In 2022, a DGPS was utilized to further validate historical4,5 collars and rectify locations into modern UTM NAD83 Zone: 9 north coordinate system (from a locally derived mine grid). Collar locations from the 1980/90s era drilling were validated for use in the mineral resource database.

Methods Used for the Mineral Resource Estimate

Grade Capping

Cumulative probability plots ("CPPs") for the assays within both domains have been used to determine high grade outliers which were capped (Table 3). CPPs of the composited data (composited at 2 m) have also been used to determine the Outlier Restriction during interpolation. Outlier restriction values are applied for distances beyond 5 m from the composite locations.

Table 3 - Capping and Outlier Restriction Values

Assay Capping Values | Composite Outliers | |||||||

DOM | Au | # capped | ||||||