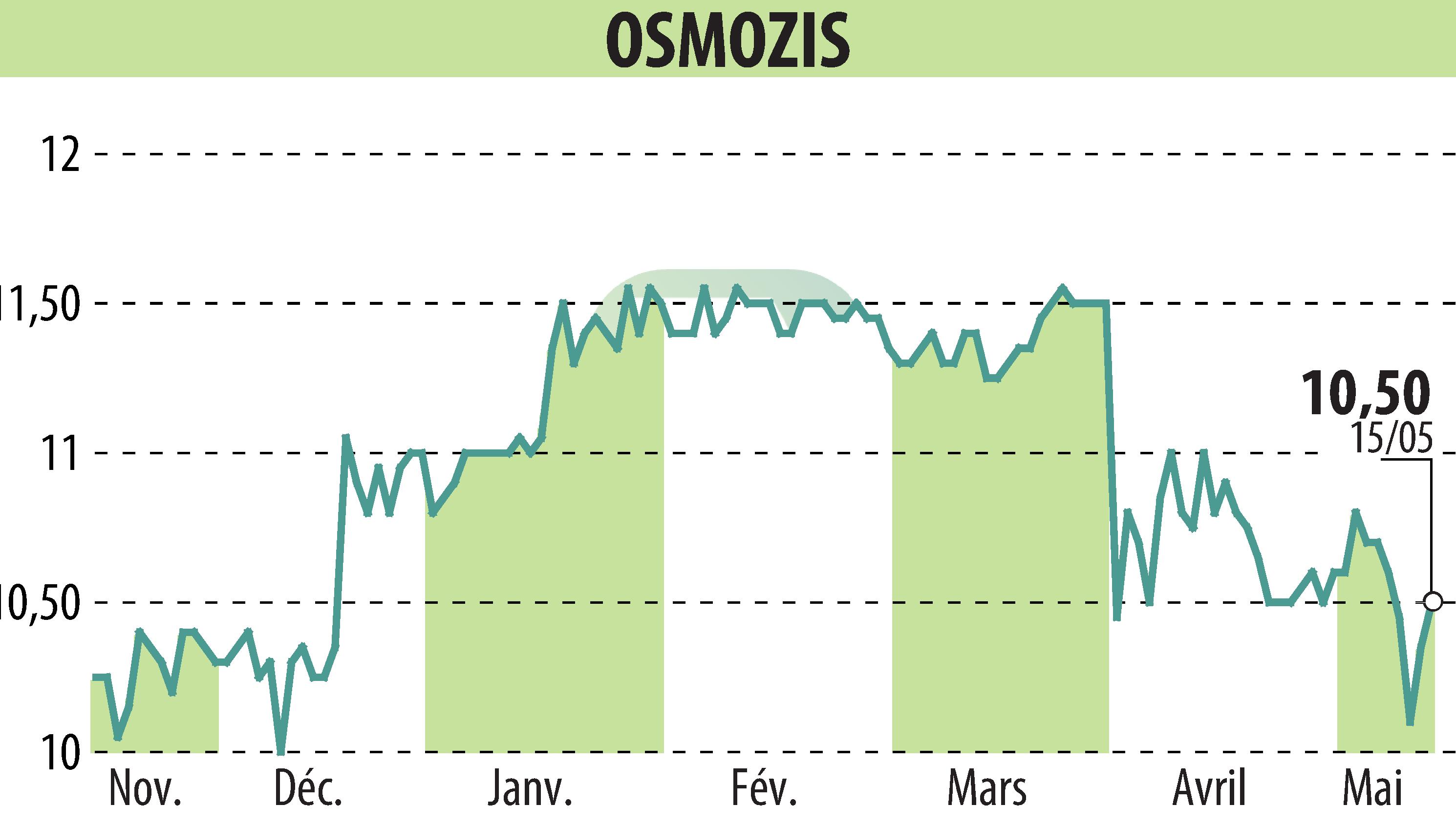

on OSMOZIS (EPA:ALOSM)

Osmozis in exclusive negotiations for a takeover by the Passman Group

The Passman Group and Osmozis announced that they had entered into exclusive negotiations for the acquisition of a majority block of the capital of Osmozis by Passman. The discussions concern the buyout and reinvestment of the founders of Osmozis as well as certain shareholders, for a predetermined transfer of their shares at 13.50 euros per share. Without forgetting an additional sale to LBO Asset Management GmbH at 15.00 euros per share. Ultimately, this operation could lead to a simplified public purchase offer at 15.00 euros per share for the rest of the capital.

The terms ready, the initiator of the project plans to hold approximately 88.56% of the capital of Osmozis, preparing the ground for a potential delisting. The operation, supported by the Osmozis board of directors, will still have to go before the Financial Markets Authority for approval. If successful, this acquisition will mark a significant strategic merger in the hospitality sector, with Passman hoping to strengthen its offering with Osmozis technology.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all OSMOZIS news