on EUROPLASMA (EPA:ALEUP)

EUROPLASMA launches significant bond financing to support its growth

On April 24, 2024, EUROPLASMA announced the launch of a new financing program in the form of convertible bonds with share subscription warrants, for a nominal amount of up to €30 million over a period of 36 months. This financing is carried out with the Environmental Performance Financing fund, Alpha Blue Ocean group. The company warns of significant potential dilution for current shareholders, exceeding 99% of the capital.

The funds raised by this financing program will mainly be used to acquire the assets of MG-Valdunes, the last French manufacturer in the railway sector, and to develop the production capacity of its subsidiary Les Forges de Tarbes. These initiatives aim to strengthen the independence and competitiveness of EUROPLASMA in its key industrial and environmental activities.

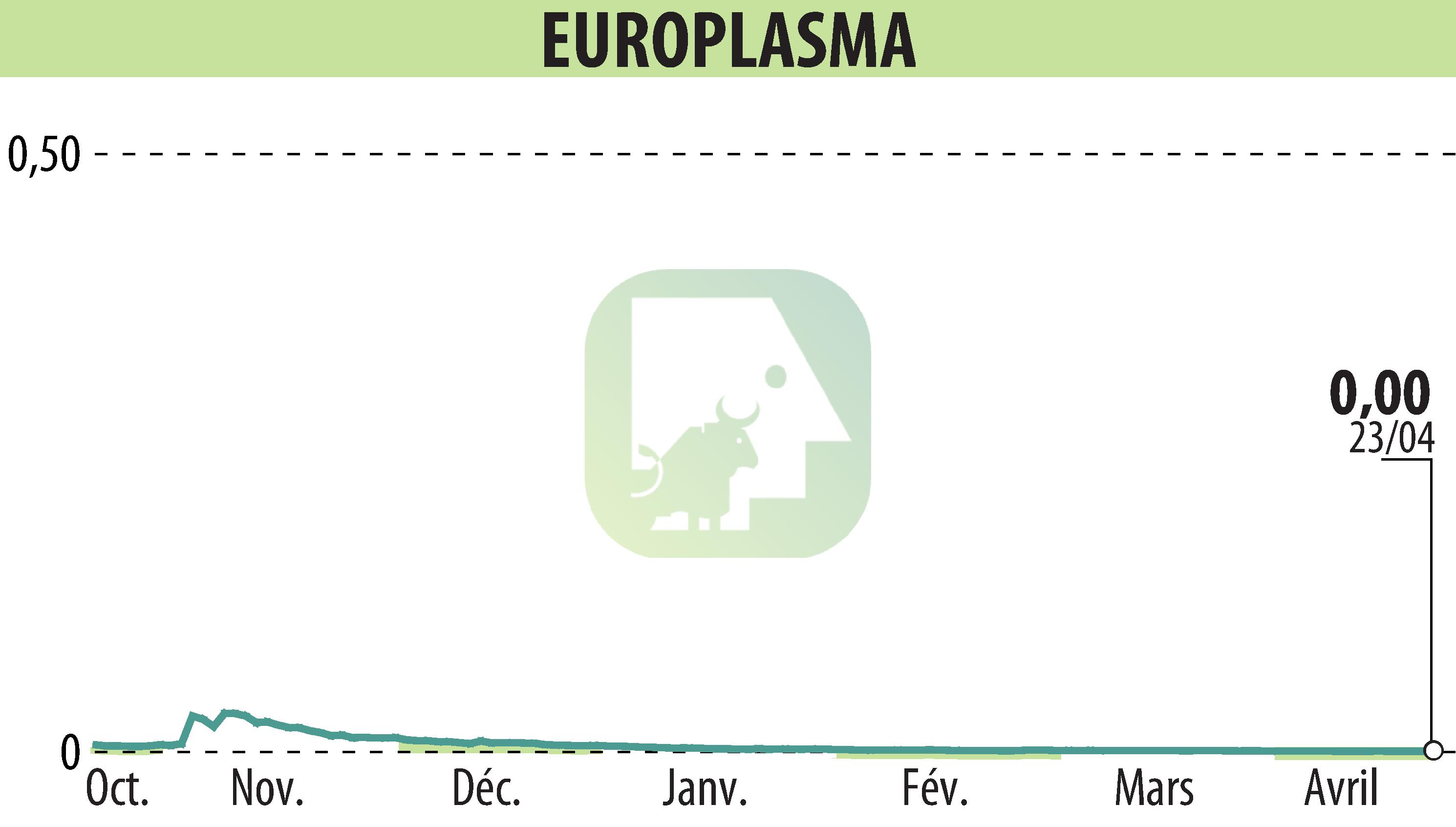

Although this transaction allows EUROPLASMA to continue its growth and expansion, it also carries a risk of downward pressure on share prices due to the potential sale of converted shares. Management advises investors to be cautious and vigilant regarding the effects of this dilutive transaction.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all EUROPLASMA news